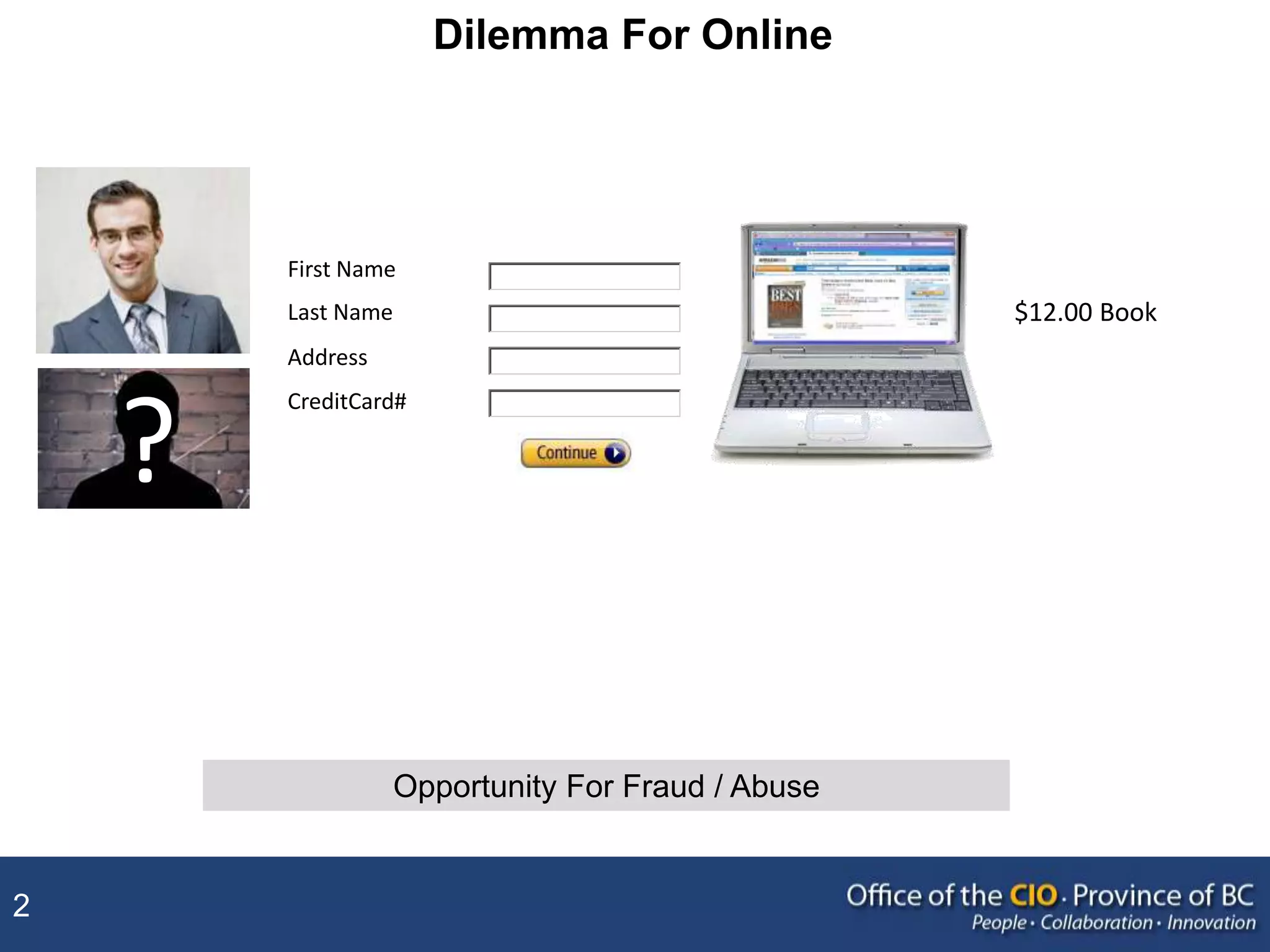

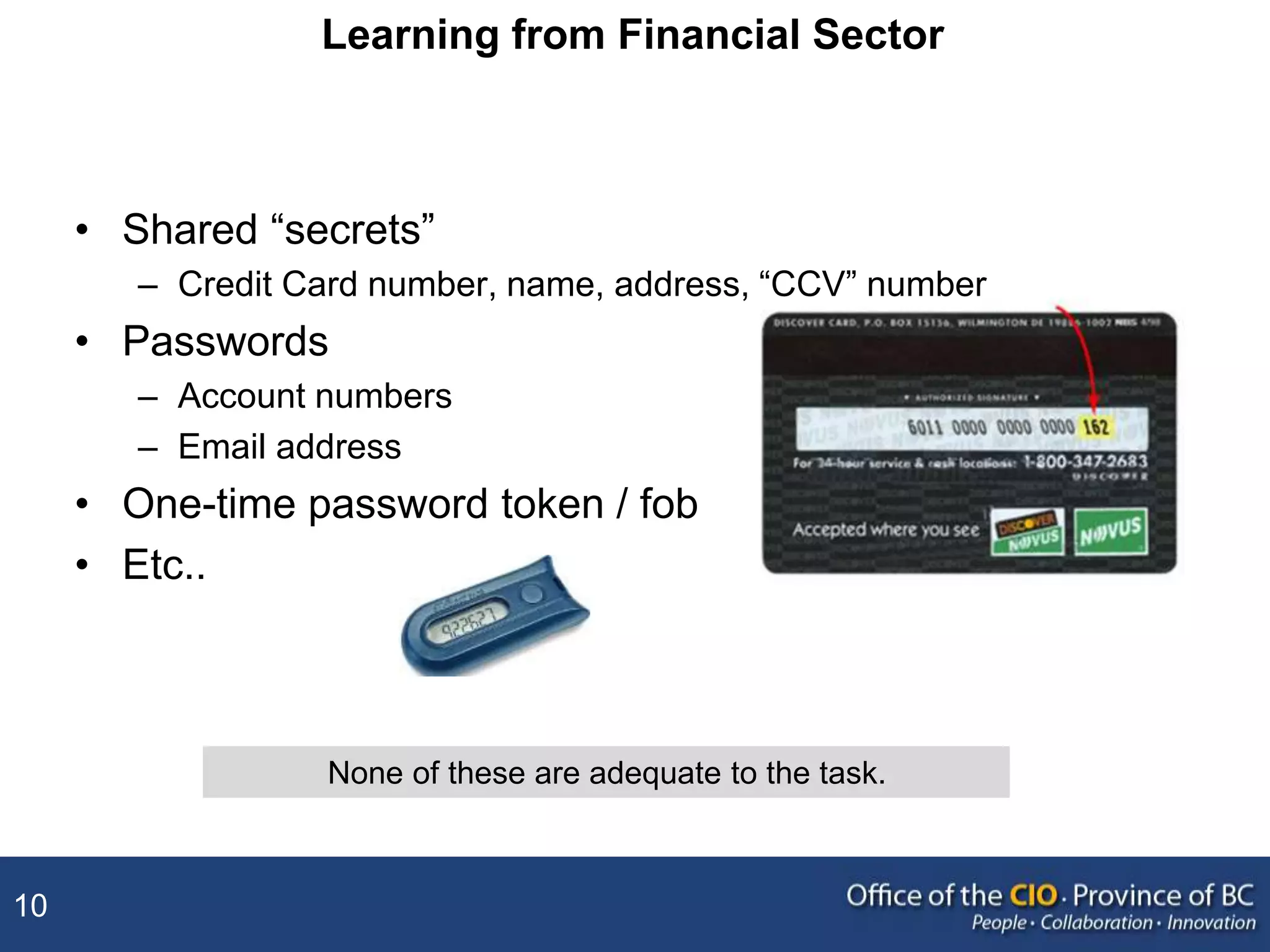

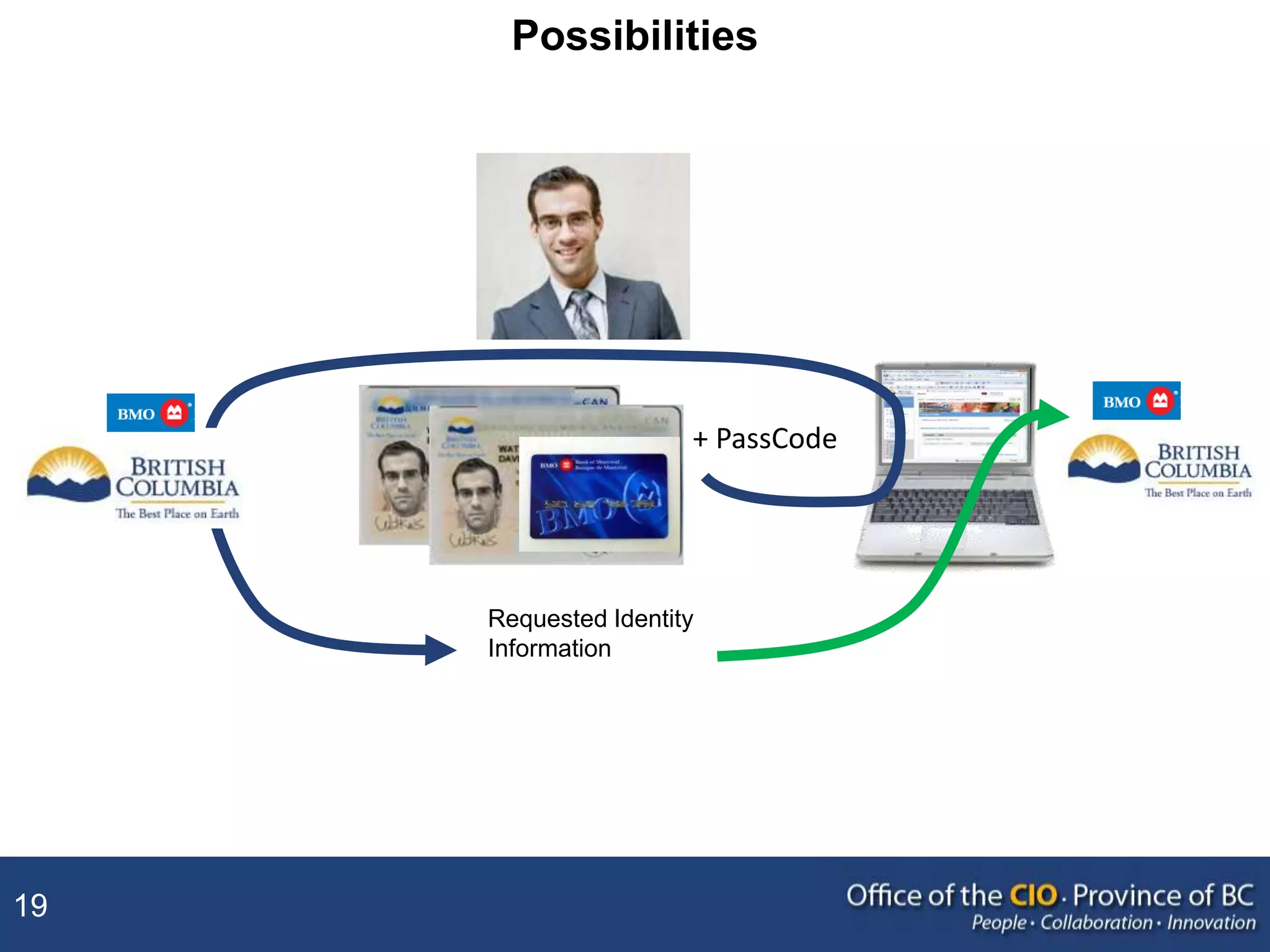

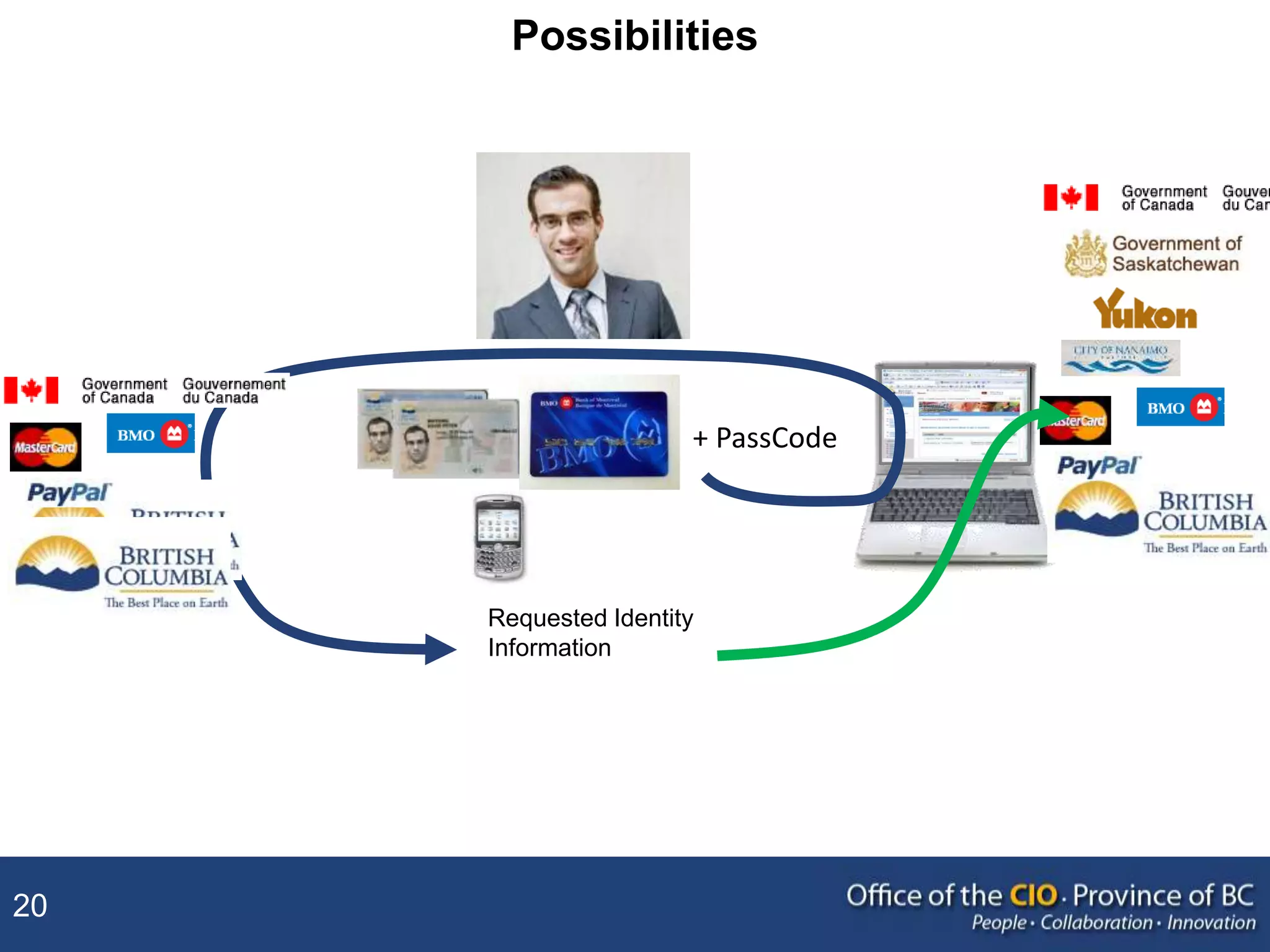

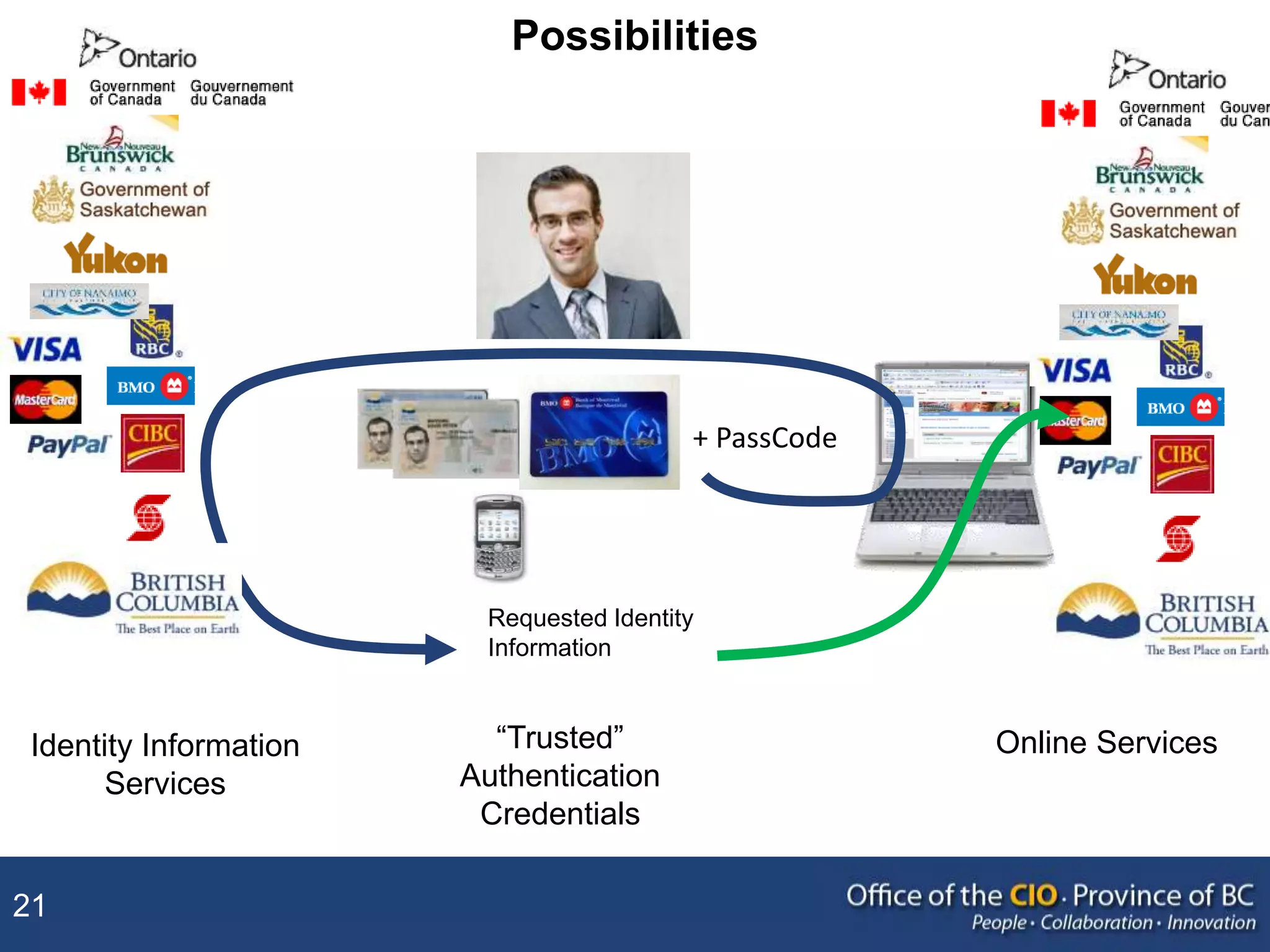

The document discusses scenarios for improving online identity verification and authentication in Canada to enable more government services to move online. It proposes that governments issue "digital credentials" similar to how they currently issue identity documents. This could allow individuals to securely provide identity information and proof of authentication to access online government services. The document also suggests that the financial sector and government need to work together to update systems using new credential technologies in a way that improves privacy while enabling online self-service options for citizens.