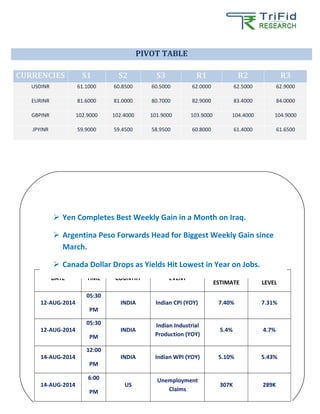

From August 11 to 14, 2014, the Indian rupee experienced fluctuations due to geopolitical tensions, recovering slightly from five-month lows but marking its worst weekly performance since August of the previous year. Key economic indicators and currency rates were reported, with the rupee closing at 61.41 against the US dollar. Market sentiment remained weak, affecting expectations for foreign fund inflows into local assets.