Embed presentation

Download to read offline

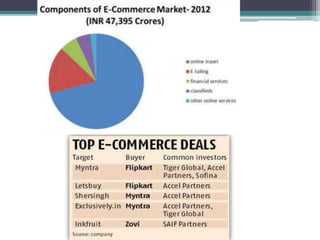

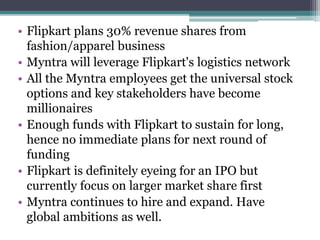

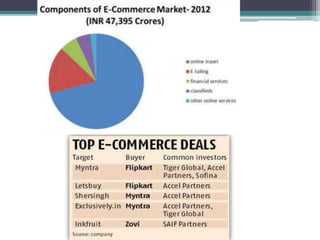

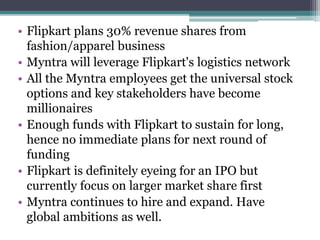

The document discusses e-commerce mergers and acquisitions in India. It notes that the e-commerce market in India is currently worth $2.5 billion but is expected to reach $20 billion in the next 5 years. It then examines the Flipkart-Myntra deal, where Flipkart acquired Myntra for $300 million. The acquisition allows both companies to operate separately while combining Flipkart's logistics network with Myntra's fashion business and online market share. The merger of the two companies aims to capture over 50% of the online fashion market in India.