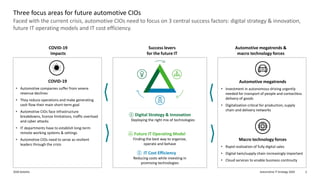

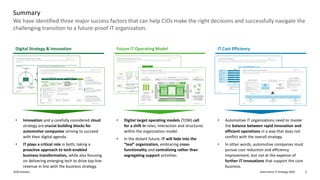

The document outlines three key success factors for automotive CIOs to develop a future-proof IT organization, focusing on digital strategy and innovation, future IT operating models, and IT cost efficiency. It emphasizes the importance of adapting to automotive megatrends, such as the rise of autonomous vehicles and digitalization, while also addressing challenges posed by the COVID-19 pandemic. The document suggests that CIOs must balance rapid innovation with operational efficiency to support their company's overarching business strategy.