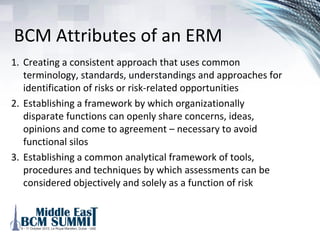

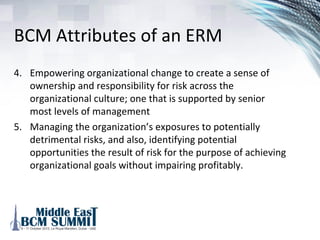

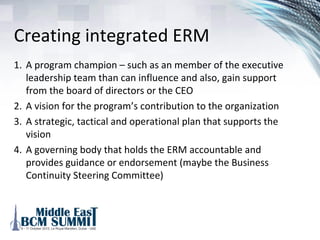

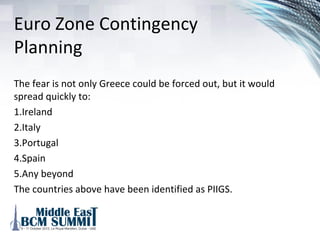

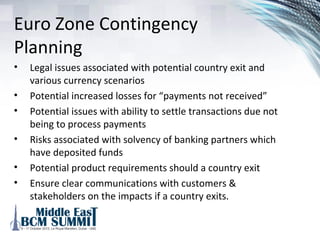

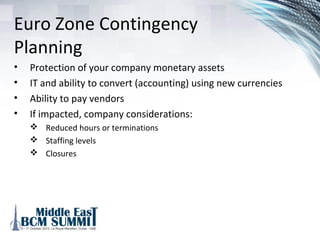

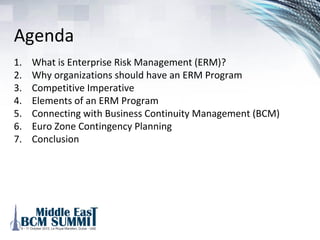

The document discusses enterprise risk management (ERM), emphasizing its importance for organizations to identify and manage key risks effectively. It outlines the elements and benefits of a robust ERM program, including improved regulatory compliance, cost efficiency, and strategic decision-making. Additionally, it connects ERM with business continuity management (BCM) and highlights the need for a structured approach to address potential risks in the context of euro zone contingency planning.

![What is Enterprise Risk

Management (ERM)?

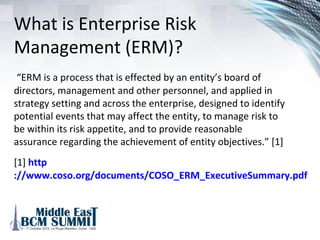

“ERM is a process that is effected by an entity’s board of

directors, management and other personnel, and applied in

strategy setting and across the enterprise, designed to identify

potential events that may affect the entity, to manage risk to

be within its risk appetite, and to provide reasonable

assurance regarding the achievement of entity objectives.” [1]

[1] http

://www.coso.org/documents/COSO_ERM_ExecutiveSummary.pdf](https://image.slidesharecdn.com/margaretmillett-developinganeffectiveenterpriseriskmanagementcapability-150819091955-lva1-app6892/85/Developing-an-Effective-Enterprise-Risk-Capability-4-320.jpg)