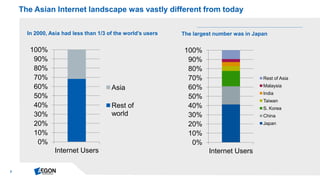

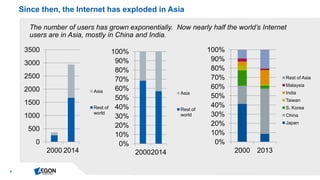

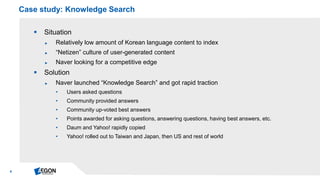

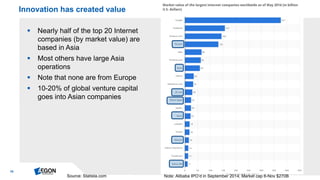

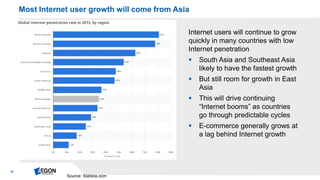

The document discusses the significant growth of internet users in Asia since 1998, highlighting that nearly half of the world's internet users now reside in the region, particularly in China and India. It examines various digital innovations and case studies in e-commerce, social media, and localized internet services across Asia, emphasizing the distinct paths of growth compared to the U.S. and Europe. The insights presented suggest that future growth in internet users and e-commerce in Asia will be rapid, requiring innovation and localization strategies for businesses, especially in the insurance sector.