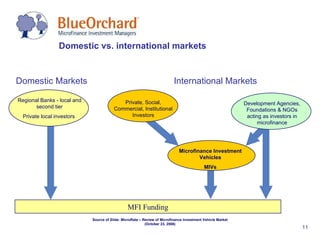

BlueOrchard is a leading commercial microfinance intermediary focused on enabling the poor worldwide through private investments in microfinance. The organization offers innovative financial products and maintains a robust investment portfolio exceeding USD 1 billion in over 125 microfinance institutions across 40 countries as of December 2009. Their mission centers on combining social progress with financial returns, thus supporting economic development and poverty alleviation.

![Thank you! BlueOrchard Finance S.A. 32 rue de Malatrex, 1201 Geneva, Switzerland Tel.: +41 22 596 4777 Fax: +41 22 596 4799 [email_address] BlueOrchard Finance USA, Inc. 1140 Broadway, #304, New York NY 10017, USA Tel.: +1 212 944 8748, Fax: +1 212 944 8749 [email_address] BlueOrchard Finance America Latina S.A.C. Pasaje Mártir Olaya 129 Lima 18, Peru Tel.: + 511 255 7049 [email_address] www.blueorchard.com Raising cattle in Mongolia P hoto Johan Sauty © BlueOrchard](https://image.slidesharecdn.com/dl4obtainingfundsfromnewfinancialinstruments-100512101532-phpapp02/85/AMERMS-Course-4-Obtaining-Funds-from-New-Financial-Instruments-PPT-1-24-320.jpg)