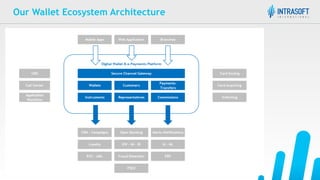

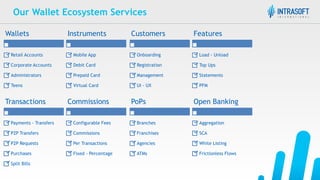

Intrasoft International presents its digital wallet ecosystems at the 7th Banking & Finance Forum, highlighting its expertise in fintech and the growing e-wallet market predicted to reach USD 2.1 trillion by 2023. The company offers a comprehensive fintech portfolio, including its core banking platform and open banking solutions aimed at enhancing customer experiences and decision-making through analytics. The document also discusses the impact of COVID-19 on digital payment trends, emphasizing a permanent shift towards contactless and e-wallet methods among consumers.