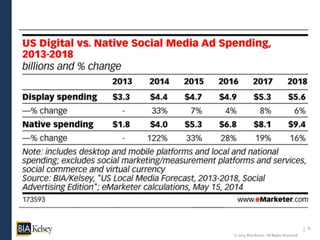

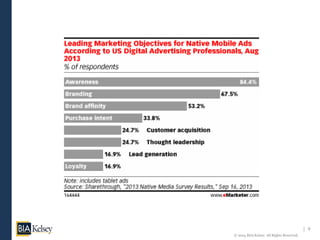

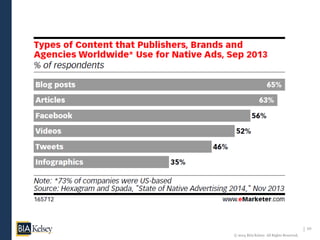

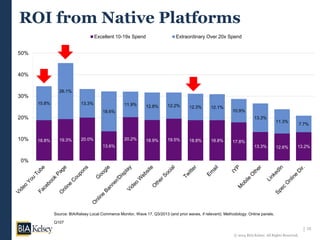

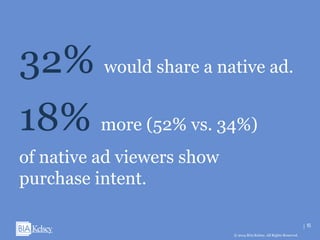

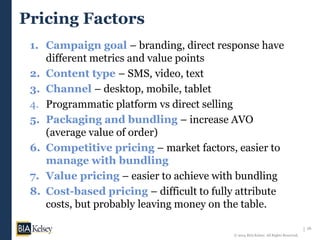

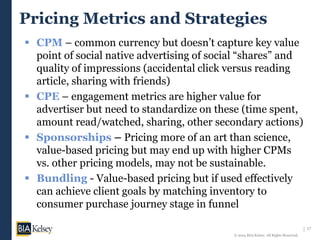

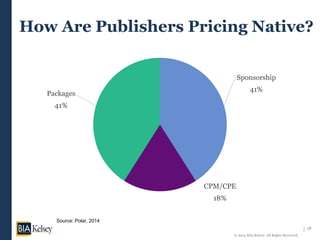

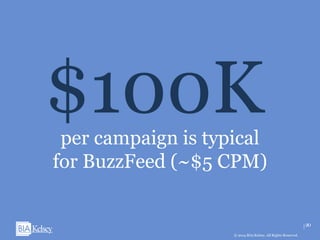

The document discusses native advertising pricing strategies. It finds that native ads have a much higher return on investment than traditional banner ads. While cost per thousand impressions (CPM) is a common pricing metric, engagement metrics like time spent and sharing may better capture native ads' value. Publishers are experimenting with various pricing models like sponsorships, CPM/CPE, and packages. The document recommends pricing native ads according to their placement in the consumer purchase funnel and bundling inventory to maximize long-term client value.