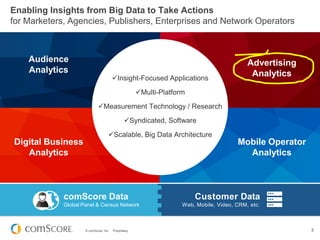

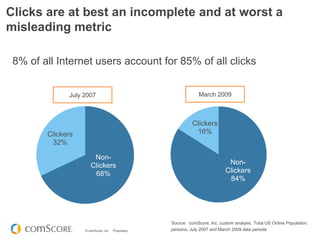

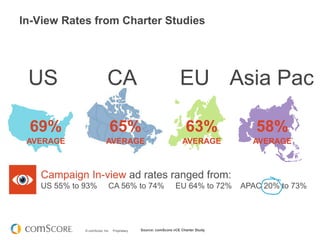

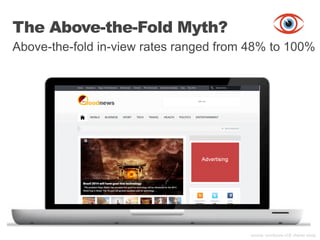

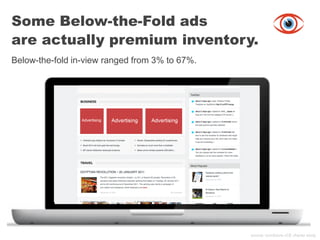

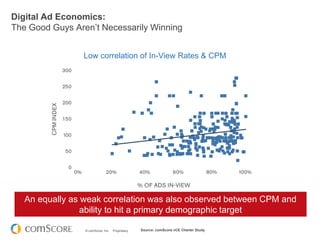

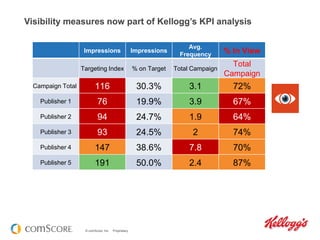

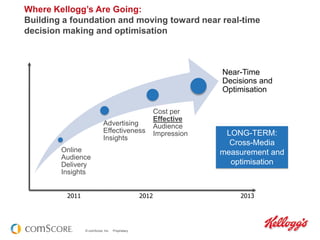

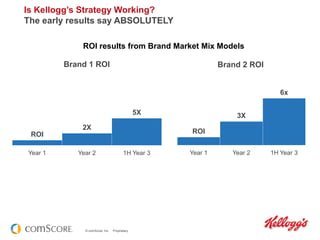

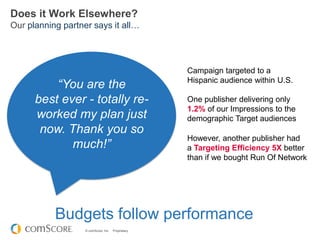

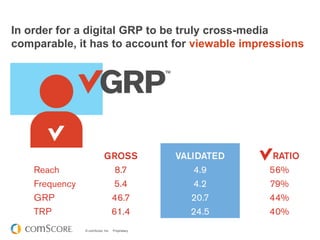

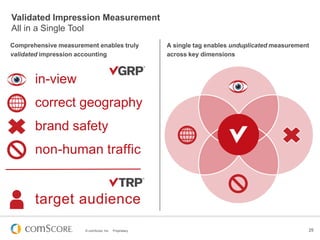

The document discusses comScore's services for measuring digital advertising effectiveness through viewability metrics and validated impressions. It provides examples of how Kellogg's has improved ROI by 2-6x by incorporating these metrics into their strategies. The presentation emphasizes that viewability measurement allows advertisers to optimize campaigns and better understand real delivery across publishers.