This document provides a summary of a time series analysis of real GDP and the share of agriculture and allied sectors in India. It includes an acknowledgment, abstract, introduction on time series analysis and econometric theory. It also discusses the importance of stationary stochastic processes, difference stationary versus trend stationary processes, and the unit root test for determining stationarity. The overall summary is that the document examines the relationship between total Indian GDP and agriculture GDP using time series analysis and unit root tests on annual data from 1954-2013.

![TIME SERIES ANALYSIS OF REAL GDP AND SHARE OF AGRICULTURE AND

ALLIED SECTOR 2015

6 | P a g e

ECONOMETRIC THEORY-TIME SERIES

ANALYSIS

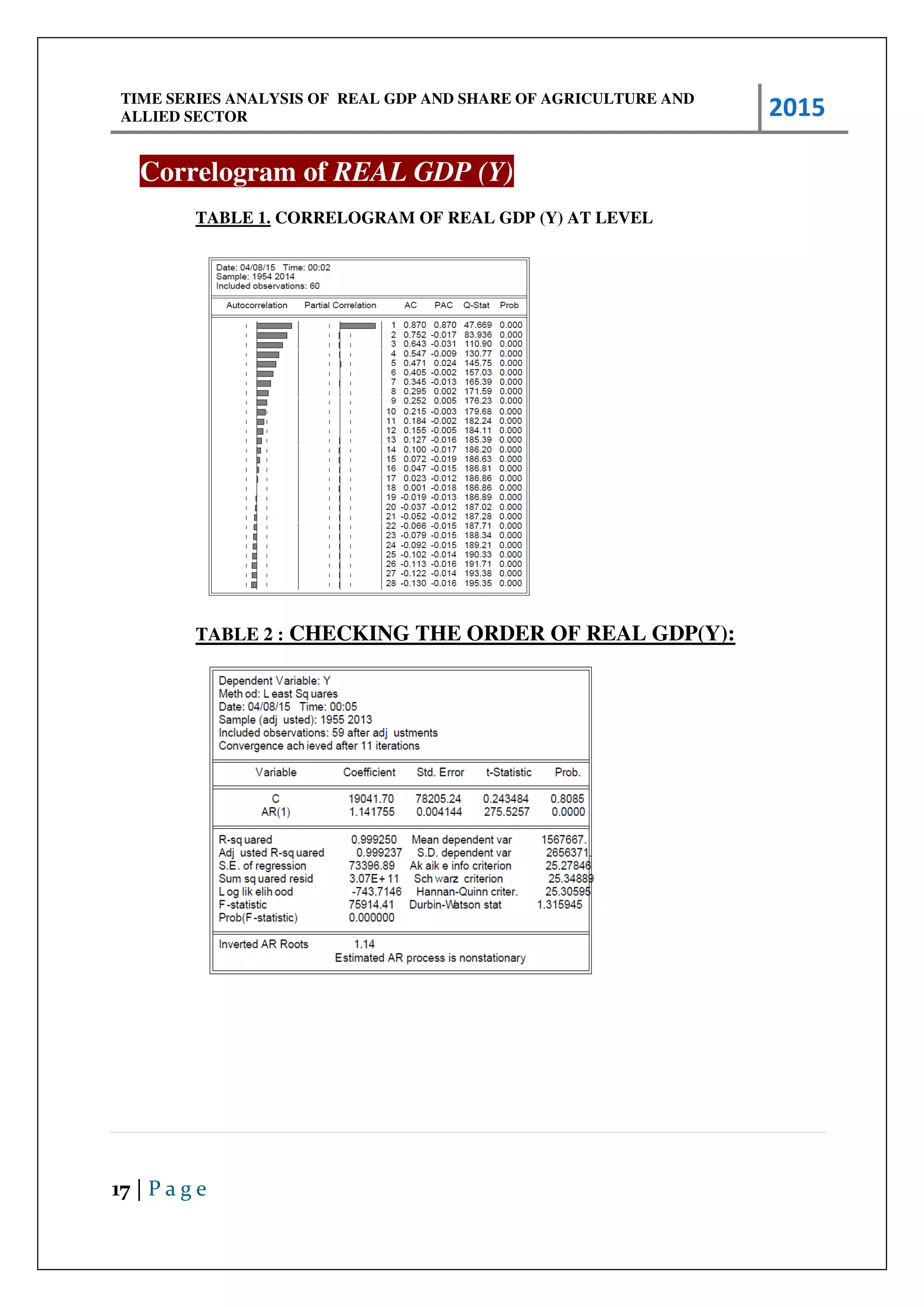

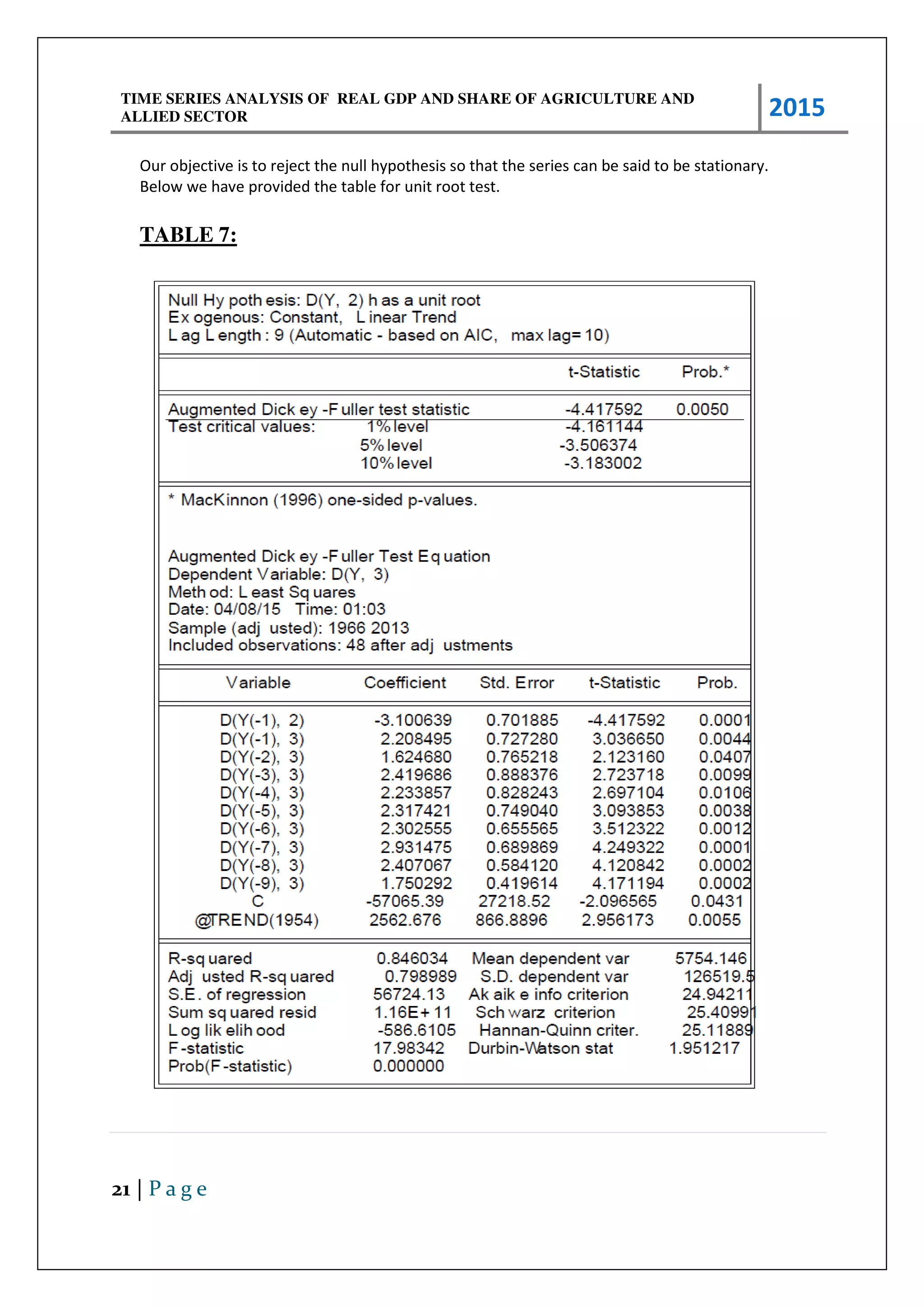

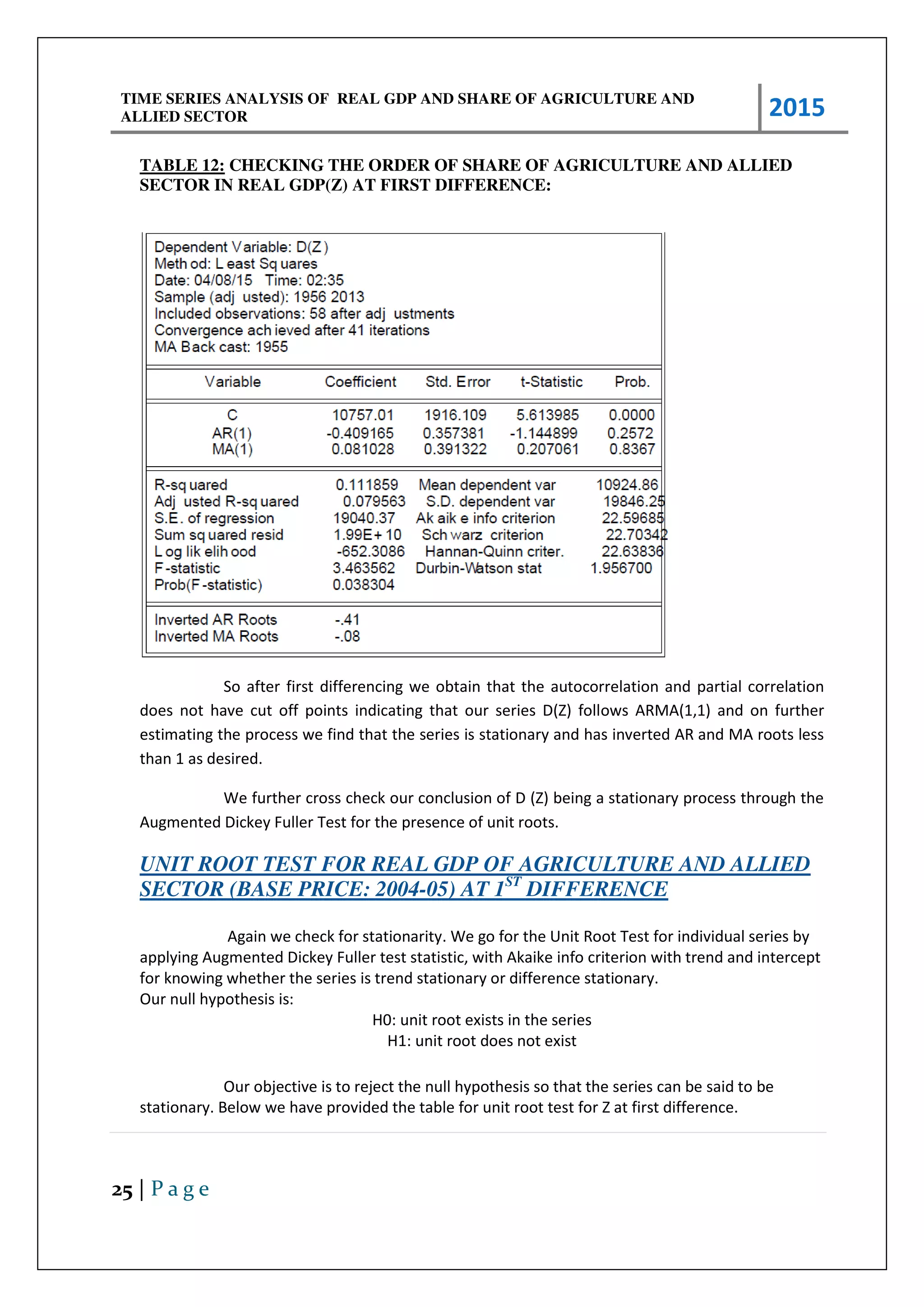

A time series is a sequence of data points, measured typically at successive points in

time spaced at uniform time intervals. This implies that time series data have a natural temporal

ordering which makes time series analysis distinct from other common data analysis problems, in

which there is no natural ordering of the observations. Basically, time series analysis comprises

methods for analyzing time series data in order to extract meaningful statistics and other

characteristics of the data, and time series forecasting is the use of a model to predict future

values based on previously observed values.

All data are for the period of 1954-2013, for a total of 60 observations.

IMPORTANCE OF STATIONARY STOCHASTIC PROCESS

A random or stochastic process is a collection of random variables ordered in time.

Continuous variables are denoted by Y(t) and discrete variables are denoted by Yt. The stationary

stochastic process has received a great deal of attention and scrutiny by analysts. A stochastic

process is constant when the mean and variance is constant over time and its covariance depends

on the distance/gap/lag between two time periods and not the actual time at which covariance is

calculated. Such a process is weakly stationary/ covariance stationary/ second order stationary/

wide sense stochastic process.

Definition of a stationary stochastic process:

Let Yt be a stochastic time series with these properties:

Mean: E (Yt = μ

Variance: var (Yt) = E (Yt – μ 2 = σ2

Co a ia e: k = E [(Yt − μ Yt+k − μ ]

Whe e k, the covariance (or auto covariance) at lag k, is the covariance between the values of Yt

and Yt+k, that is, et ee t o Y alues k pe iods apa t. If k = , e o tai 0, which is simply the

variance of Y (= σ2).

For the purpose of forecasting, we will use a stationary time series because

non stationary time series have a time varying mean or time varying variance or maybe

both. Then, we can study behaviour only for the concerned time period. Therefore,

generalization to other time periods is not a possibility.](https://image.slidesharecdn.com/18b5c40f-33d1-446a-9131-1aa6e3370322-160323055344/75/econometrics-project-PG1-2015-16-6-2048.jpg)

![TIME SERIES ANALYSIS OF REAL GDP AND SHARE OF AGRICULTURE AND

ALLIED SECTOR 2015

32 | P a g e

22. "Handbook of Statistics on Indian Economy". Reserve Bank of India: India's

Central Bank. 2011.

23. "World Wheat, Corn and Rice". Oklahoma State University, FAOSTAT.

24. "Indian retail: The supermarket's last frontier". The Economist. 3 December 2011.

25. Sinha, R.K. (2010). "Emerging Trends, Challenges and Opportunities presentation,

on publications page, see slides 7 through 21". National Seed Association of India.

26. Fuller; Korisettar, Ravi; Venkatasubbaiah, P.C.; Jones, Martink. et al. (2004).

"Early plant domestications in southern India: some preliminary archaeobotanical

results". Vegetation History and Archaeobotany 13 (2): 115–129.

doi:10.1007/s00334-004-0036-9.

27. Tamboli and Nene. "Science in India with Special Reference to Agriculture". Agri

History.

28. Gupta, page 57

29. Harris & Gosden, page 385

30. Lal, R. (August 2001). "Thematic evolution of ISTRO: transition in scientific issues

and research focus from 1955 to 2000". Soil and Tillage Research 61 (1–2): 3–12

[3]. doi:10.1016/S0167-1987(01)00184-2.

31. agriculture, history of. Encyclopedia Britannica 2008.

32. Shaffer, pages 310-311

.](https://image.slidesharecdn.com/18b5c40f-33d1-446a-9131-1aa6e3370322-160323055344/75/econometrics-project-PG1-2015-16-32-2048.jpg)