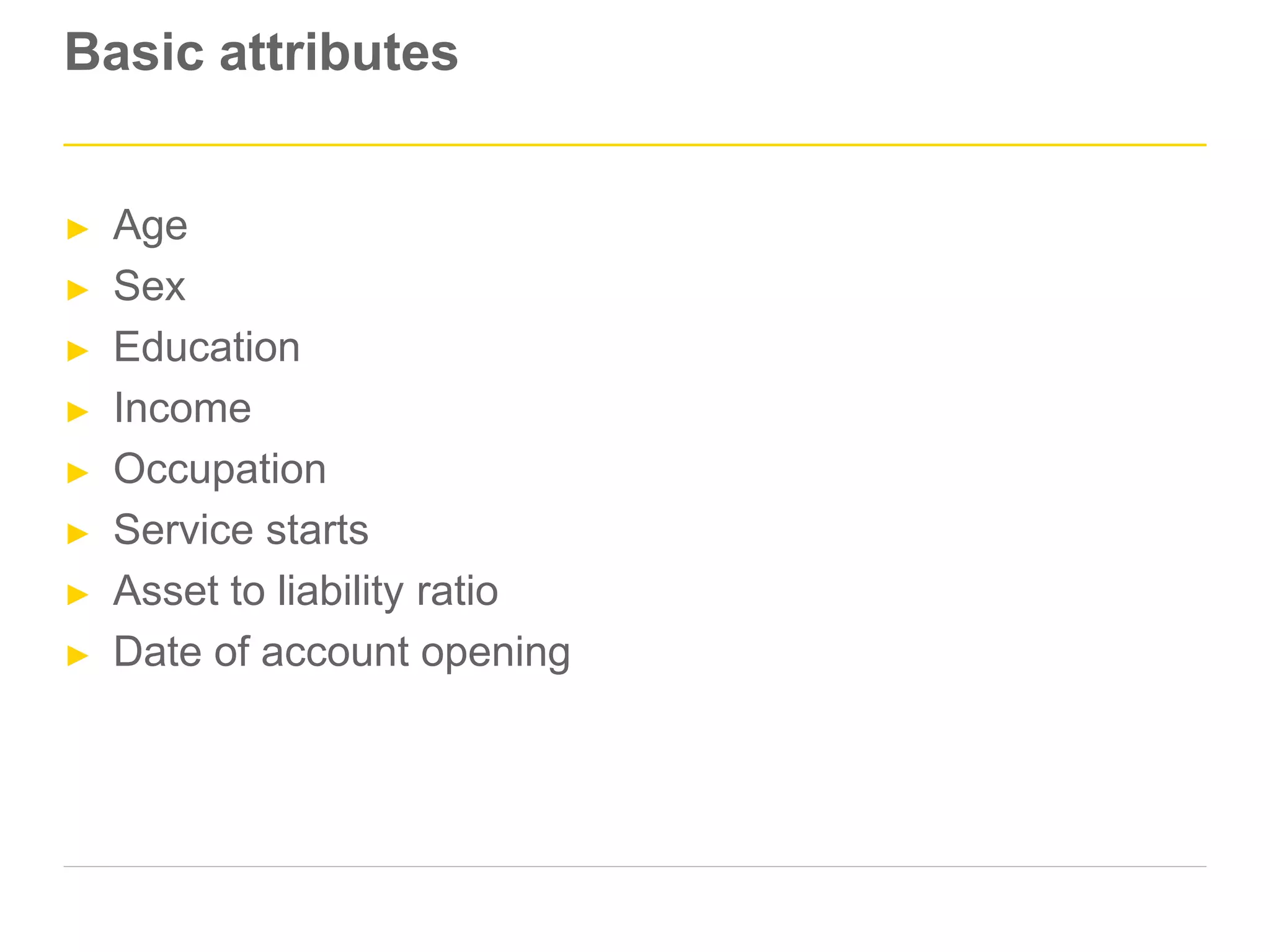

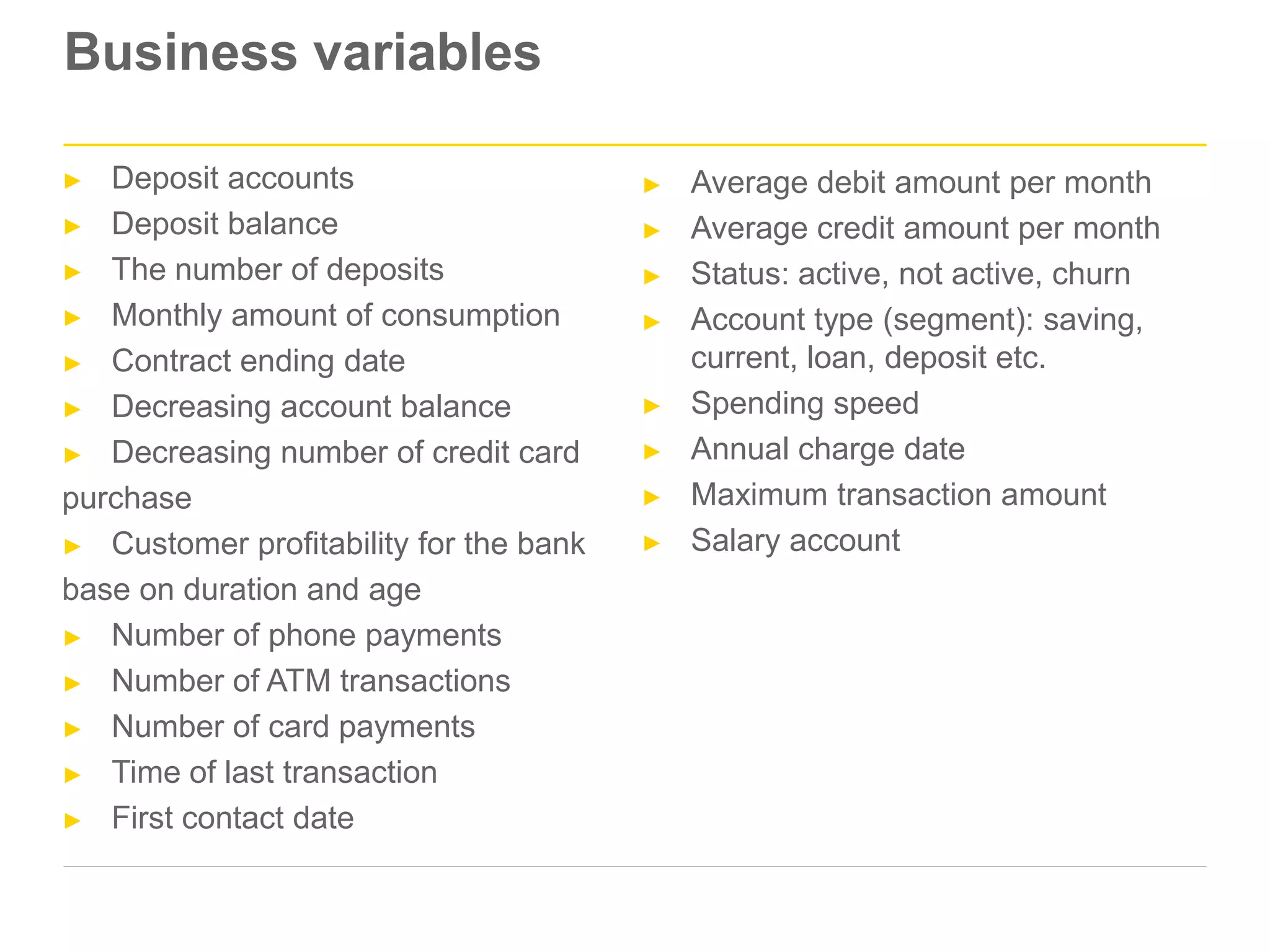

This document discusses variables and modeling approaches for customer churn and attrition modeling in banking. It identifies several key factors related to customer churn, including spikes in churn rates at the end of deposit periods and different churn patterns for different account types. It outlines various groups of variables that can be used in modeling, including customer transaction history, demographic and personal profile data, and business-related variables like account balances and transaction amounts. Finally, it reviews several common modeling approaches and their performance based on literature, including decision trees, random forests, support vector machines, logistic regression, and neural networks. Proper customer segmentation is identified as important for precise modeling.

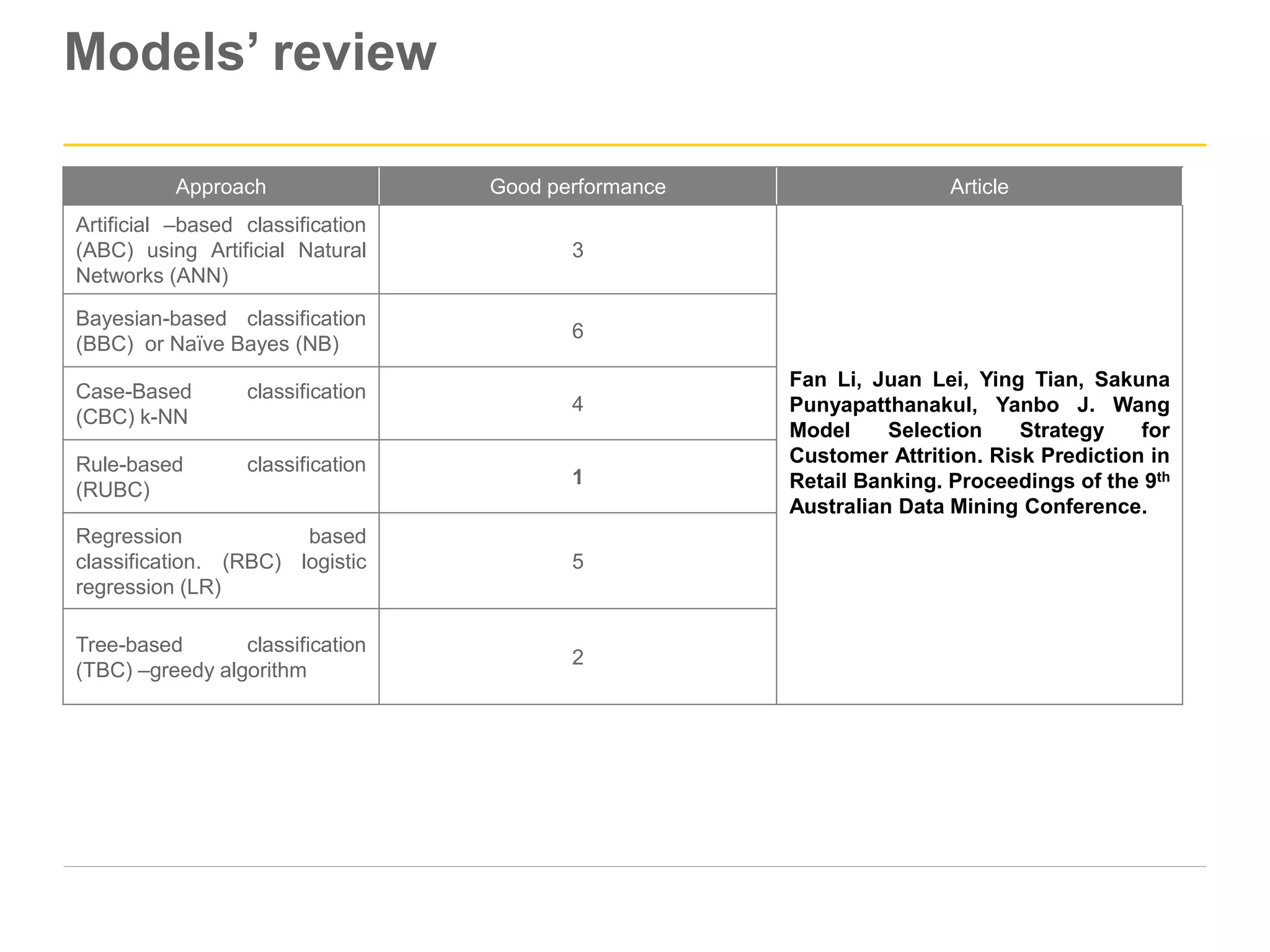

![Models’ review

Approach

Best

model Article

CART + TreeNet +

C5.0

CART

Chandar, M Laha, A., and Krishna, P. Modeling churn behavior of bank

customers using predictive data mining techniques. [J] National Conference on

Soft Computing Techniques for Engineering Applications (SCT-2006). 2006, (3)

24-26

FUZZY C-Means

clustering

N/A

Popovic,D. and Basic B.D. Churn prediction Model in retail banking Using Fuzzy

C-means Algorithms .[J] Informatica 2009 (33) 243-247

Sampling techniques

+ gradient Boosting +

weighted random

forest

Weighted

random

forest

Buzes, J. and Poel D.V. Handling Class Imbalance in Customer Churn

Prediction[J] Expert System with Applications 2009 (36) 5445-5449

SVM + random

sampling +

imbalance

characteristic of data

set

N/A

Benan He, Yong Shi, Qian Wan, Xi Zhao, Prediction of customer attrition of

commercial banks based on SVM model. Procedia Computer Science 31 (2014)

423-430](https://image.slidesharecdn.com/customerattritionandchurnmodeling-151214082647/75/Customer-attrition-and-churn-modeling-6-2048.jpg)