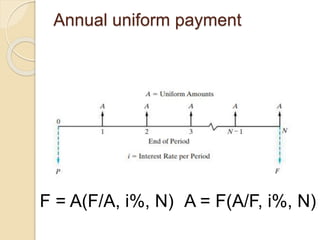

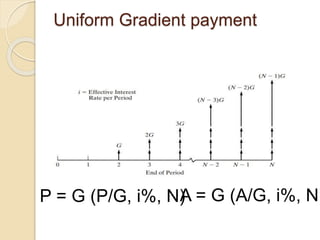

This document discusses different methods of calculating interest on loans and investments that are compounded over discrete time periods, such as weekly, monthly, or yearly. It provides formulas for calculating single payments, annual uniform payments, and uniform gradient payments. It also includes two examples, one calculating monthly loan payments over 36 months and the other calculating the value of a retirement account earning 8% annual interest over 35 years after initial contributions ended after 5 years.