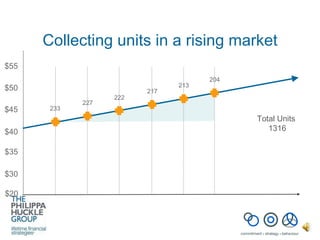

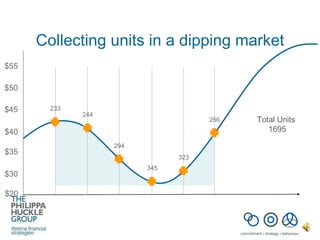

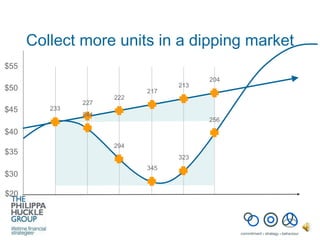

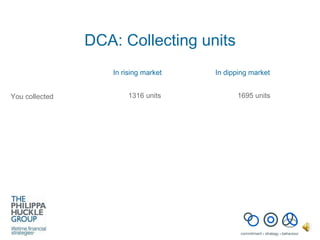

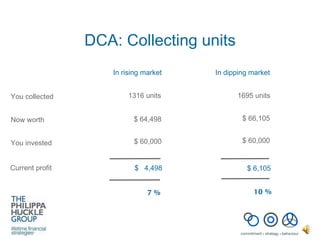

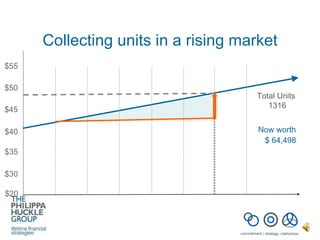

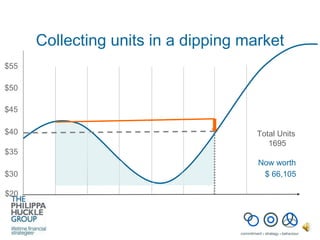

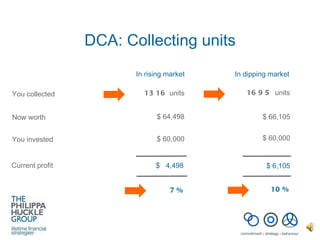

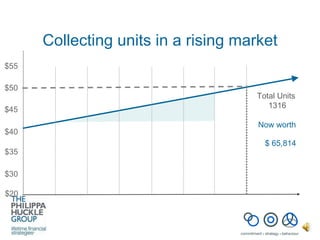

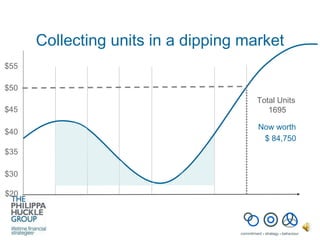

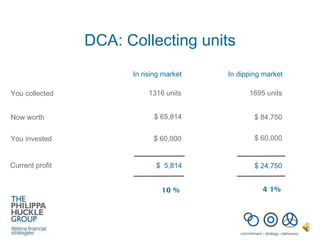

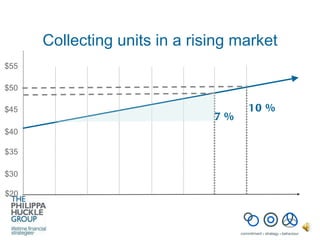

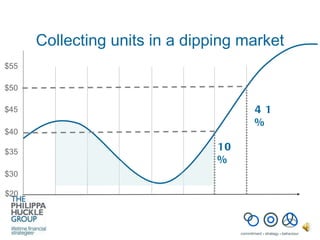

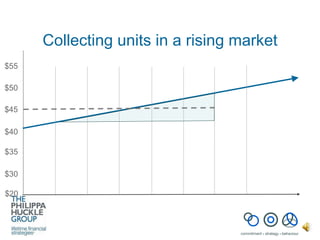

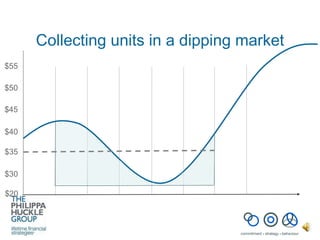

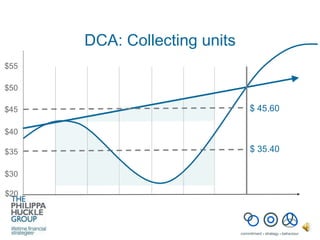

The document discusses the investment strategy of dollar cost averaging. It compares two approaches: lump sum investing versus regular monthly investments. Dollar cost averaging involves investing small, regular amounts over time to take advantage of fluctuating market prices. This allows investors to acquire more shares when prices are low and fewer shares when prices are high, lowering the average cost per share. The strategy works best when used during a dipping market, as the investor is able to acquire the most shares at the lowest prices.