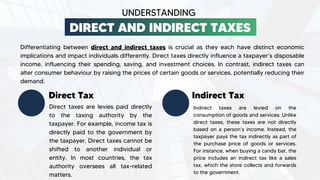

The document outlines the differences between direct and indirect taxes, explaining how direct taxes are paid directly to the government by individuals and businesses, while indirect taxes are levied on goods and services and paid by consumers. It emphasizes the importance of understanding these tax types for compliance with tax laws, and notes that both types are crucial sources of revenue for governments. The document also highlights specific types of taxes applicable in the UAE and the role of tax consultants in ensuring compliance.