The document summarizes the national economic outlook presented at the 2013 Arkansas Economic Forecast Conference. It includes the following key points:

1) The Federal Reserve will continue its quantitative easing program of $40 billion in mortgage backed securities and $45 billion in Treasury securities per month.

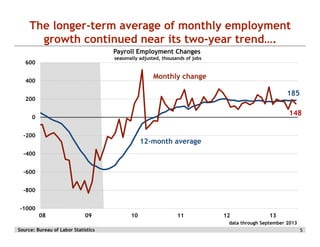

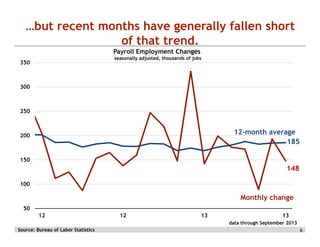

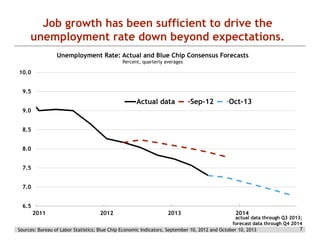

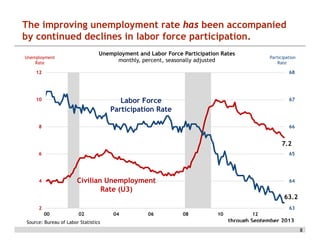

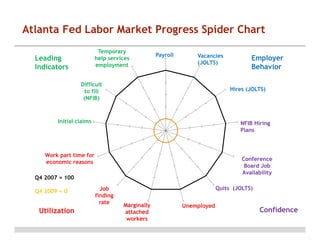

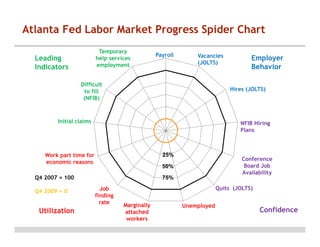

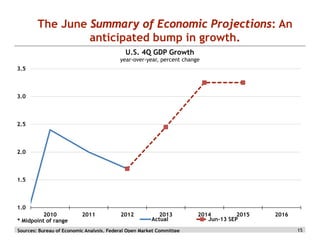

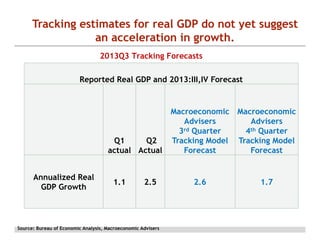

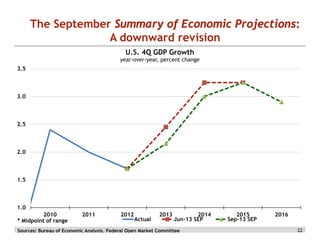

2) Recent economic data has fallen short of projections of increasing growth, ongoing job gains, and inflation moving back to 2%. Unemployment has declined faster than expected but labor force participation continues to drop.

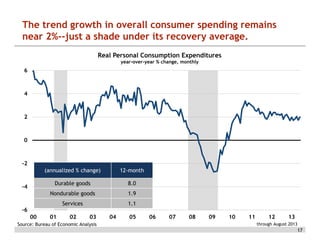

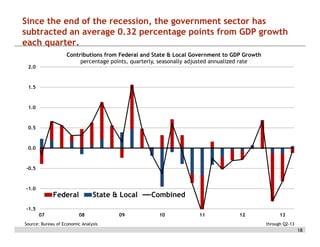

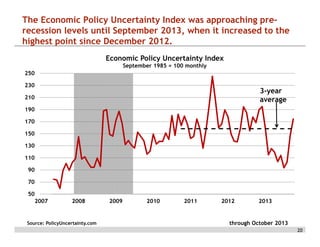

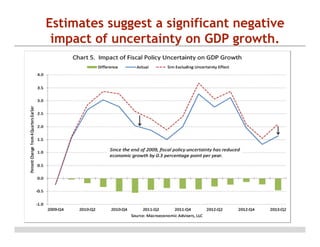

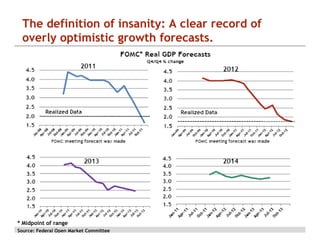

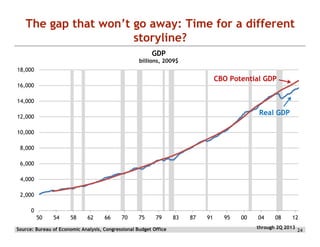

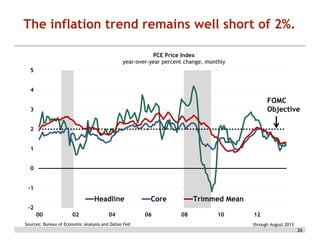

3) While consumer spending growth has remained around 2%, government spending cuts have subtracted from GDP growth. Estimates of GDP growth have been revised downward and forecasts have historically been too optimistic. Inflation remains below the Fed