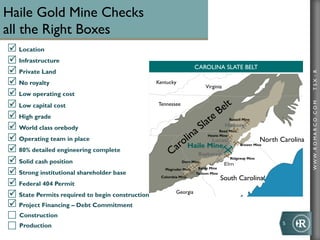

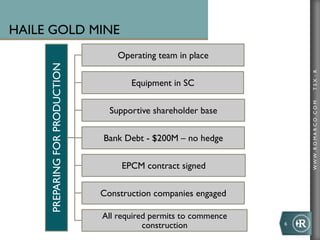

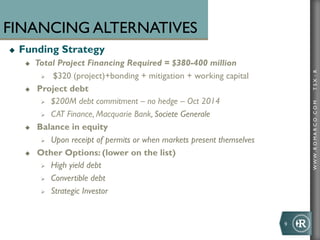

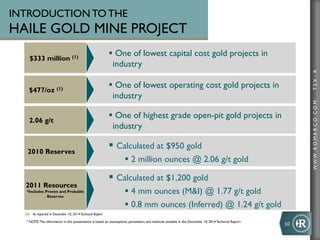

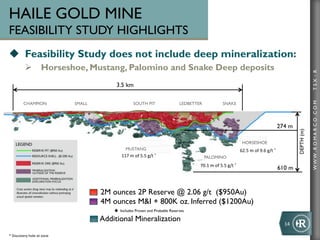

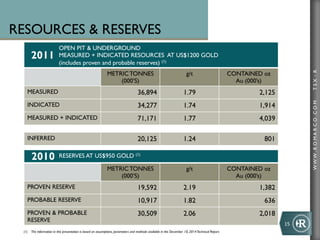

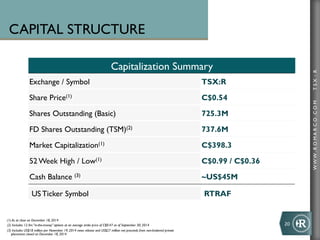

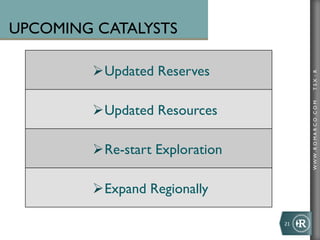

This document is a corporate presentation from Romarco Minerals outlining forward-looking projections and estimates for its Haile Gold project in South Carolina. It summarizes technical reports that estimate the mine life, production levels, costs, revenue and financial analysis for an open pit gold mine at Haile. The presentation contains forward-looking statements regarding these projections and estimates, and includes cautionary notes about the assumptions and uncertainties inherent in such forward-looking information.