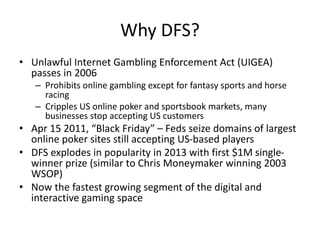

The document discusses the rapid growth and dynamics of daily fantasy sports (DFS) following the UIGEA's passage in 2006, highlighting major players like FanDuel and DraftKings, along with their market shares and financials. It notes the demographics of DFS players, current competition formats, and potential future entrants, while also addressing risks related to legal regulations and player attrition. Despite high engagement rates and revenue growth, both major DFS platforms currently operate at a loss and face challenges related to sustainability and profitability.

![FanDuel $ Q4 2014

• $370M+ Entry fees

• $333M Prizes

• $36.8M Revenue (9.9% effective rake)

• 1M+ paid active users

[1] FanDuel Financials](https://image.slidesharecdn.com/daily-fantasy-sports-notesrobinhowlett-151111000843-lva1-app6891/85/Daily-Fantasy-Sports-DFS-Notes-7-320.jpg)

![FanDuel $ Q4 2014

• 300%+ YoY Revenue growth

– 2013: $14.3M

– 2014: $57.3M

• 424% YoY growth in active paid customers

– Q4 2013: 193k

– Q4 2014: 1.01M

• However, YoY avg. revenue per user decreased (-

5.3%), and effective rake increased (9.1% to 9.9%)

[1] FanDuel Financials](https://image.slidesharecdn.com/daily-fantasy-sports-notesrobinhowlett-151111000843-lva1-app6891/85/Daily-Fantasy-Sports-DFS-Notes-8-320.jpg)