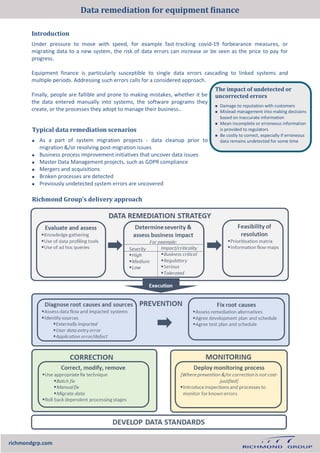

Richmond Group provides strategies for successfully remediating data errors that can occur during periods of rapid change or system migrations. They recommend taking a step back to assess the severity and business impact of data issues before prioritizing a two-pronged approach - addressing root causes to prevent future errors while also fixing existing errors close to the source. Engagement across departments and some agile techniques can help communicate progress during the remediation process.