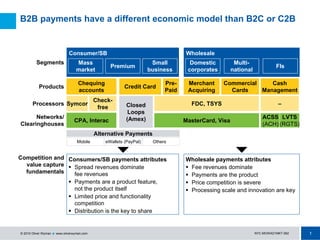

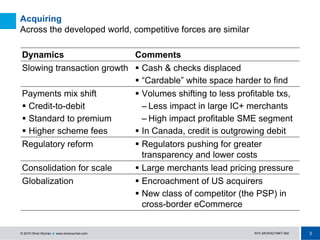

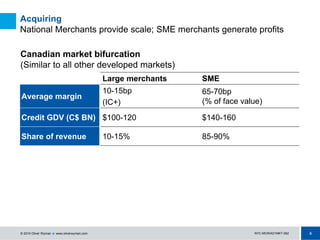

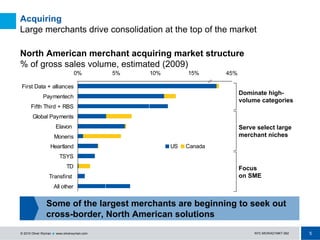

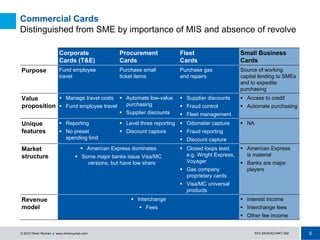

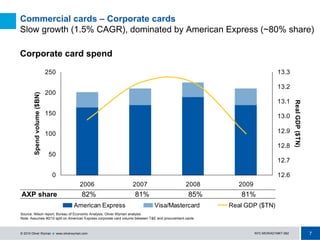

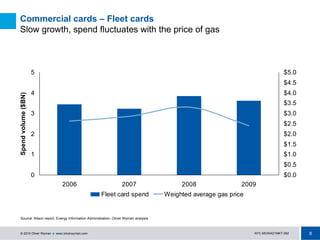

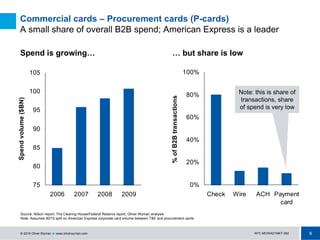

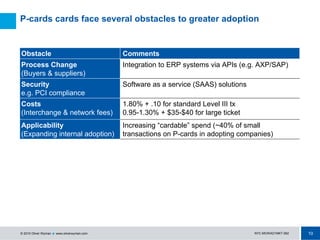

B2B payments have different economic models than B2C payments. While cards play a role in B2B payments, they face obstacles to greater adoption, particularly for procurement cards. Merchant acquiring is the largest segment but faces slowing growth and pricing pressures. Commercial cards target important niches like corporate travel and fleet management, but procurement cards are the only segment with substantial room for growth, though they face challenges to adoption beyond low-ticket categories.