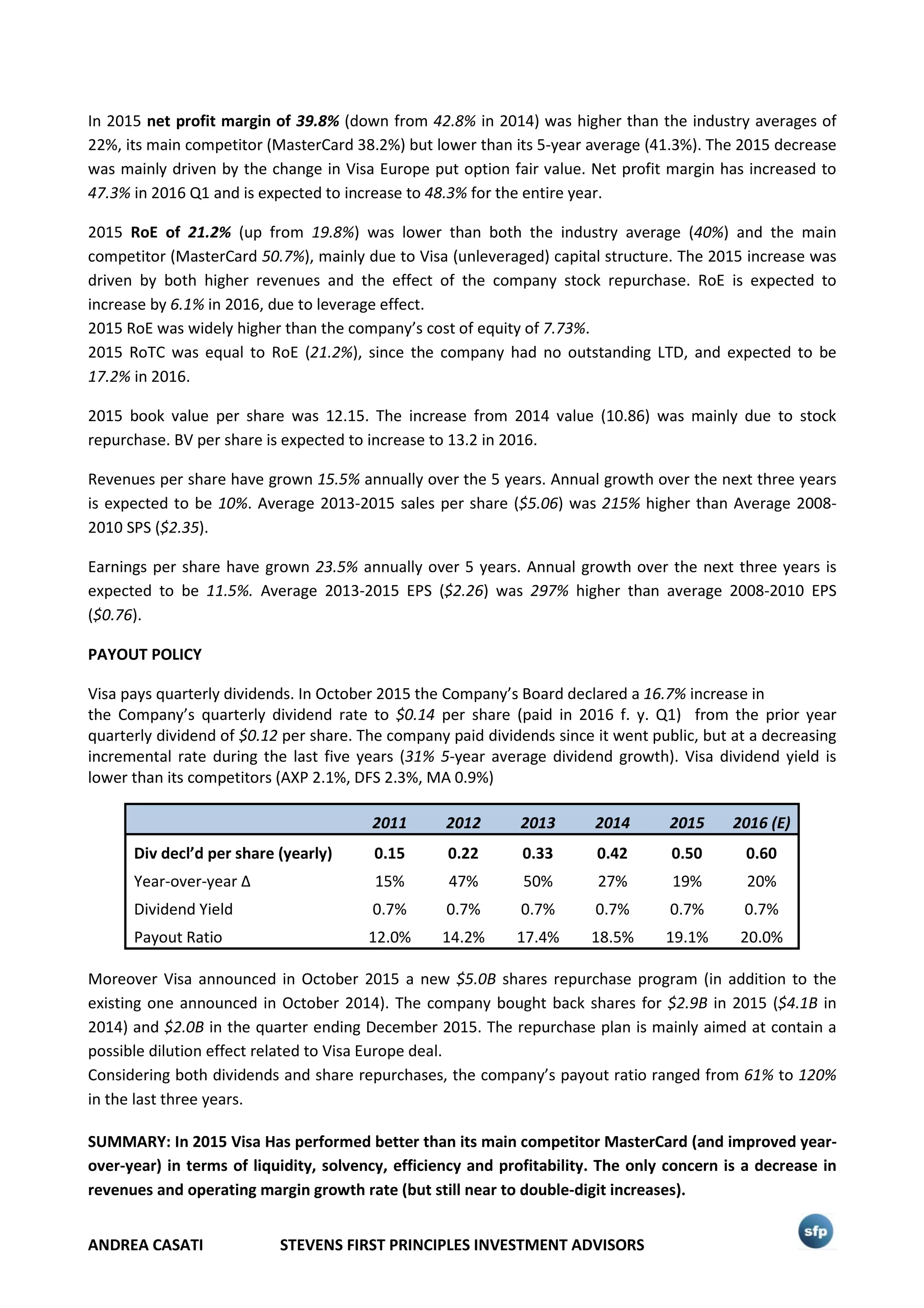

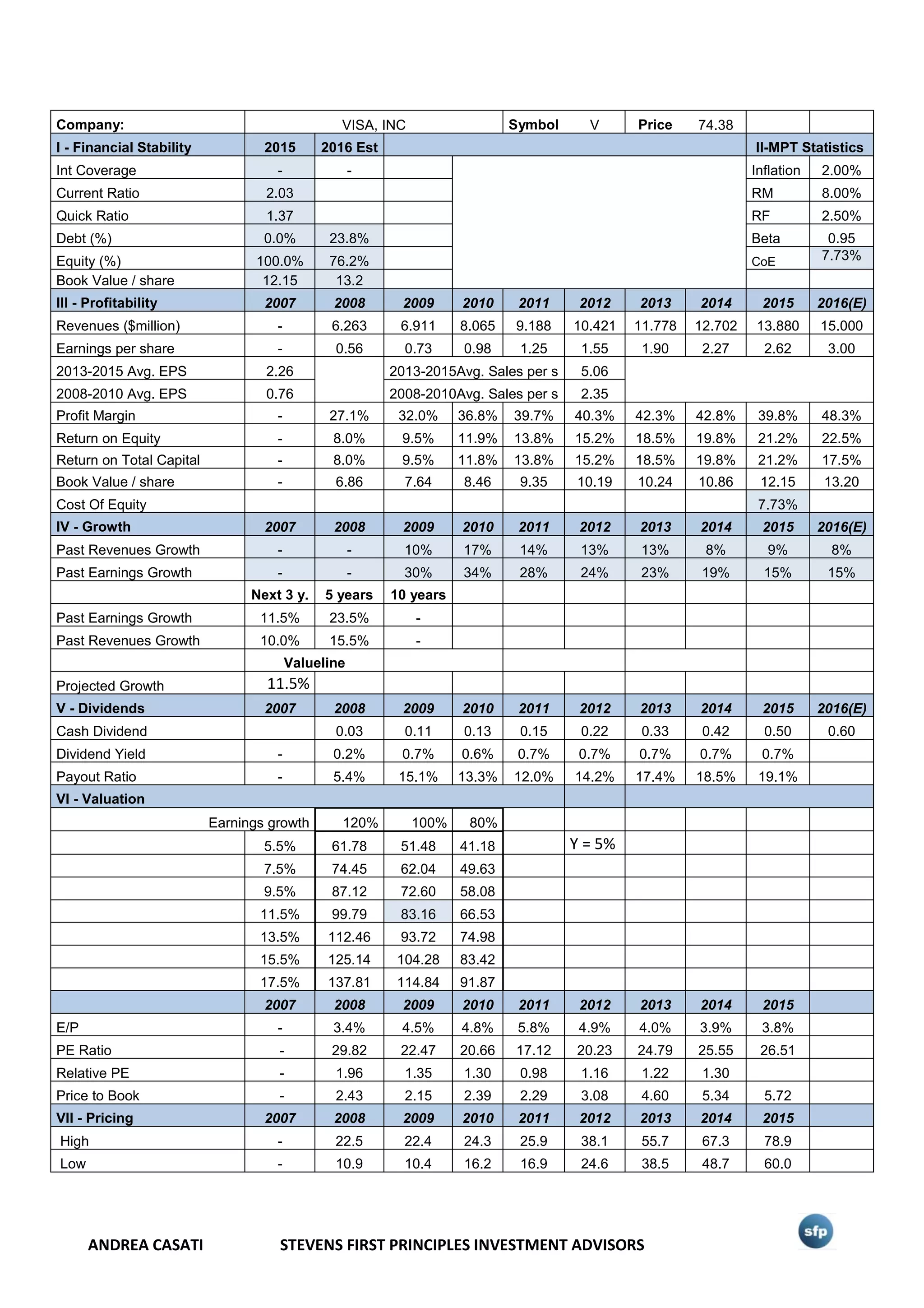

Visa Inc. is a leading global payments technology company that processes over $7 trillion in transactions annually. The document analyzes Visa's business, industry, and financials. It recommends a bull call spread strategy for Visa due to its strong fundamentals and leadership position, though notes increasing regulation, technology changes, and macroeconomic uncertainty could impact performance. Visa is expected to grow revenues and earnings in the coming years driven by its global network expansion and new payment solutions.