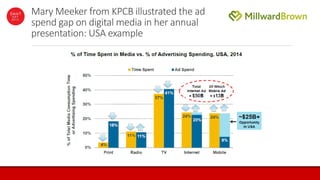

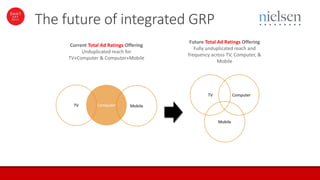

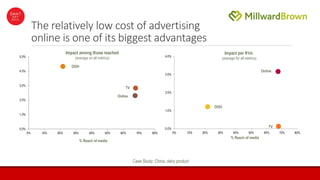

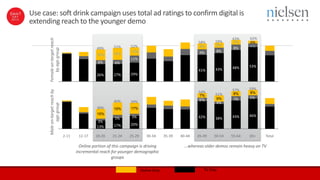

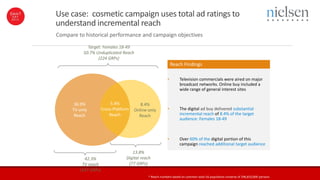

- The document discusses integrated metrics and cross-platform measurement of advertising campaigns across TV, desktop, mobile, and other digital platforms.

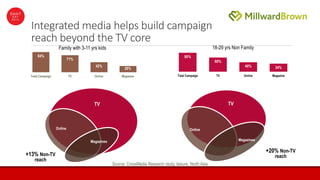

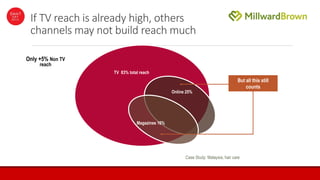

- It provides examples from various countries and campaigns that demonstrate how measuring audiences across multiple platforms can increase campaign reach by up to 20% over TV-only measurement.

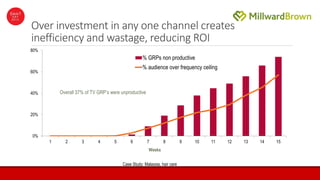

- Integrated metrics that combine TV and digital platforms are being adopted in Southeast Asia, including Thailand, and allow for more effective optimization of advertising spending across channels.