This document provides an investor presentation for a quantitative investment strategy called QARMA. It summarizes the strategy, performance, and risk management approach. Key points include:

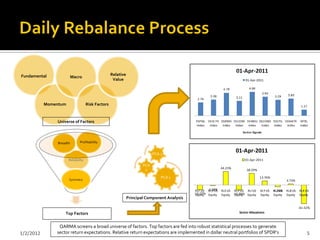

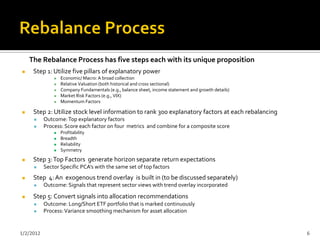

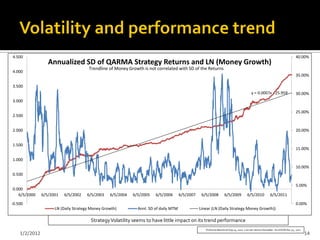

- QARMA uses a quantitative model to generate sector allocation signals based on factors like valuation, fundamentals, and momentum across different time horizons. It implements the signals with dollar neutral ETF portfolios.

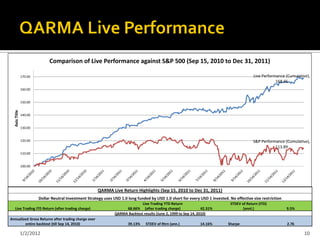

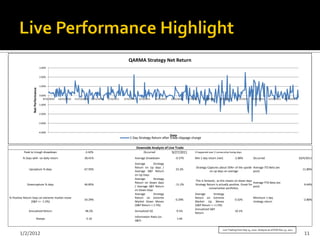

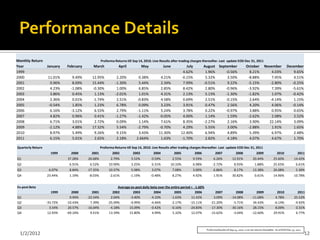

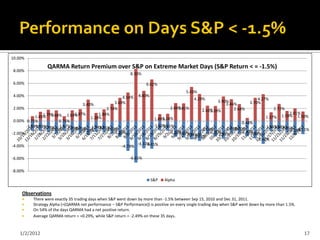

- Backtested performance from 1999-2010 showed annualized gross returns of 39.13% with a Sharpe ratio of 2.76. Live trading since September 2010 achieved a 68.66% return, outperforming the S&P 500.

- Risk is managed by capping leverage at 1x, using only liquid