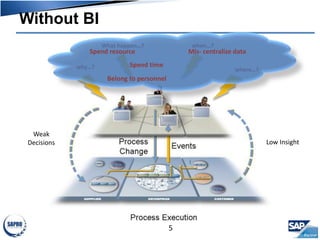

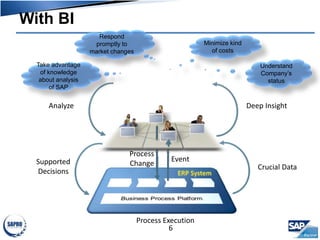

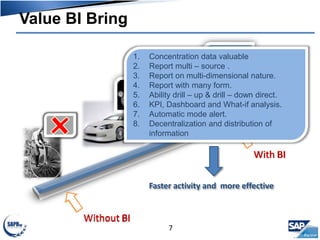

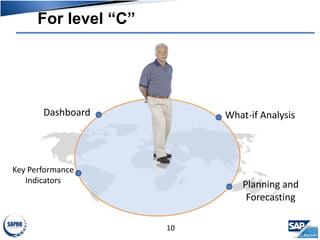

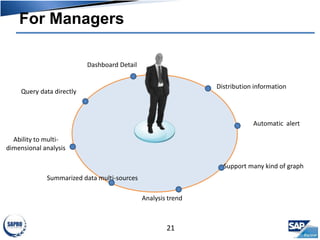

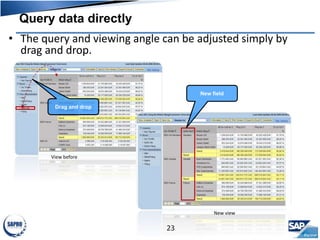

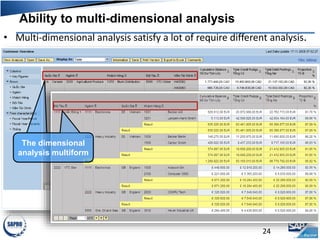

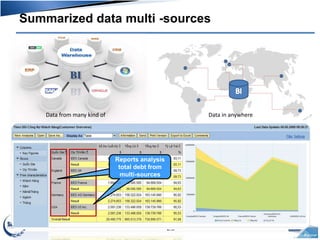

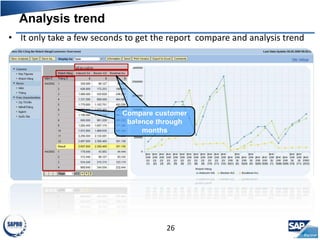

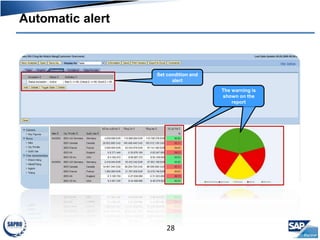

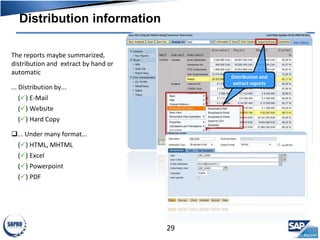

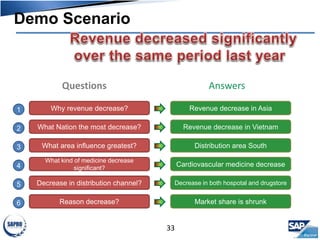

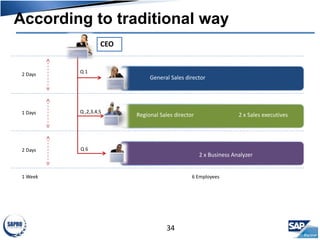

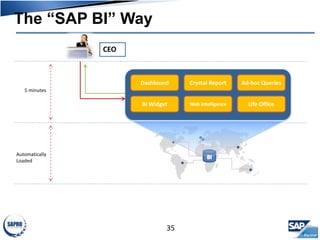

This document discusses how business intelligence (BI) solutions from SAP can provide various levels of employees with easy access to consolidated data and insights. For level C employees, BI enables dashboard views with key performance indicators and what-if analysis. Managers benefit from multi-dimensional analysis, direct querying of summarized multi-source data, trend analysis with automatic alerts, and flexible report distribution. The demo then shows how BI solutions like SAP Business Objects and SAP Business Intelligence can answer various questions about revenue decreases much faster than traditional methods.