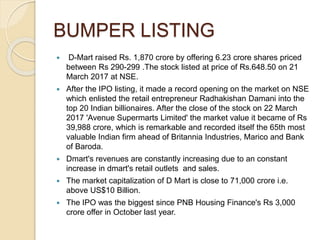

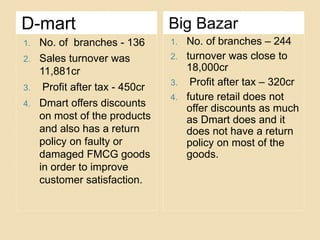

D-Mart is a chain of 136 hypermarkets and supermarkets across India founded by RK Damani in 2000. It has the highest sales per store of any grocery chain in India at Rs. 53 crore on average and an overall sales turnover of Rs. 11,500 crores as of 2017, making it the largest branded retail chain in the country. D-Mart had a very successful IPO in 2017, raising Rs. 1,870 crores and seeing its stock price rise over 100% on listing day to make its founder one of the richest people in India. It employs a low-cost model through owned properties, efficient cost control, and favorable supplier terms.