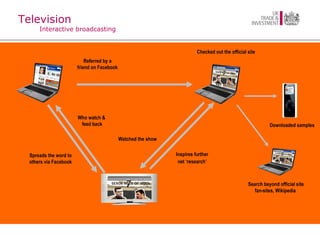

The document provides an overview of opportunities in the digital content sector in the UK, including key industries like games, media, publishing, and film/animation. It discusses the UK's strengths such as access to creative/technical talent, spending consumers, and infrastructure. Market trends are outlined for sectors like creative agencies, film, gaming, music, publishing, radio, and television that involve digital distribution, social media, and new devices. Case studies and investor opportunities are also mentioned.

![Thank you! tony.hughes@pera.com [email_address] August 2009](https://image.slidesharecdn.com/digitalcontentbriefingtourmay2010-100609142311-phpapp01/85/Digital-content-briefing_tour_may2010-38-320.jpg)