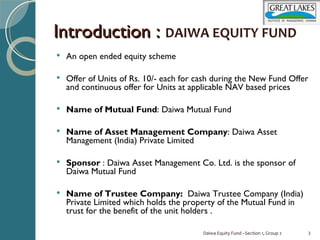

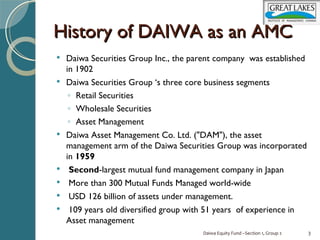

1) The Daiwa Equity Fund is an open-ended equity scheme offered by Daiwa Mutual Fund, which is sponsored by the 109-year old Daiwa Asset Management Co. Ltd.

2) The fund seeks to generate long-term growth of capital through a diversified portfolio of predominantly equity and equity-related securities. It aims to invest in companies with good growth prospects available at reasonable valuations.

3) The report recommends buying the Daiwa Equity Fund as its investment objective and returns strategy align with the investor's profile of a 25-year old with a high-risk appetite and 3-5 year investment horizon. The fund offers an opportunity for aggressive equity returns