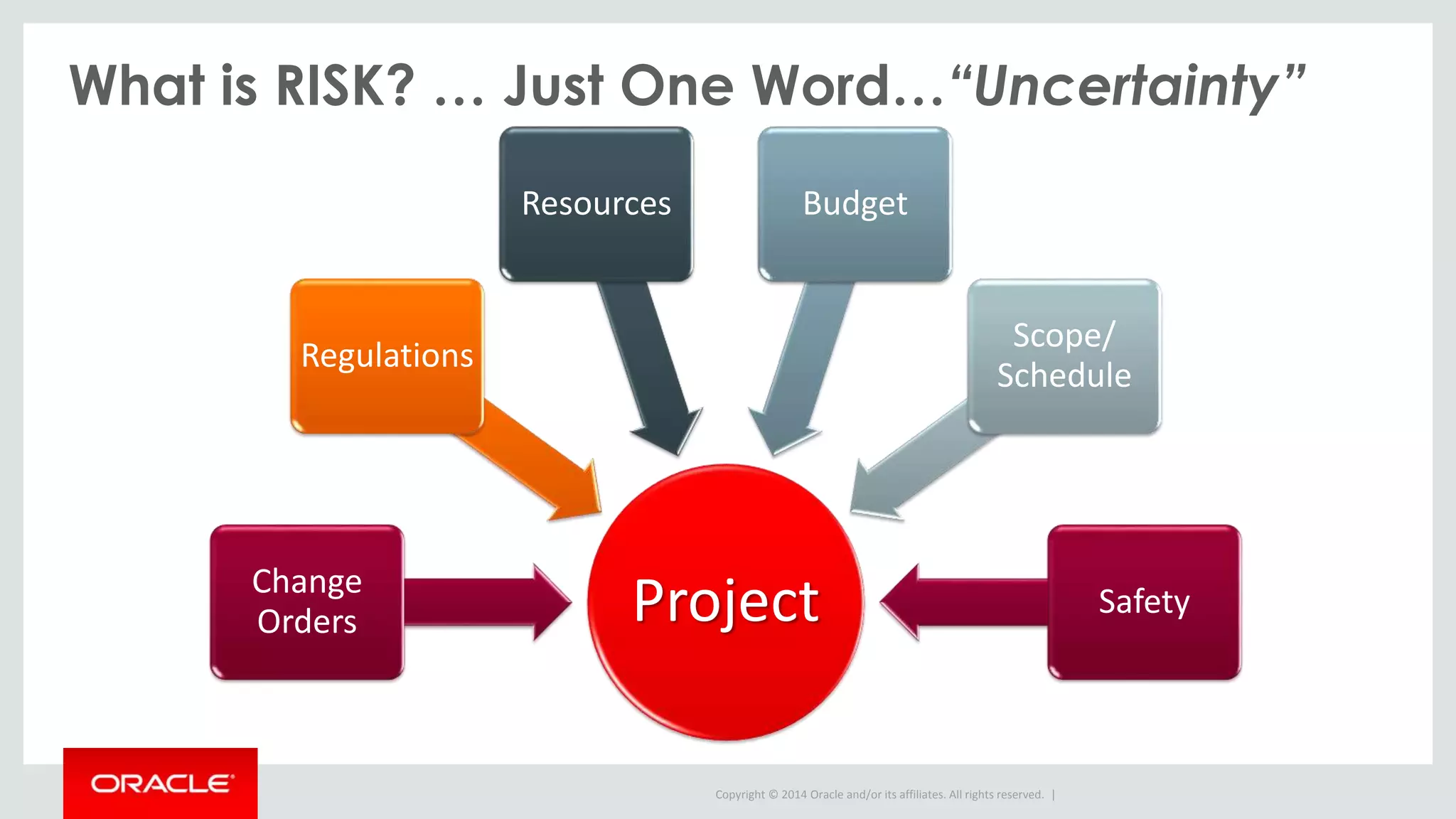

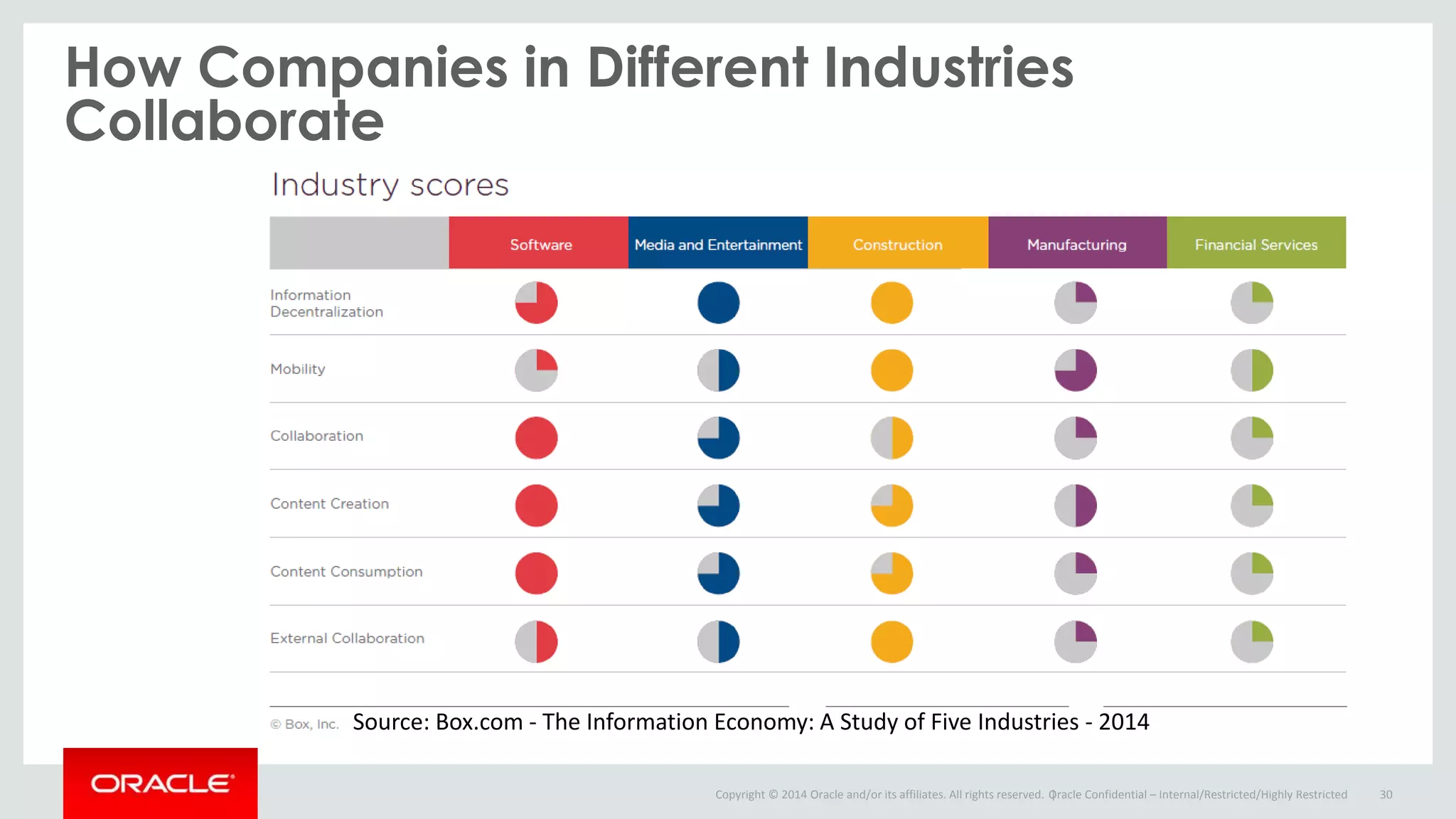

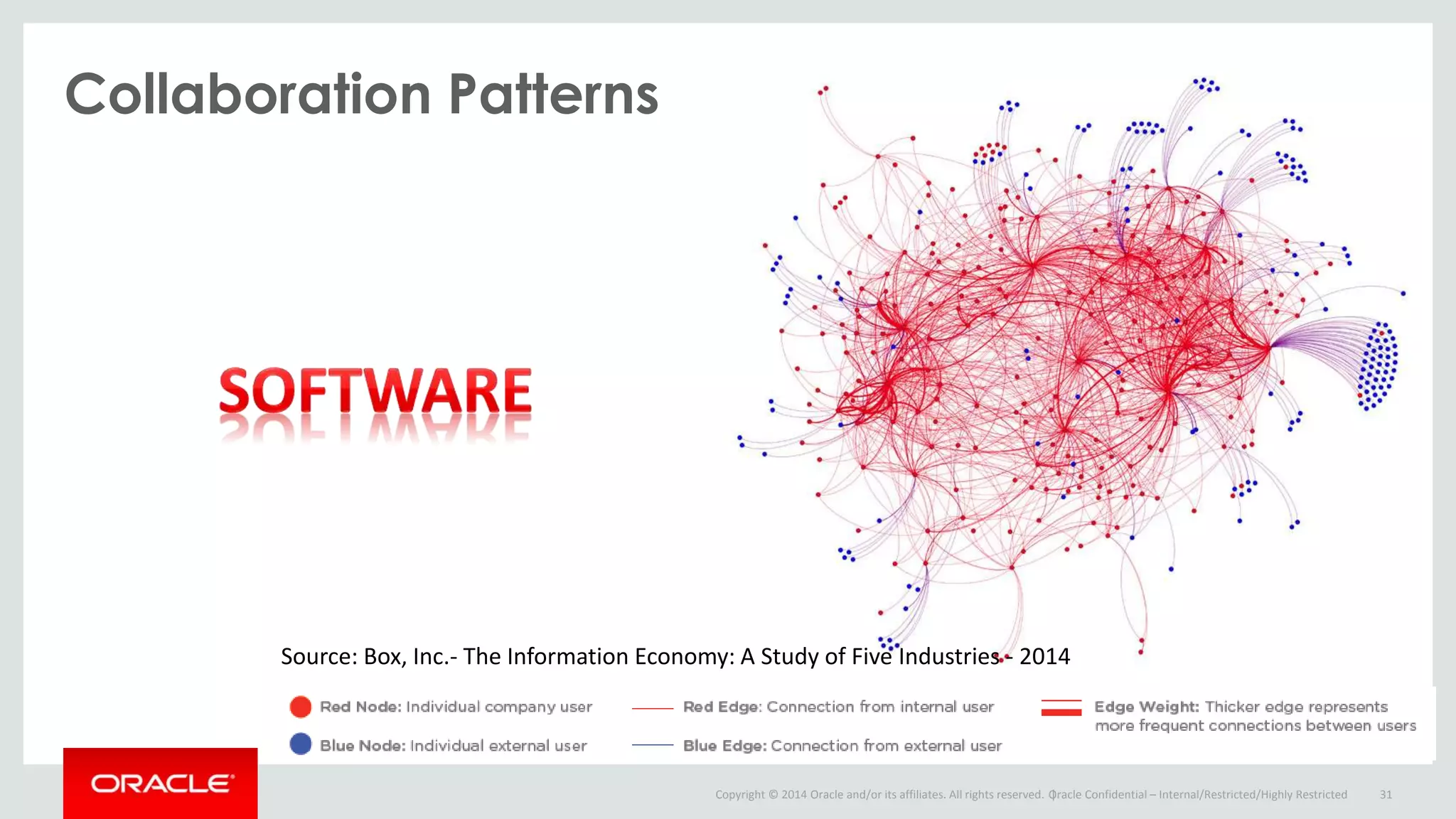

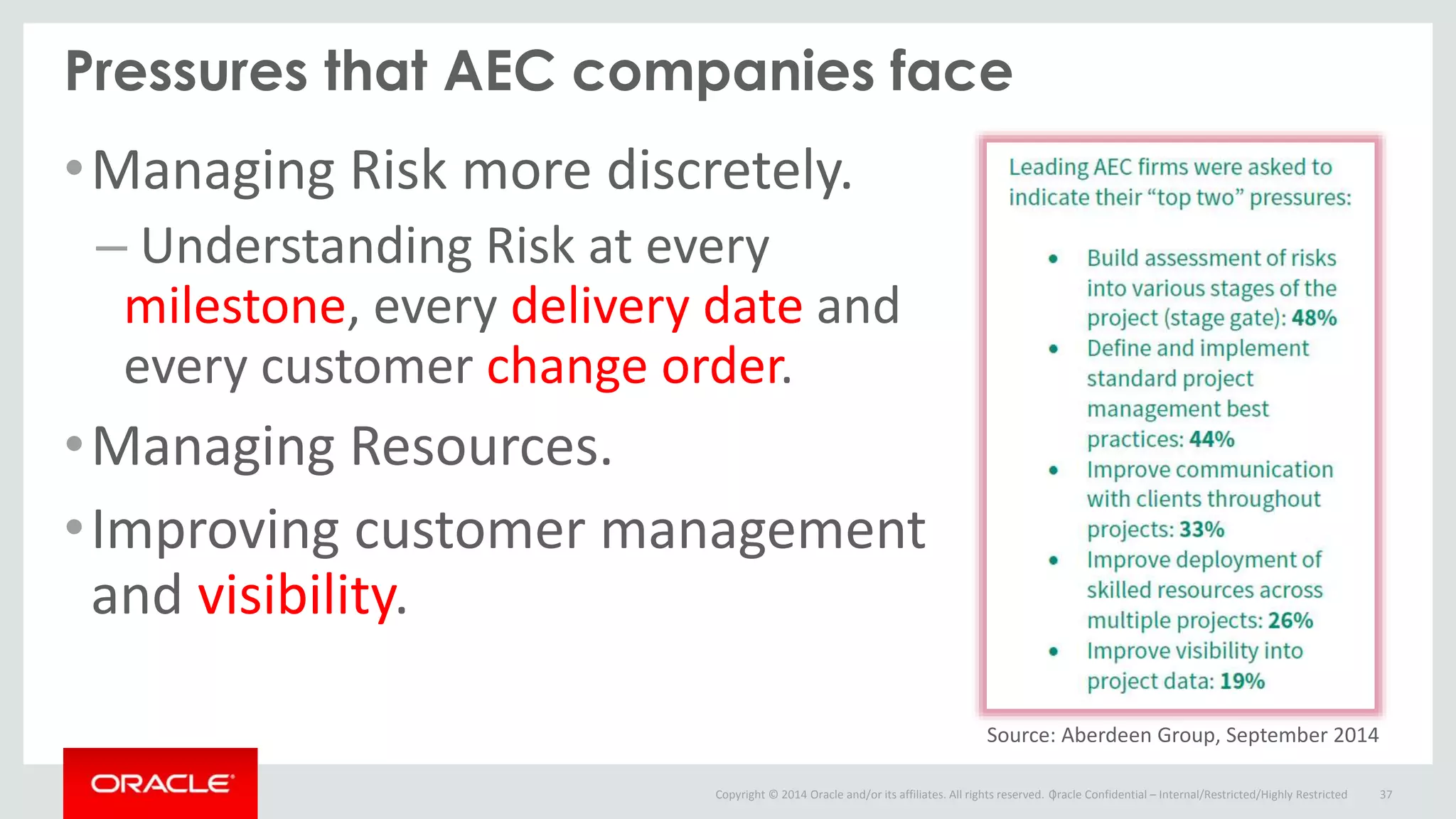

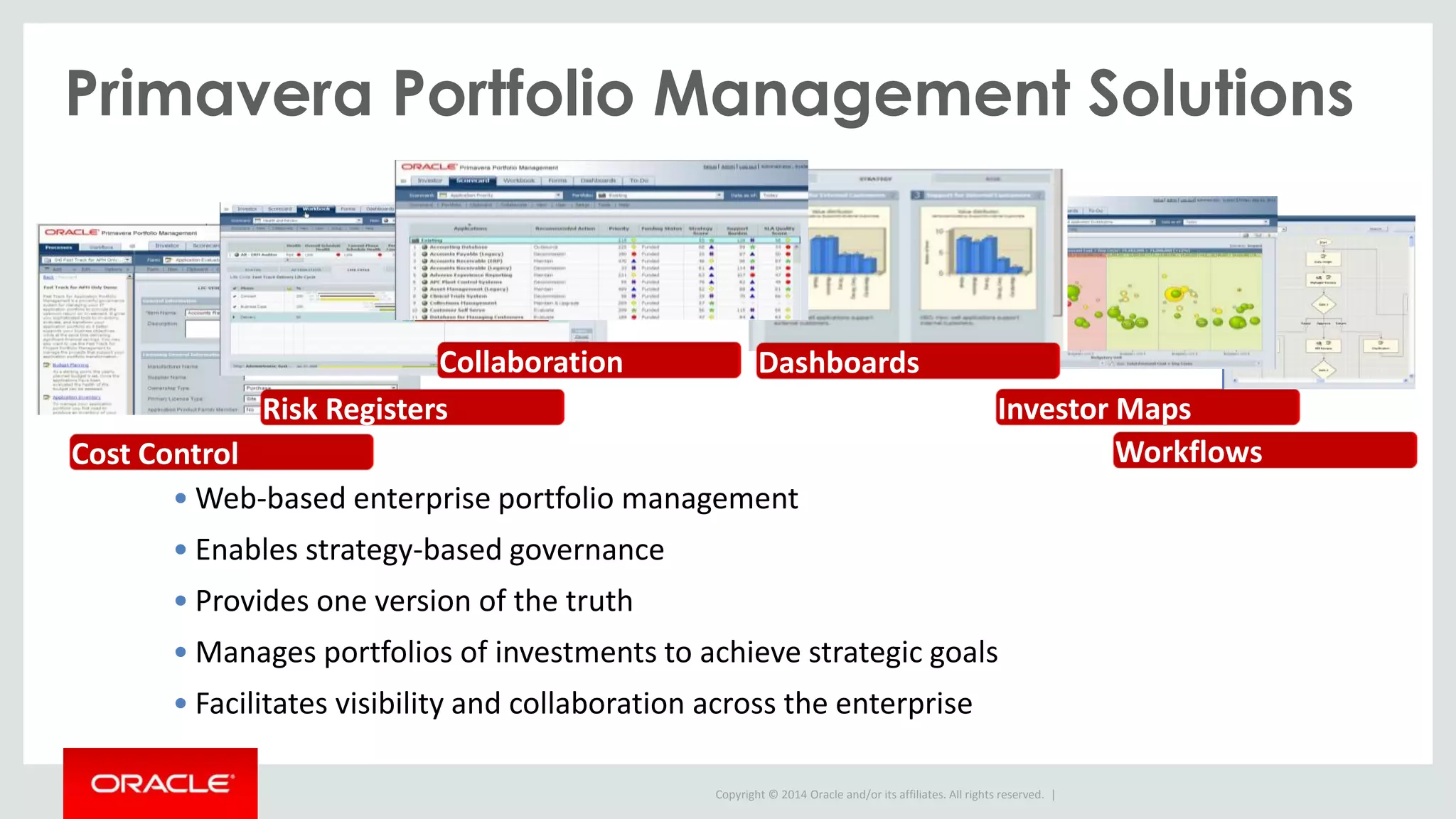

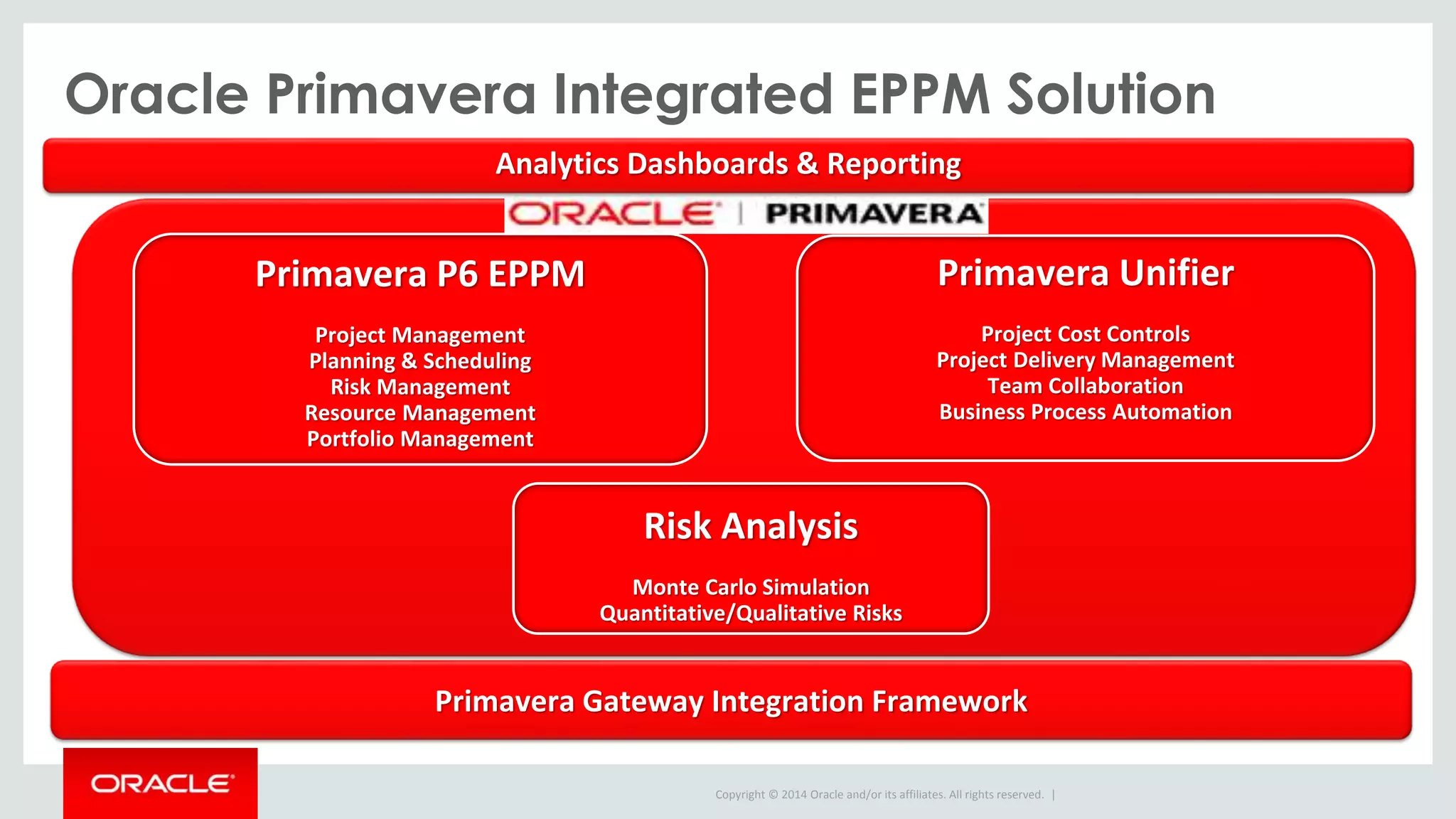

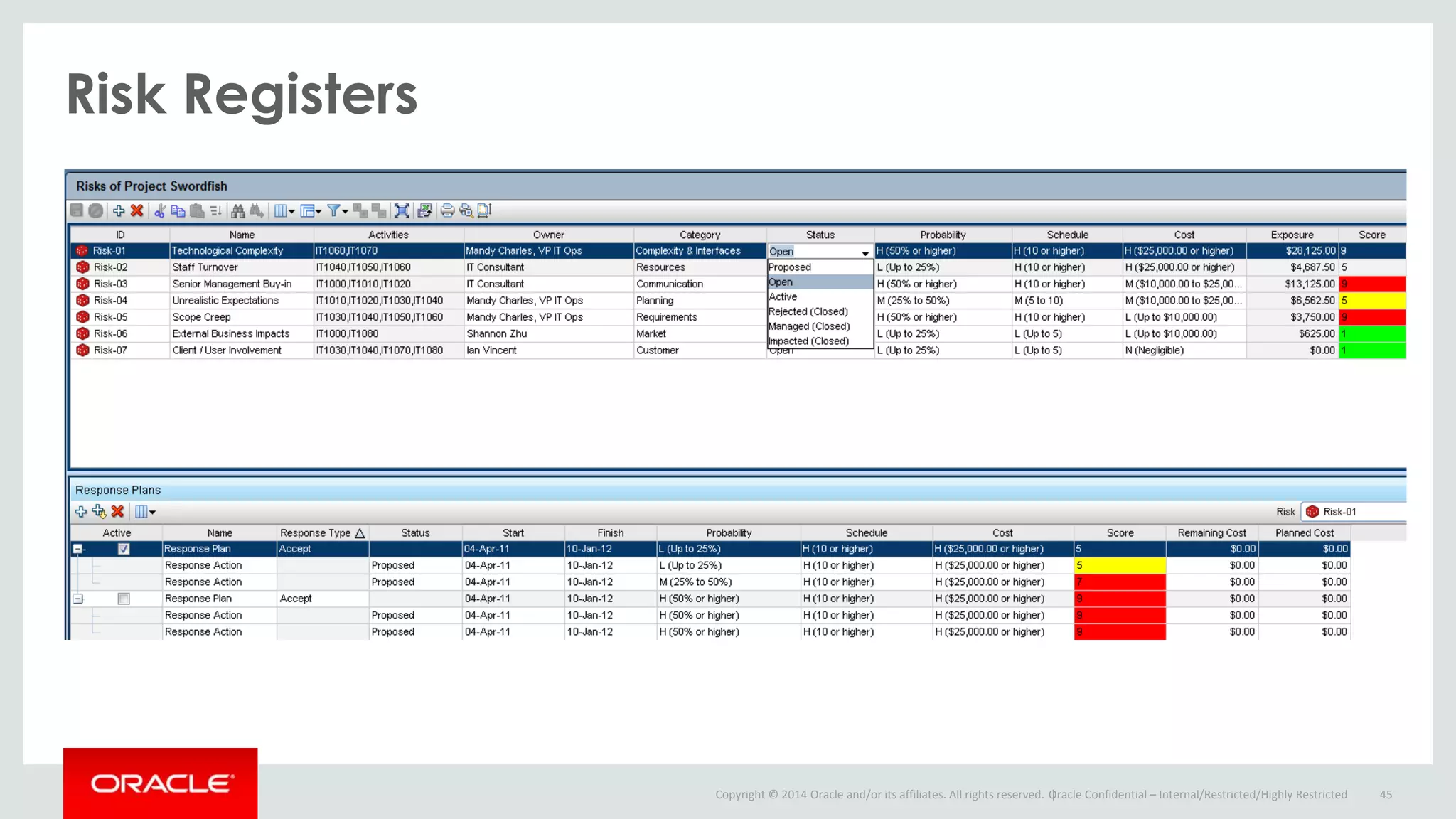

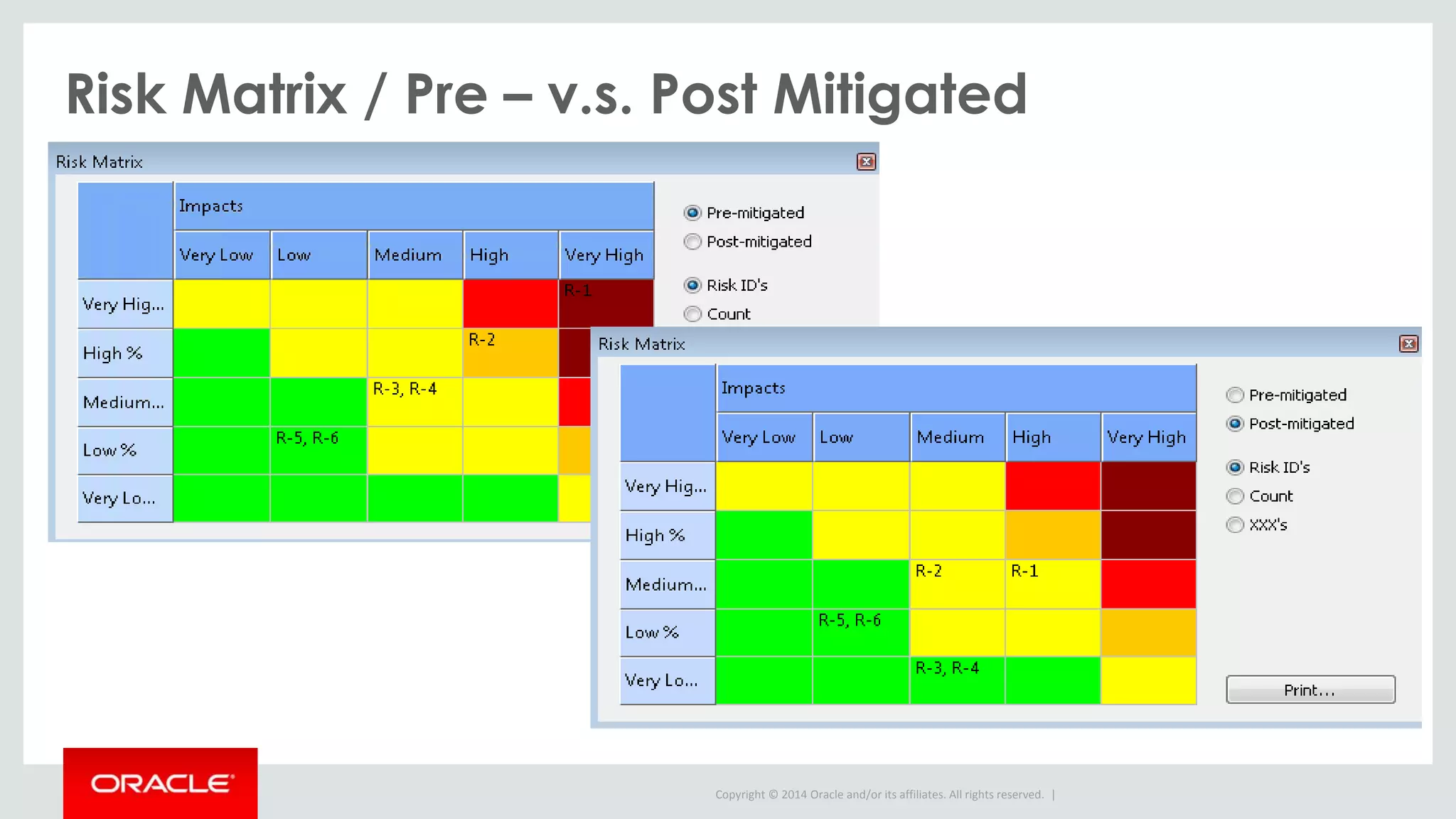

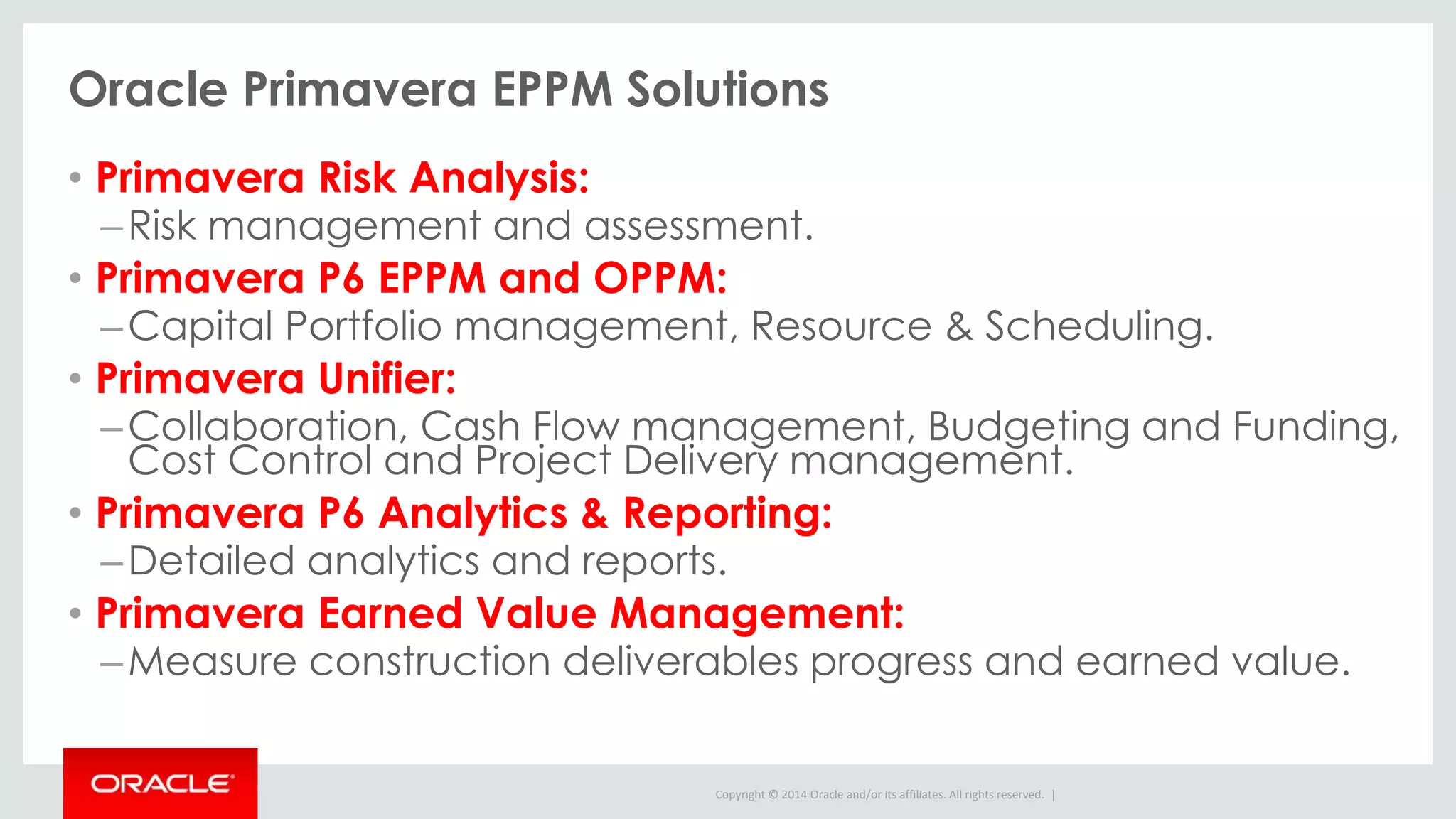

The document discusses effective project portfolio management emphasizing the importance of cash flow and risk management for organizational success. It highlights the necessity for a strategic governance framework to optimize project selection, funding, and performance while addressing the common pitfalls of traditional risk management methods. Additionally, it advocates for collaboration and transparency across projects to improve decision-making and reduce financial uncertainties.