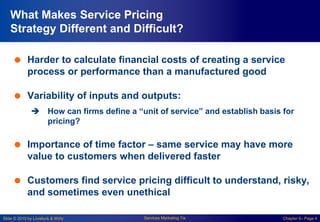

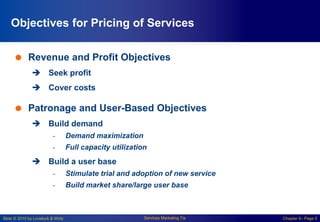

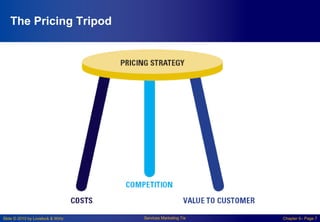

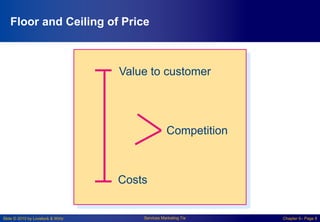

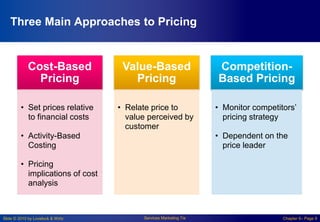

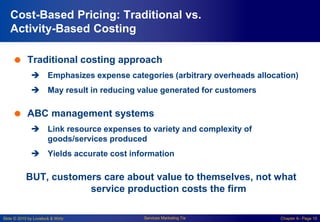

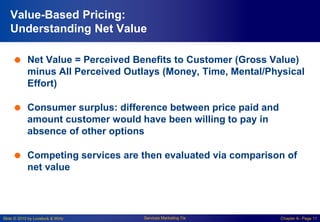

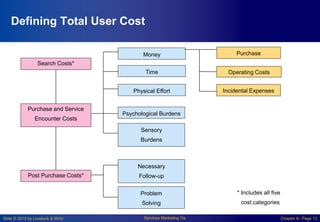

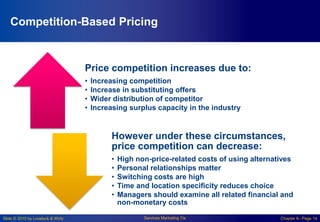

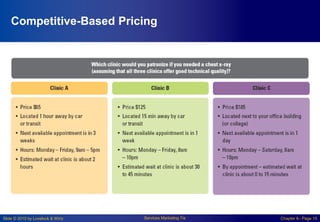

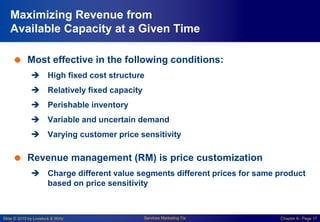

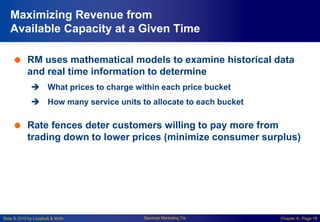

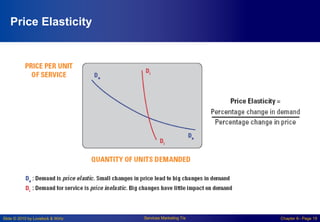

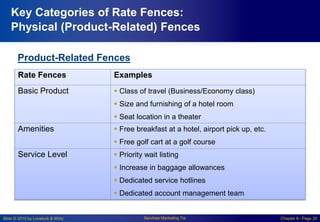

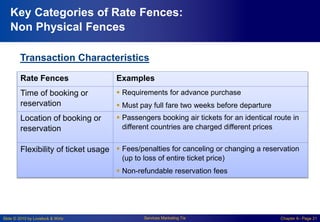

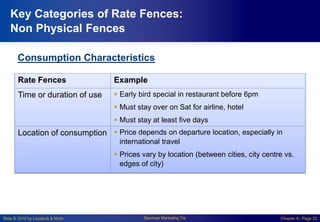

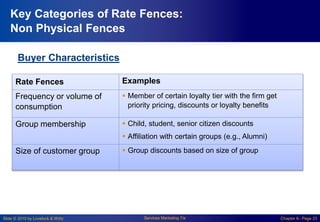

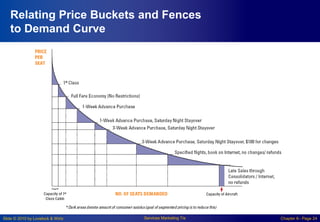

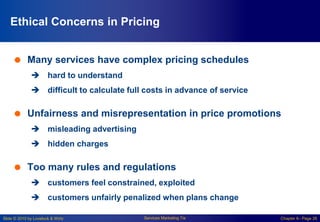

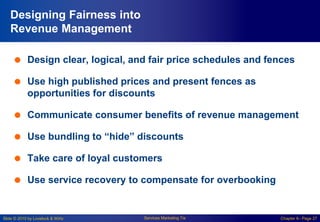

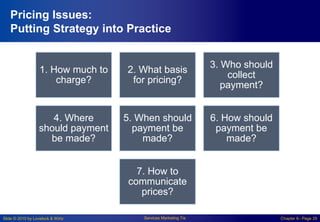

The document summarizes key topics from Chapter 6 of the textbook, including effective pricing strategies for services, the pricing tripod approach using costs, value and competition, revenue management techniques, ethical pricing concerns, and considerations for implementing pricing in practice. It provides overviews and definitions of these concepts, examples, and factors for firms to consider in setting service prices.