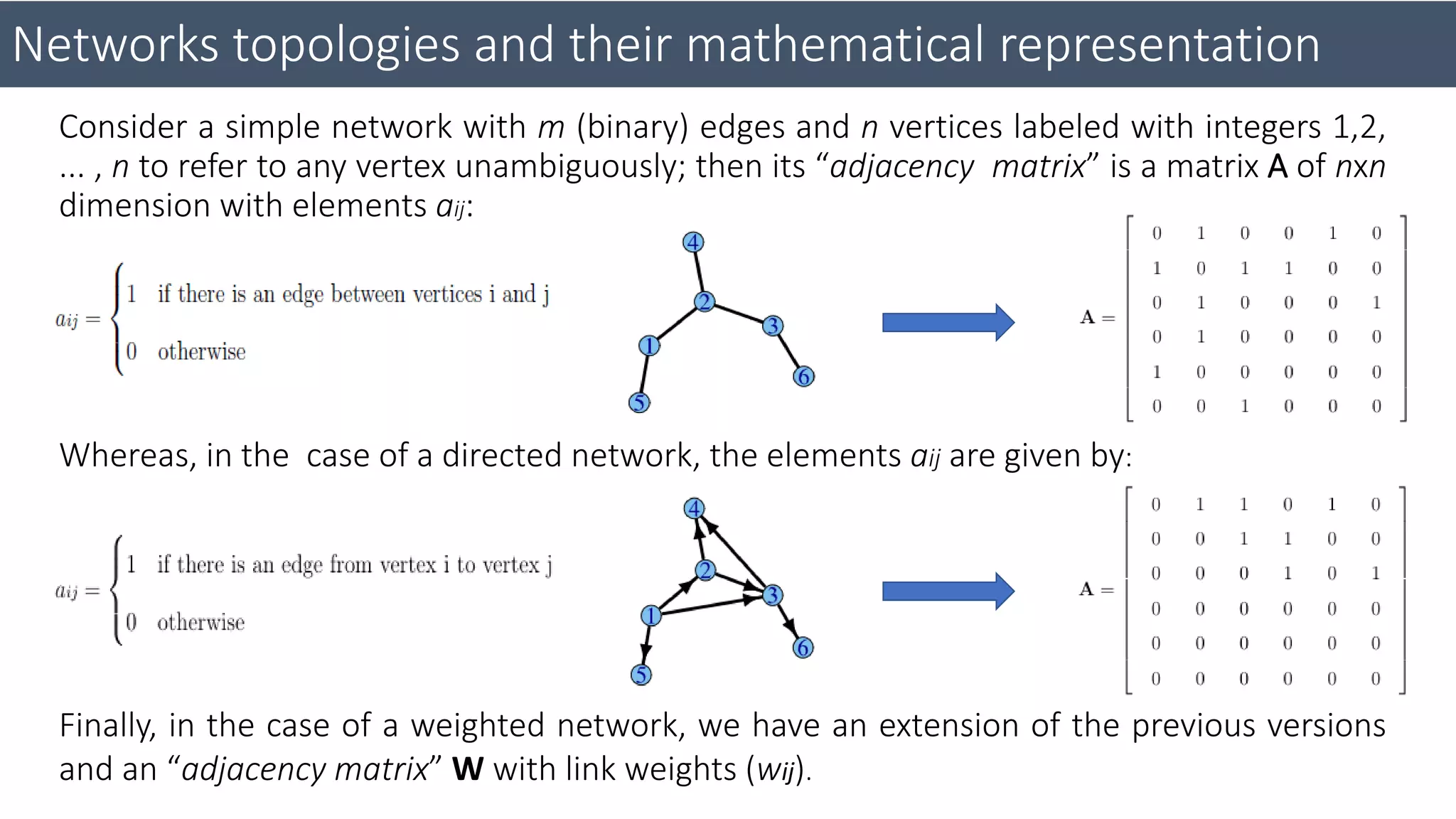

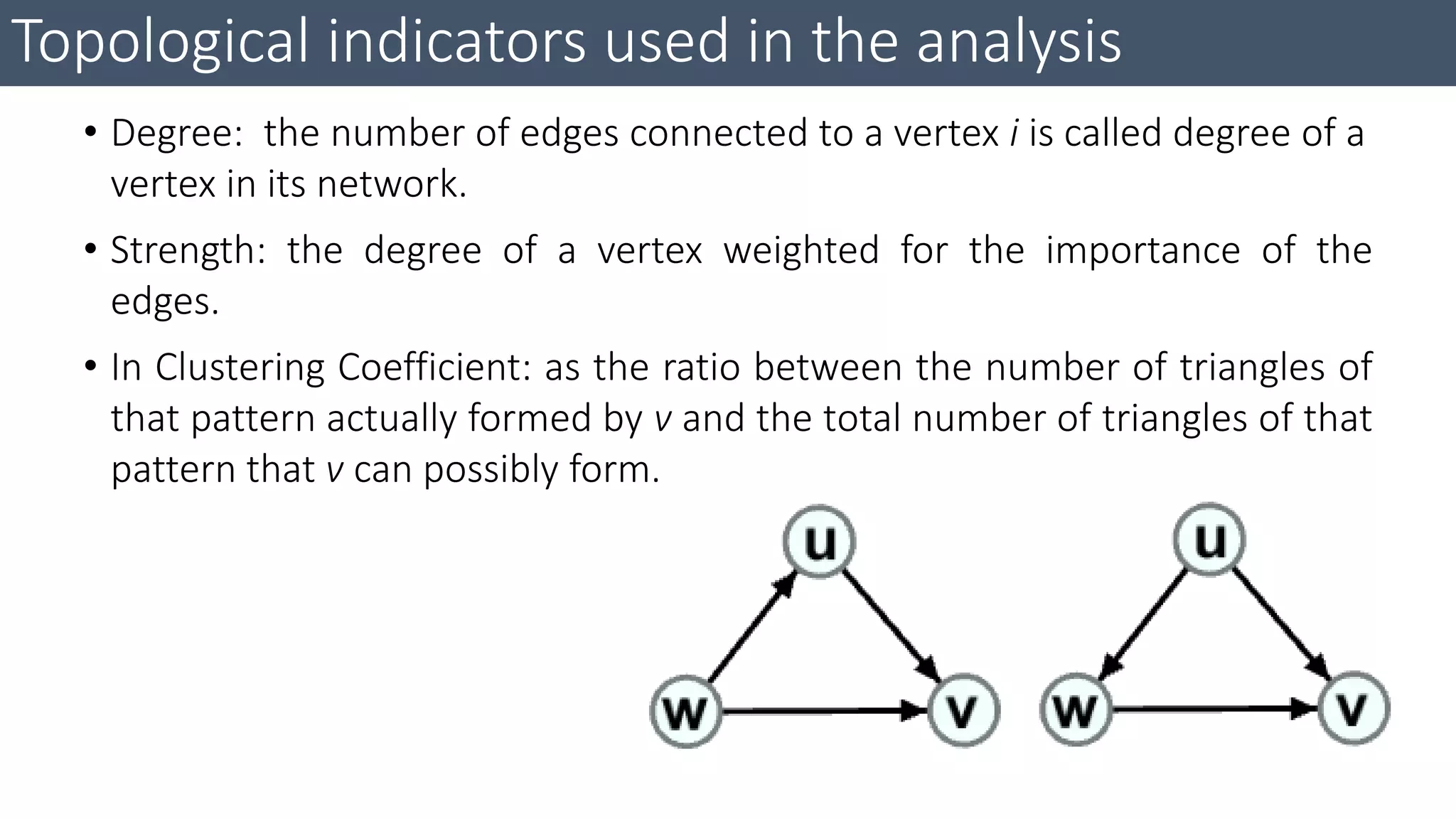

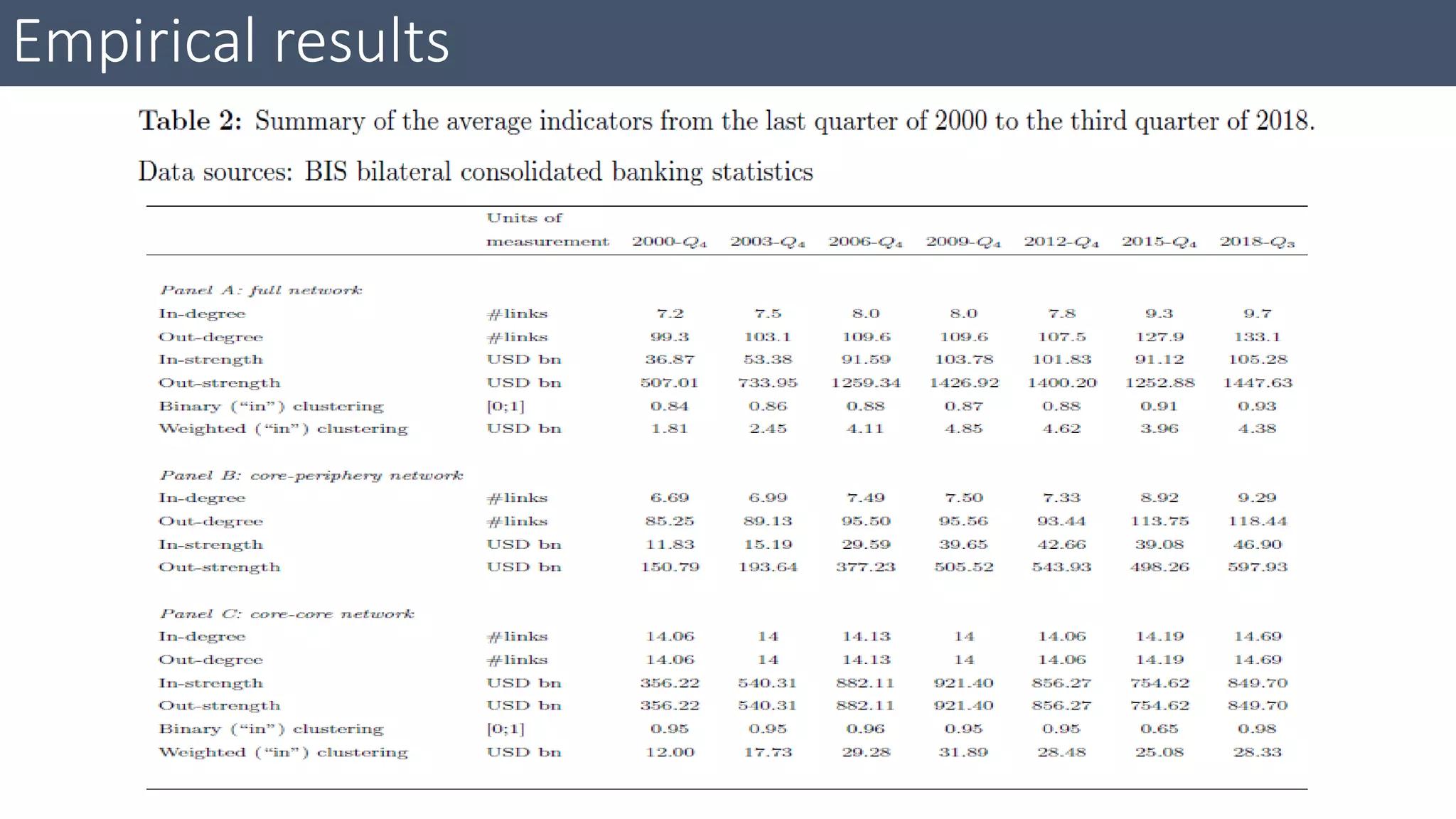

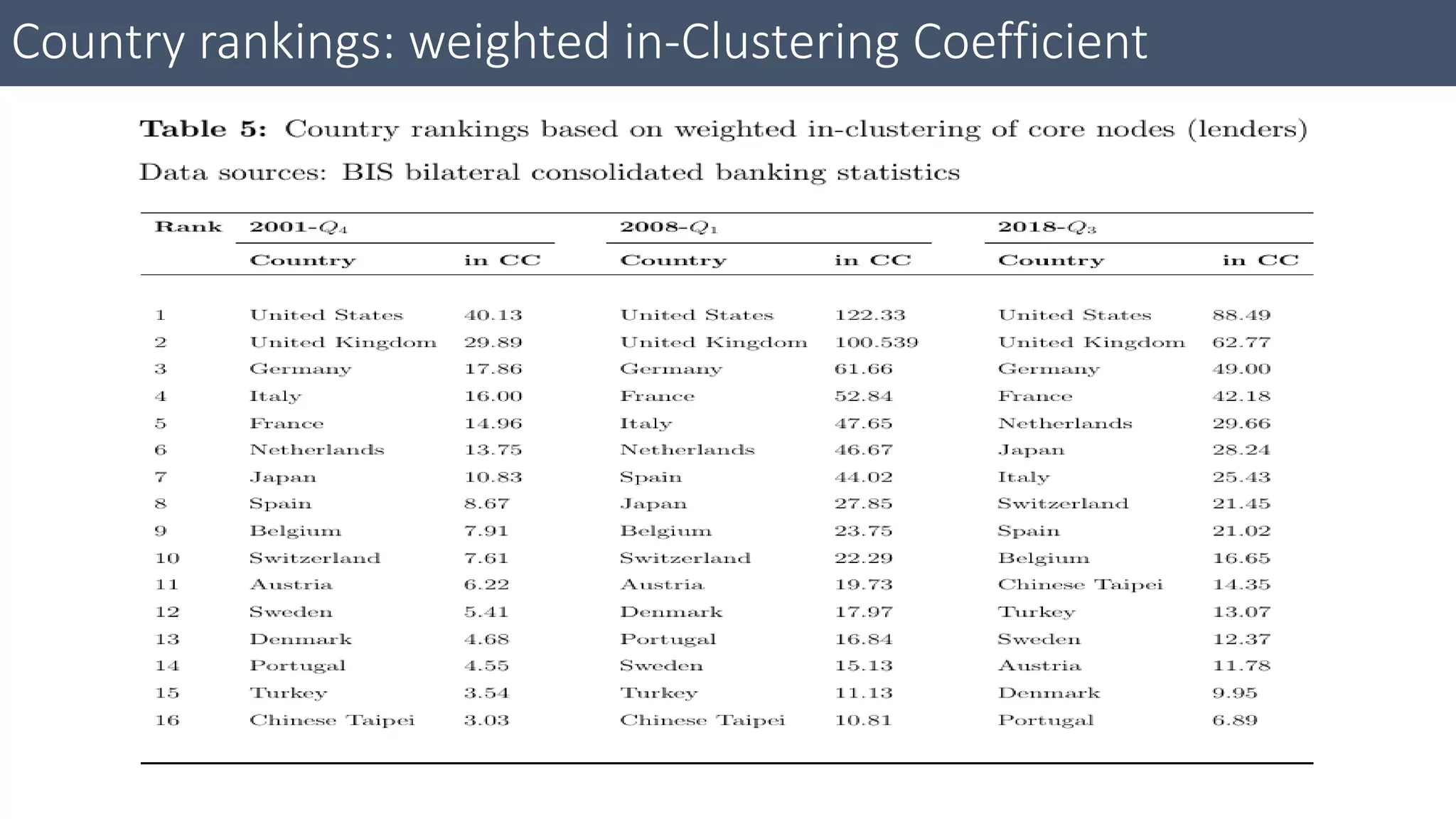

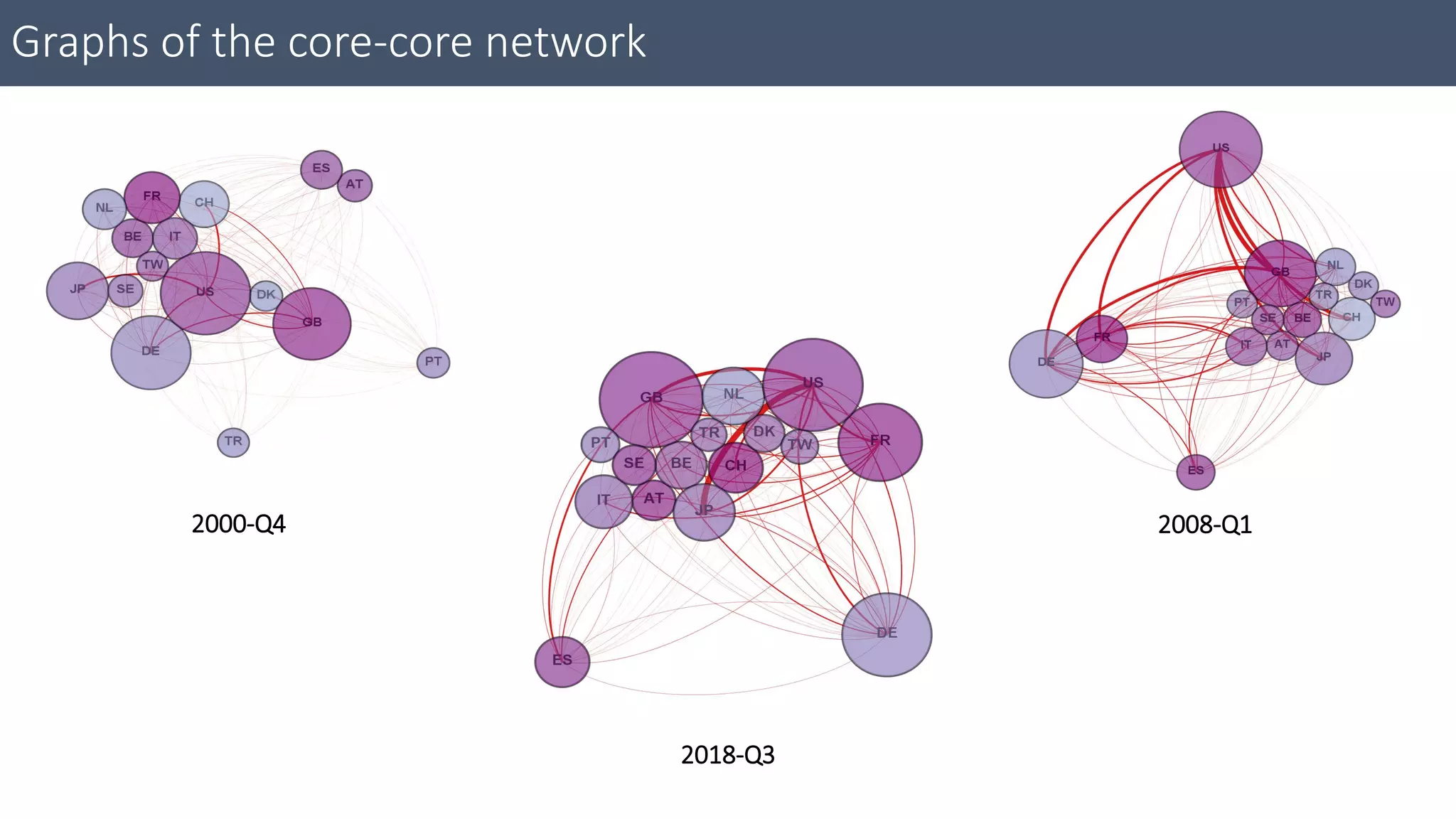

This document analyzes banking networks from 2000 to 2018 using network analysis methods. It defines banking networks with countries as nodes and cross-border banking exposures as weighted, directed edges. Three network types are examined: full, core-periphery, and core-core. Topological indicators like degree, strength, and clustering coefficients are calculated for each country and network averages over time. Graphs show the evolution of network structure from 2000 to 2008 to 2018. Insights into country rankings and indicator trends provide information on systemic risk in the global banking network.