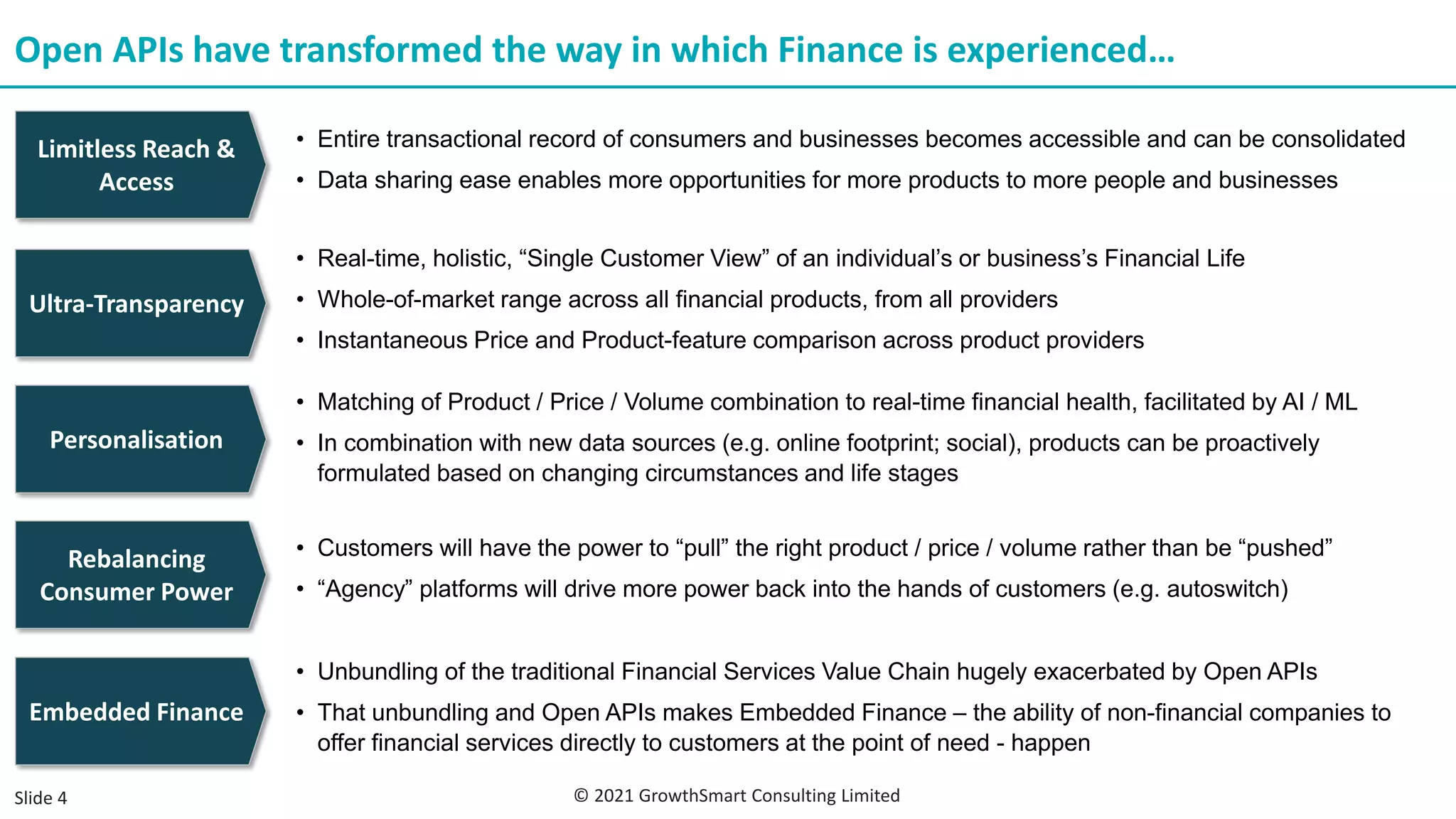

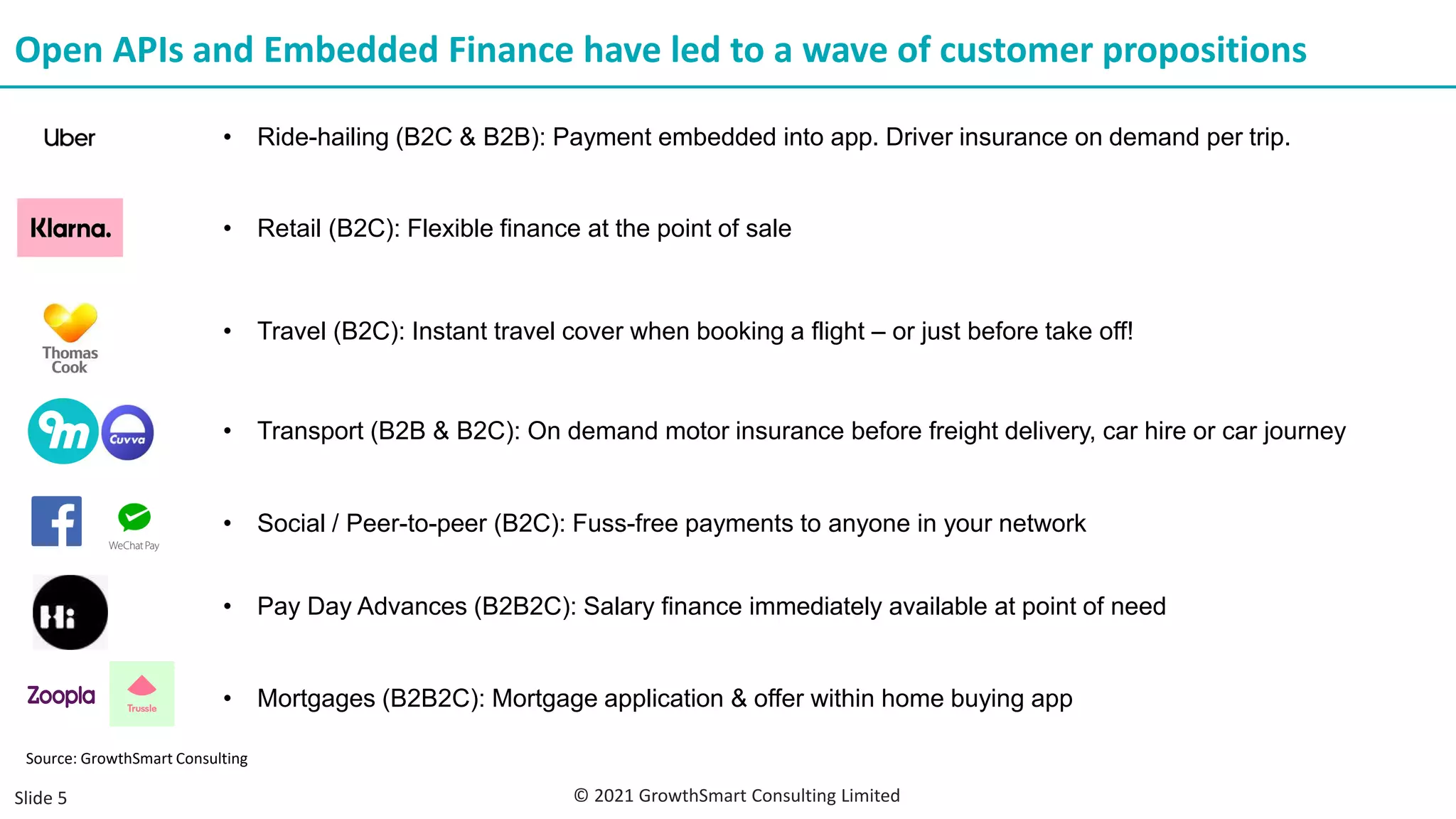

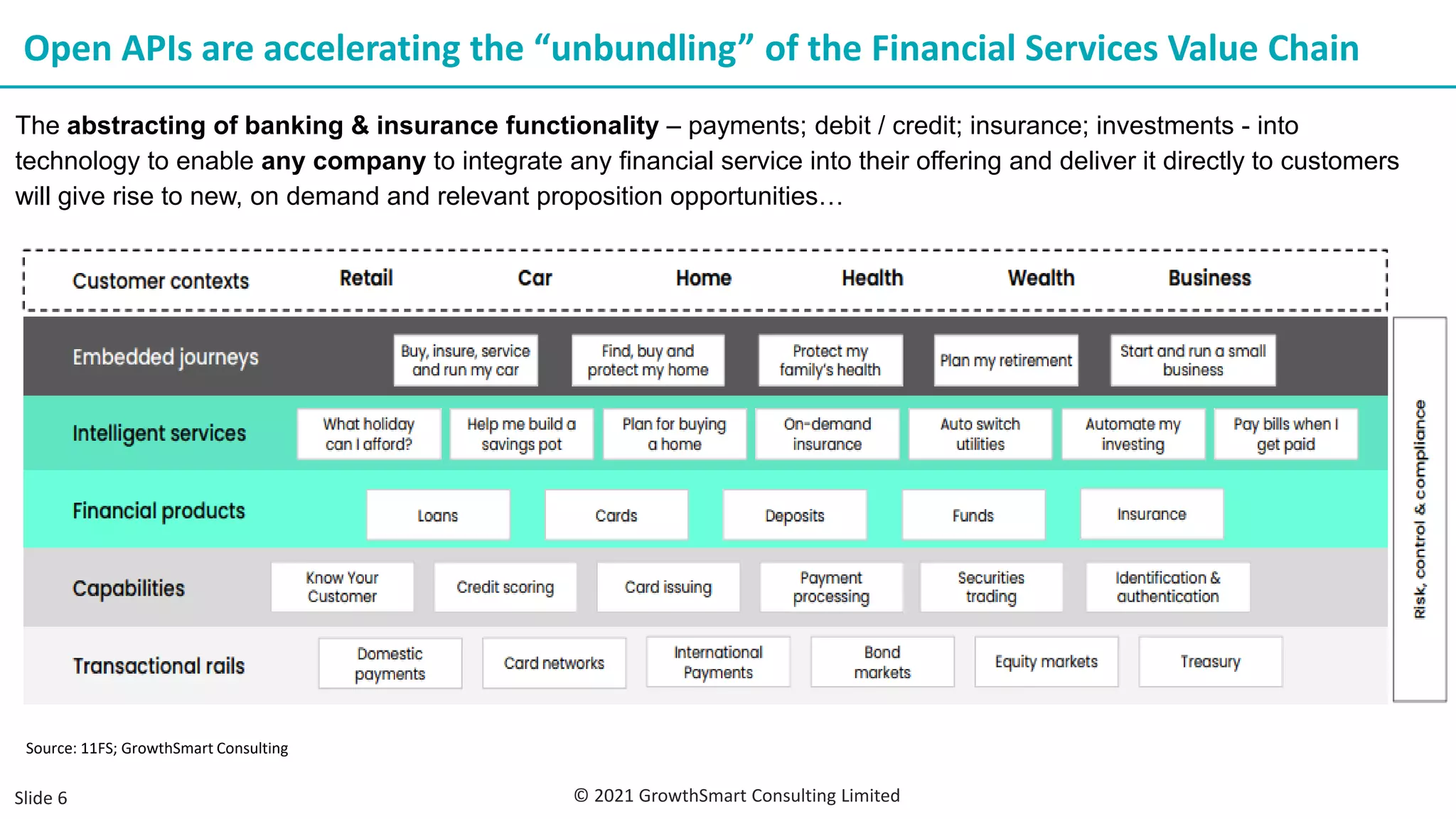

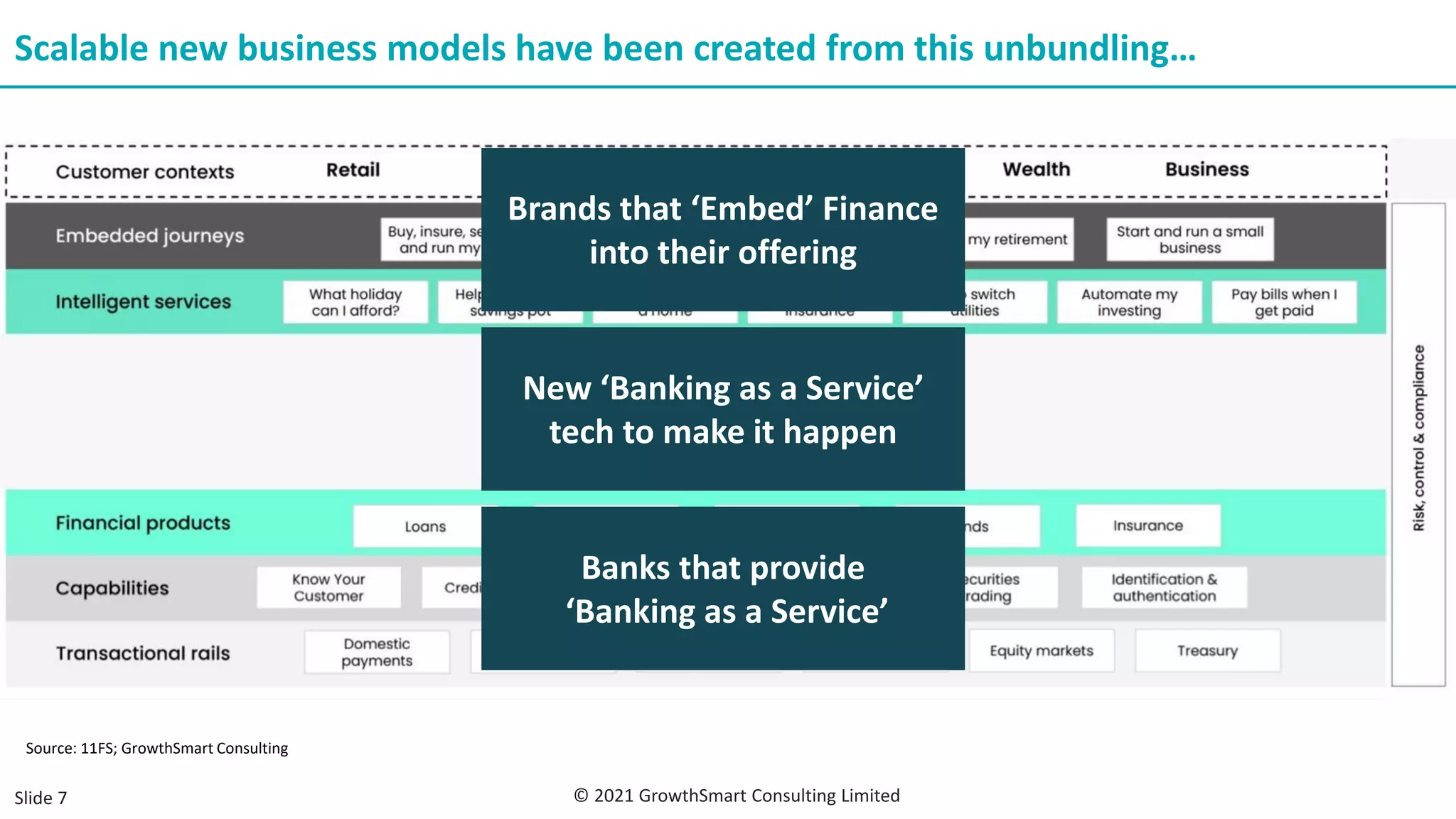

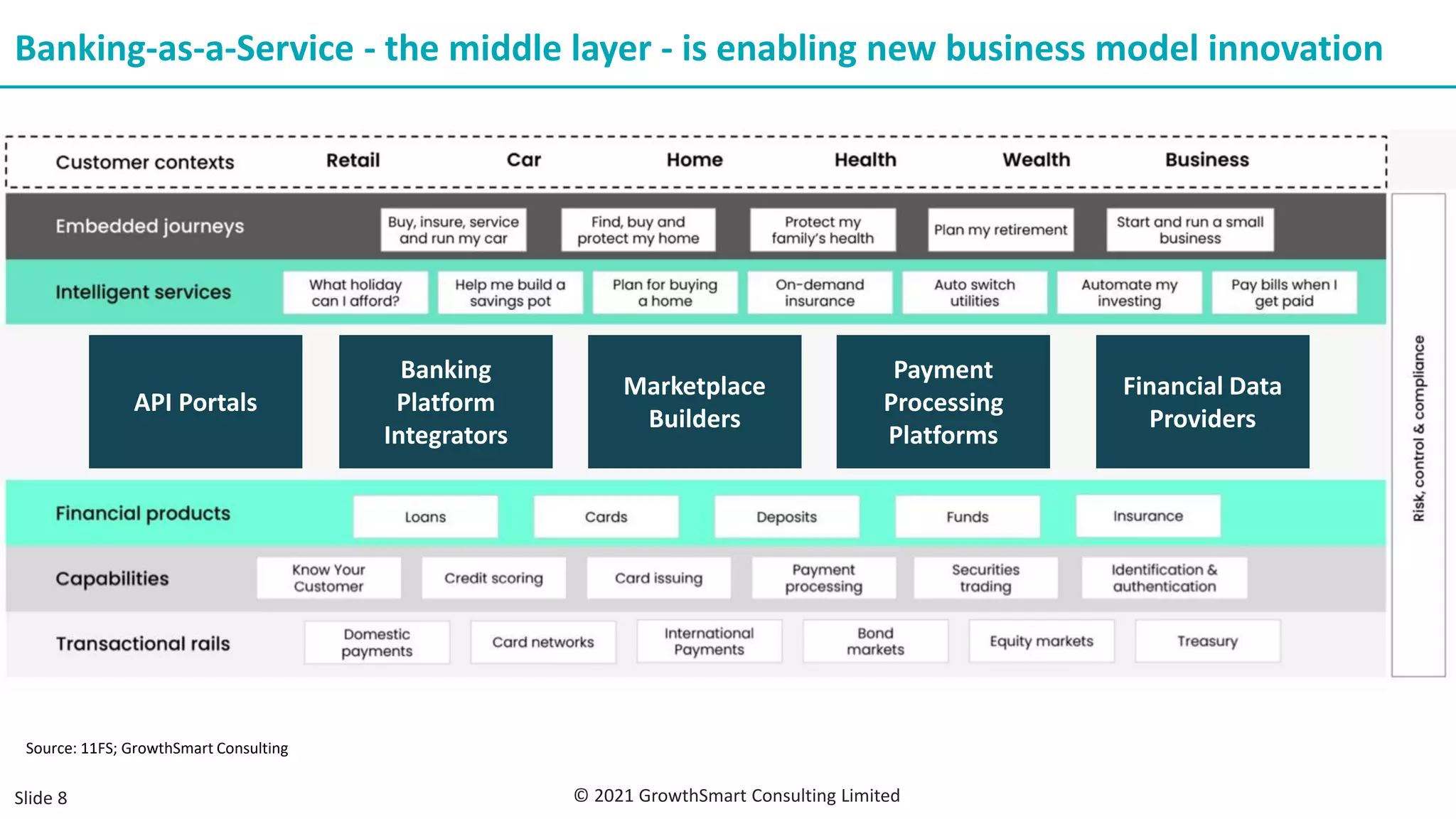

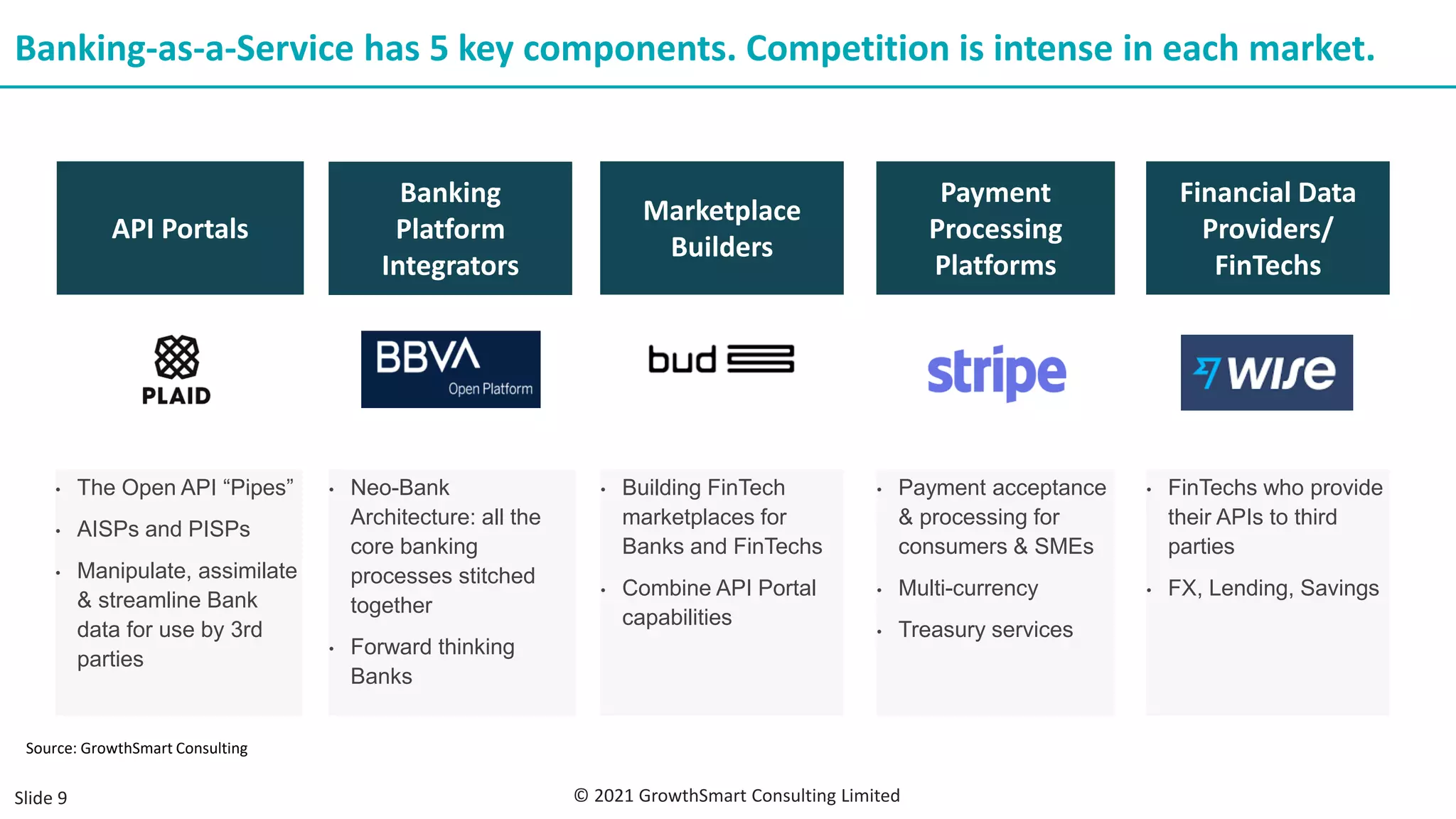

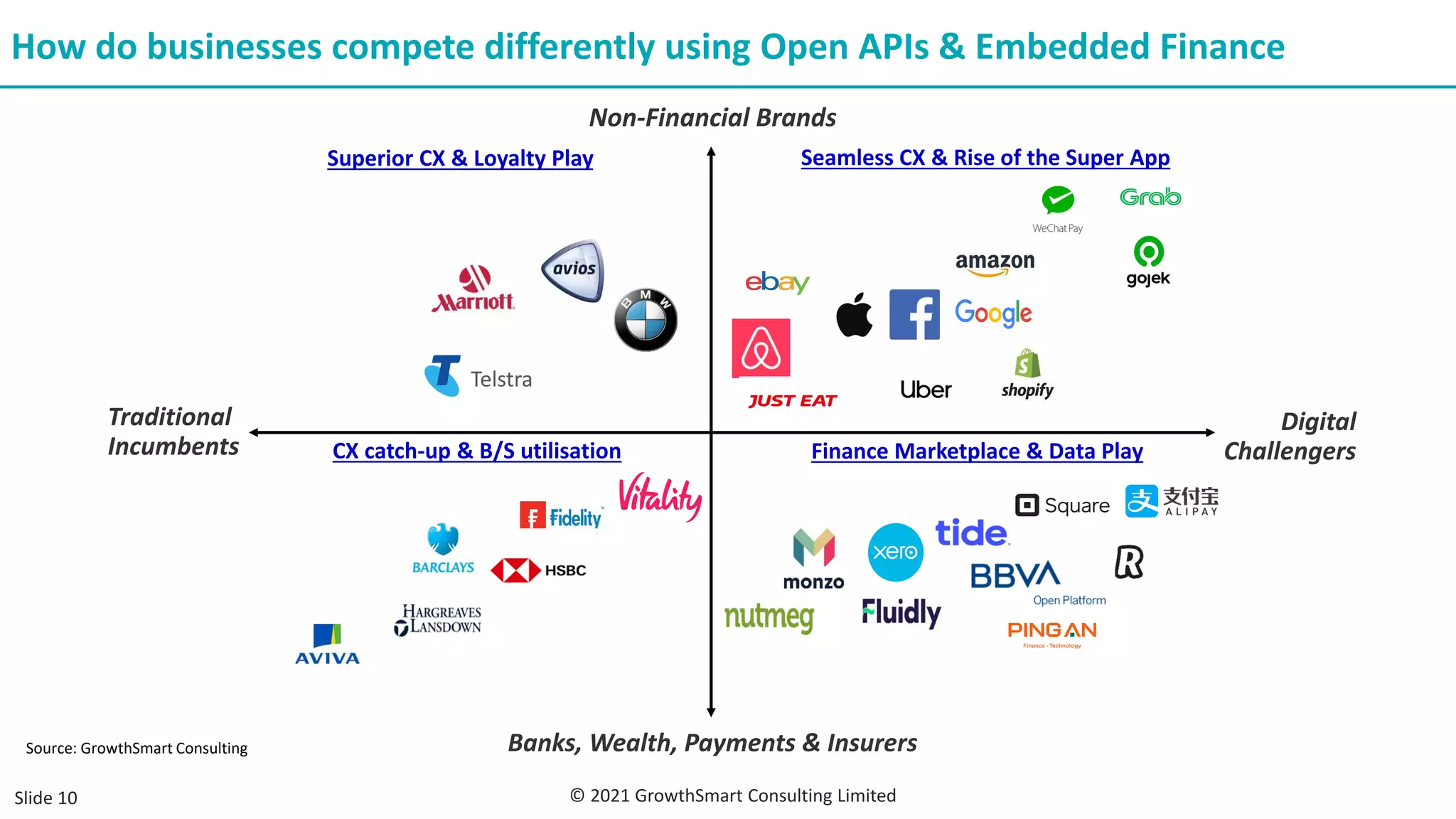

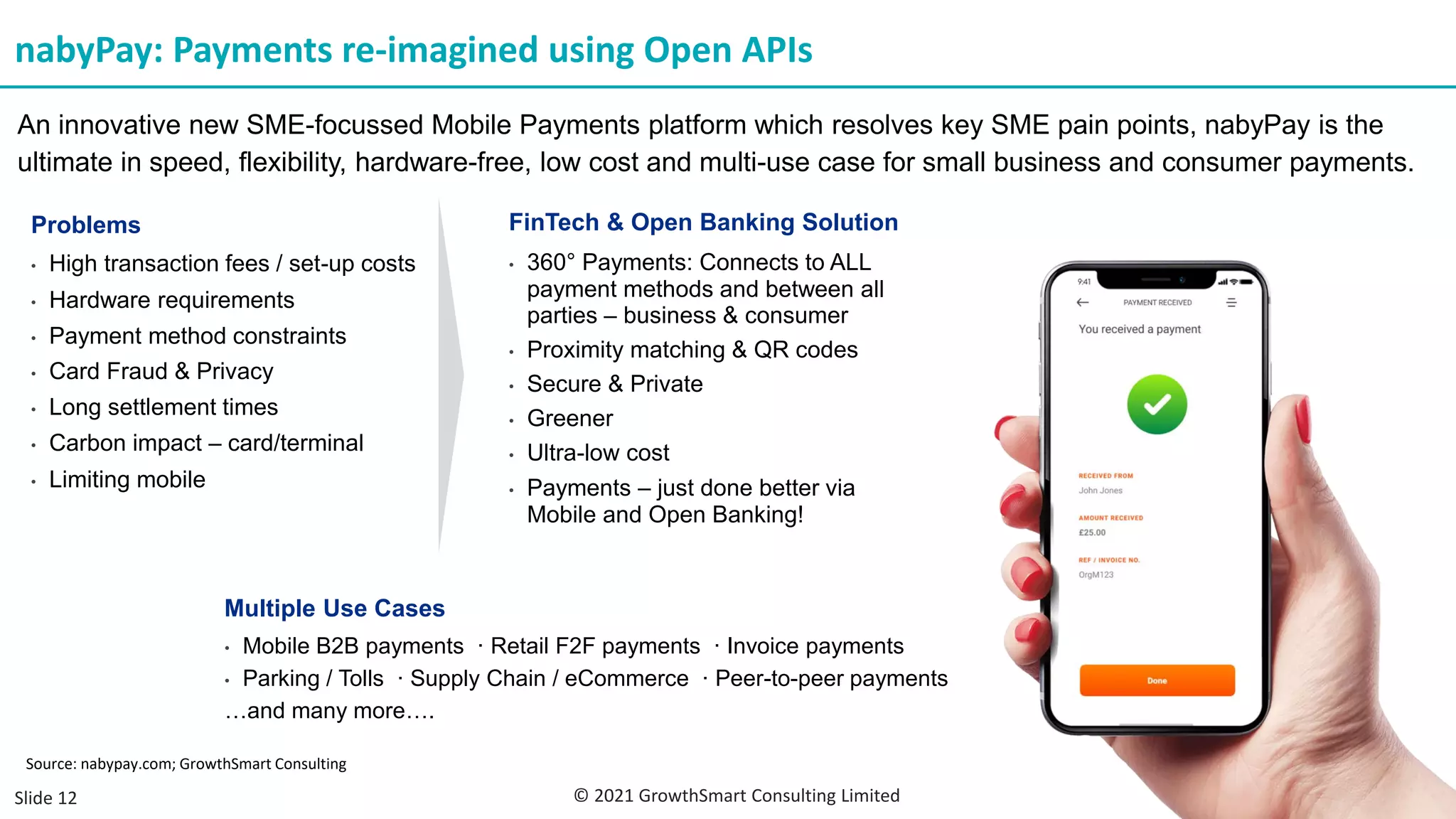

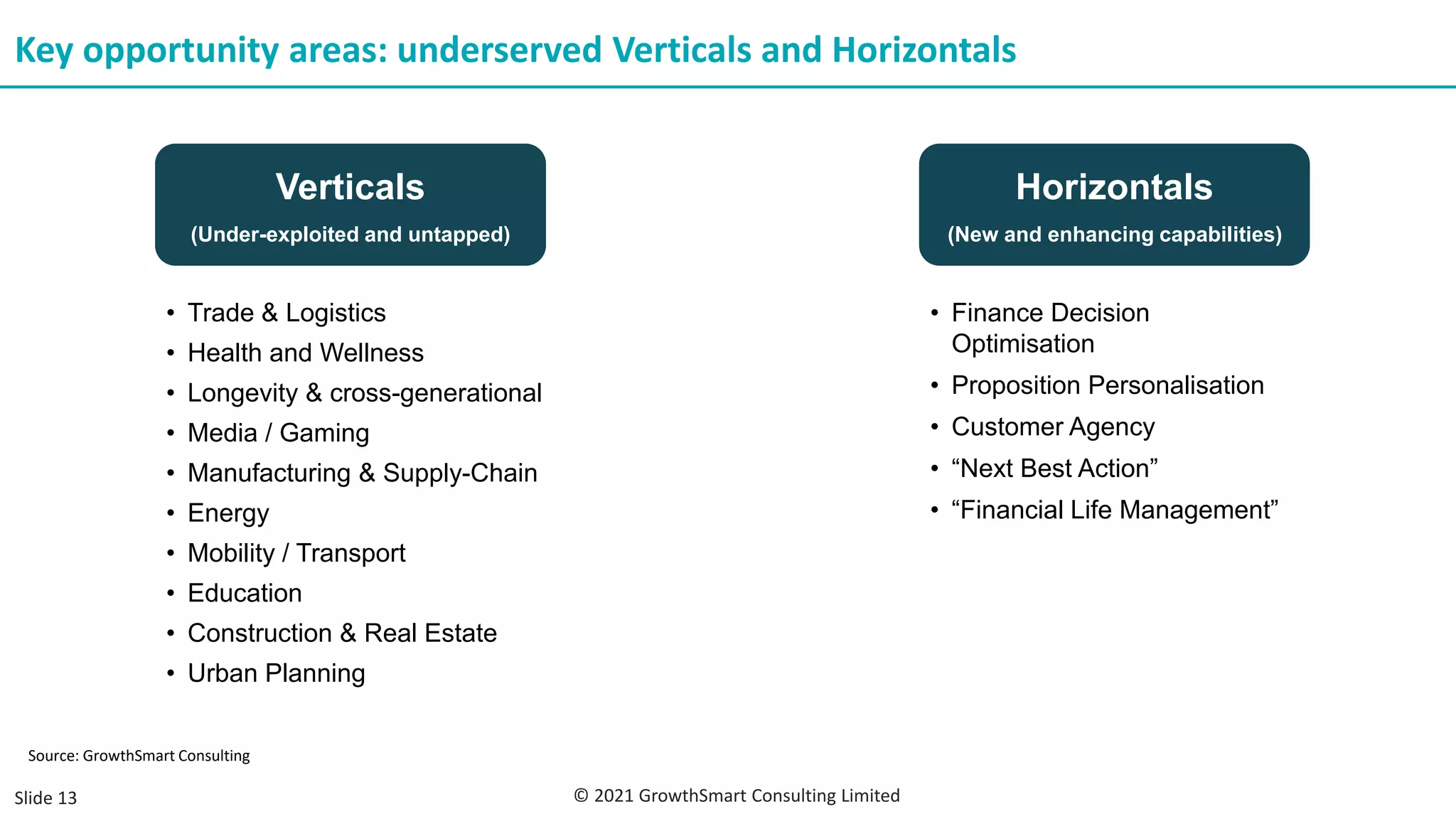

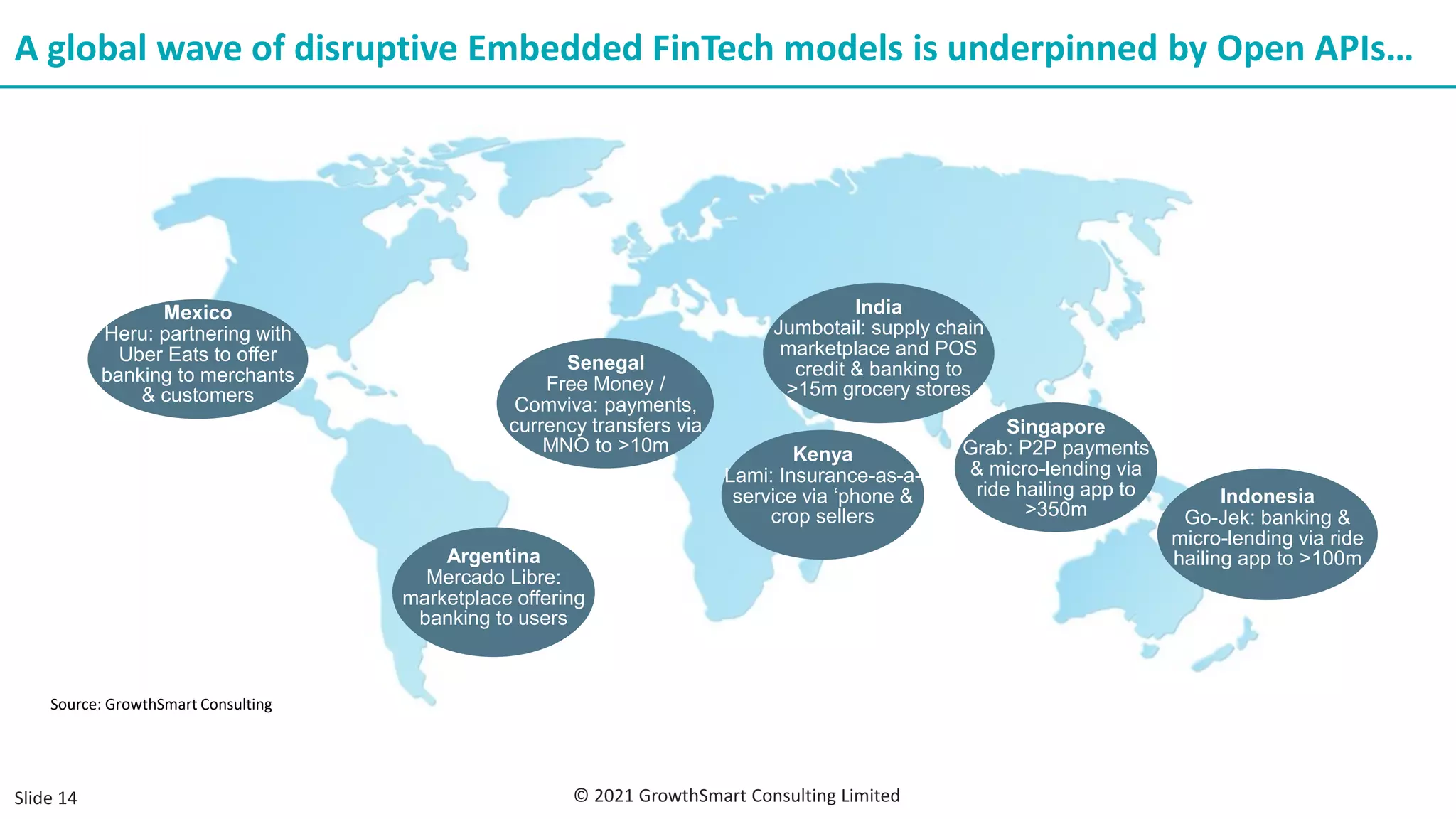

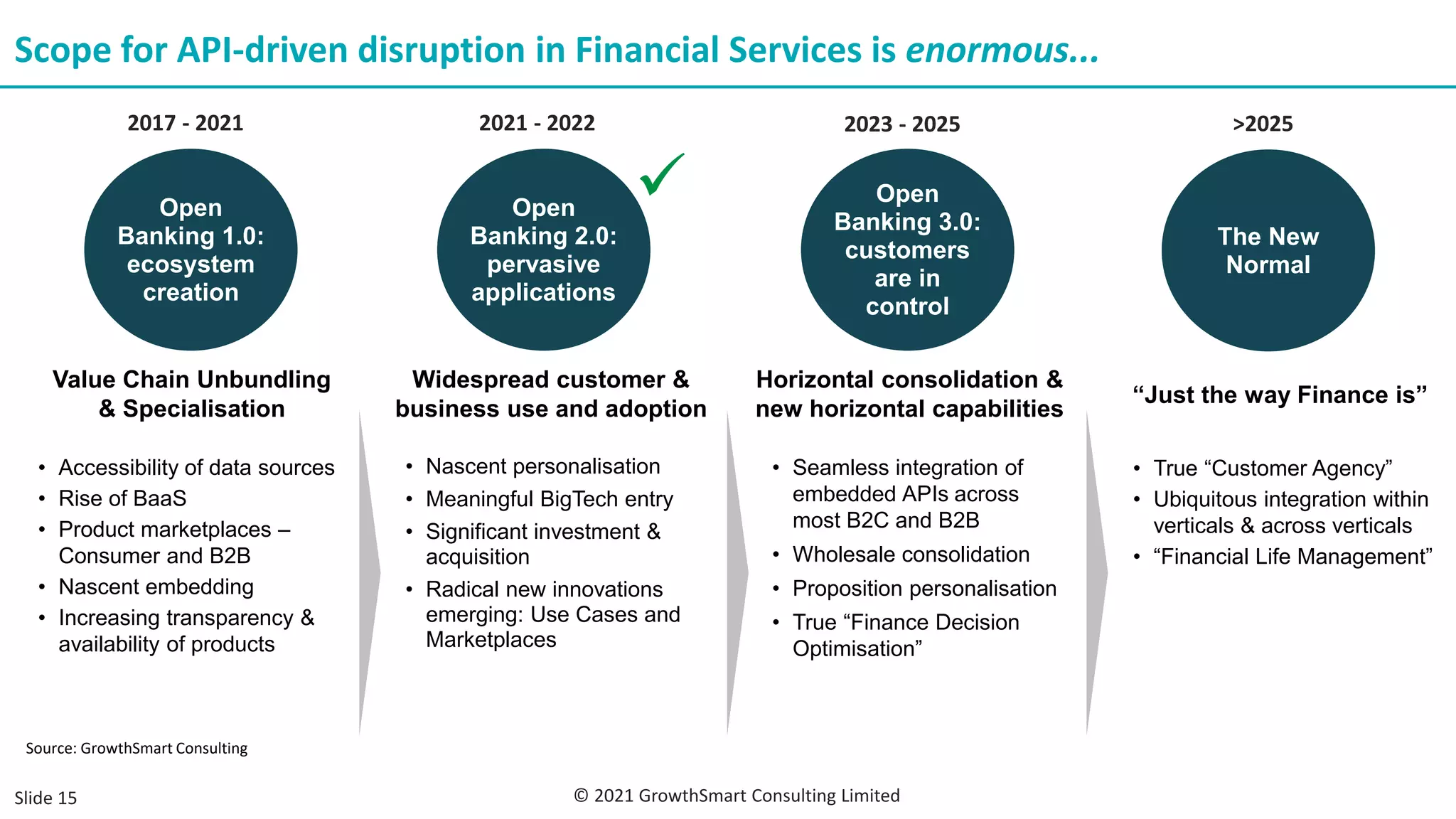

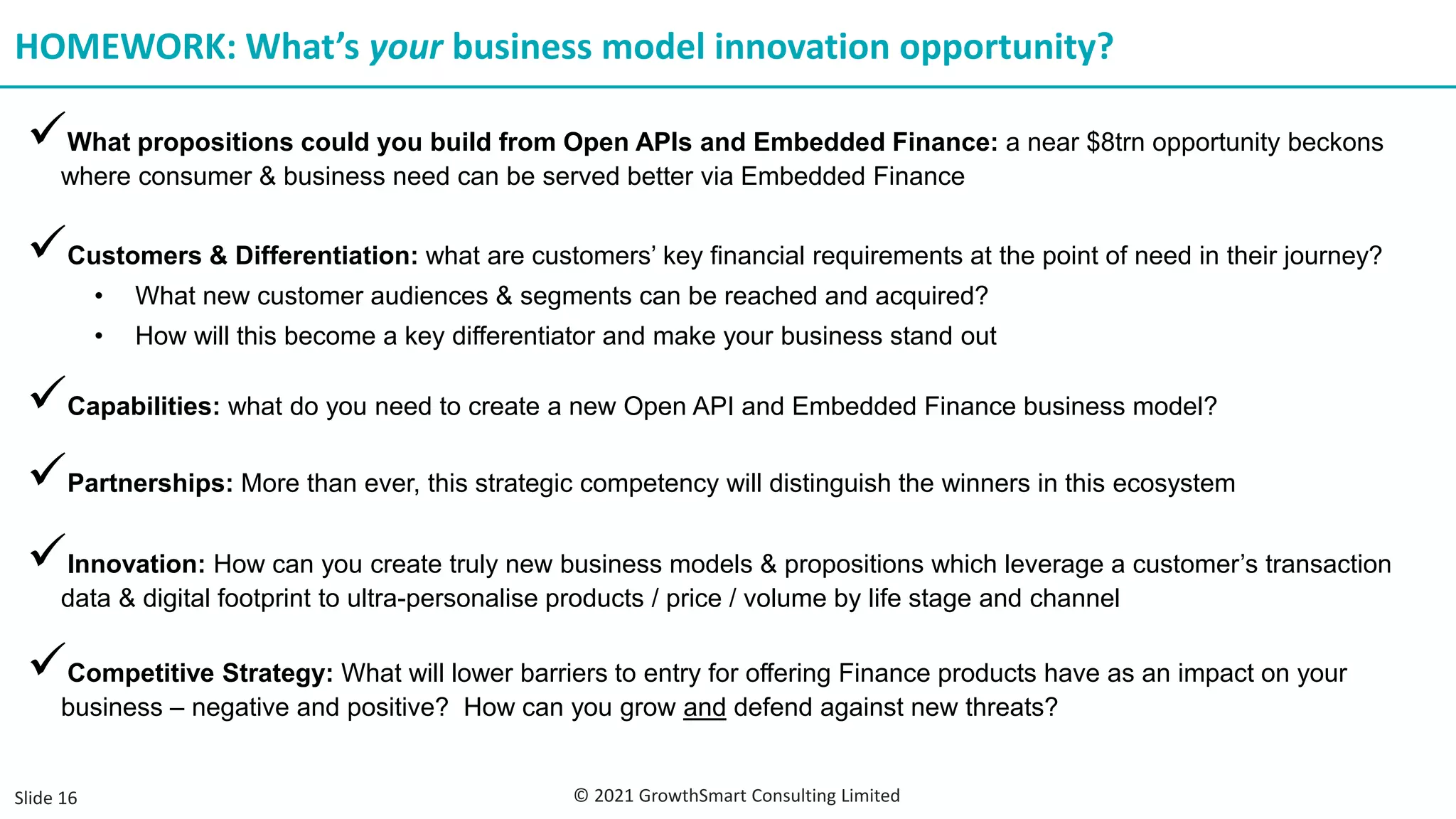

The document discusses how open APIs and embedded finance are transforming the financial services landscape, enabling new business models and improving customer experiences. It highlights examples of successful fintech innovations and the critical aspects of competition in the evolving market, emphasizing personalization and consumer agency. Additionally, it outlines opportunities for businesses to leverage these technologies for growth and differentiation, while posing strategic questions for potential innovation.