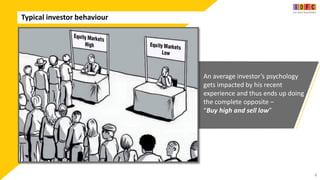

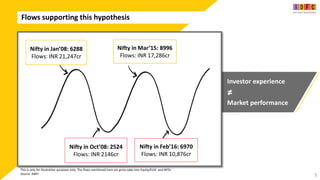

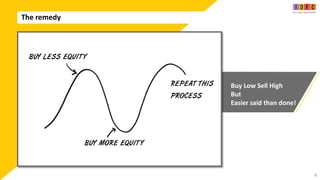

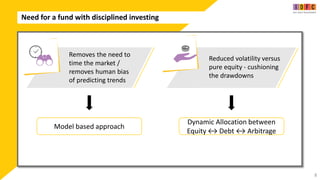

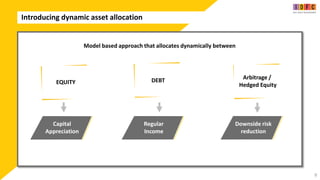

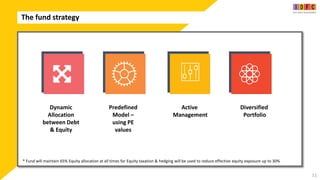

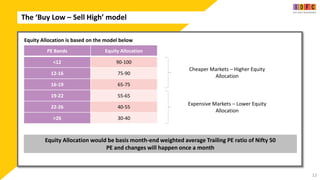

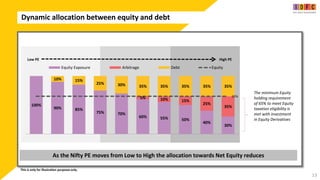

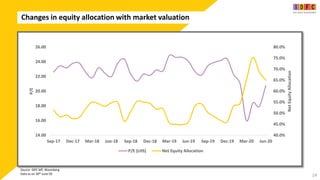

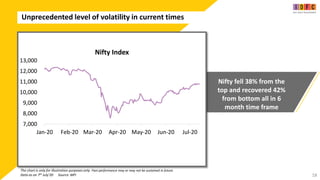

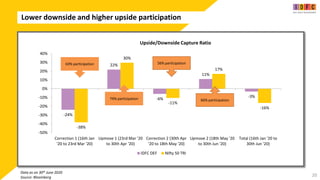

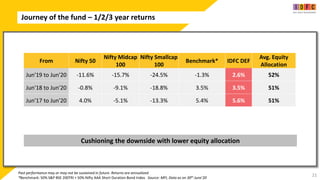

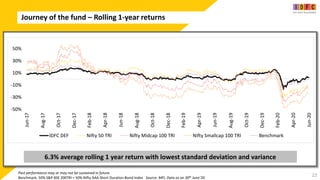

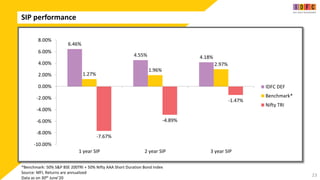

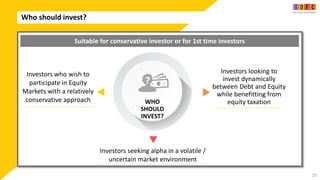

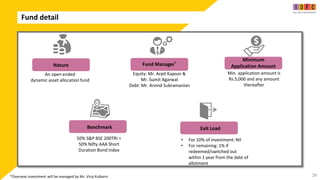

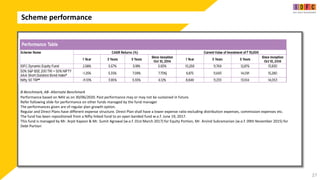

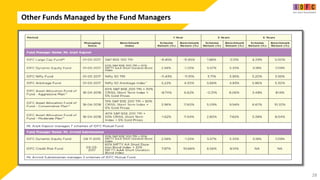

The document provides information on the IDFC Dynamic Equity Fund, a dynamic asset allocation fund. It discusses typical investor behavior of buying high and selling low, and how the fund aims to remedy this by buying low and selling high through its model-based approach. The fund uses a predefined model to dynamically allocate between equity, debt, and arbitrage based on equity market valuations. As valuations become cheaper, equity allocation increases, and becomes lower as valuations become more expensive. This is aimed at participating in market upside while providing downside protection. Performance data shows the fund has achieved its objectives of lower volatility and downside protection compared to pure equity funds.