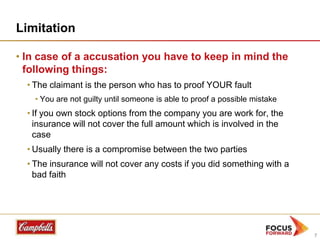

This document provides an overview of directors and officers (D&O) liability insurance. It discusses the history, coverages, and limitations of D&O insurance. D&O insurance protects executives and managers from losses and liability due to high-risk business decisions and covers legal expenses if a lawsuit is filed against them for actions performed as part of their roles. It was first established in the 1930s in the US and developed further in the 1980s as more companies sought to insure these risks. While policies can vary, D&O insurance typically covers legal defense costs and settlement payments if a claim is made, as long as the actions were not intentionally malicious or negligent.