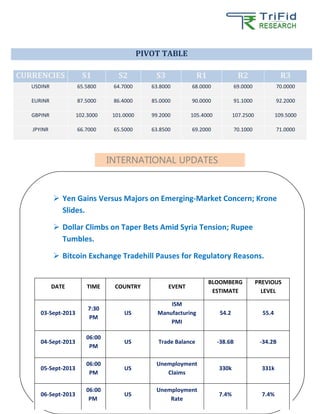

The weekly report provides an overview of currency exchange rates and the Indian rupee from September 2nd to September 6th, 2013. The rupee posted its largest monthly decline in at least 18 years but rebounded on aggressive central bank intervention. The report analyzes currency exchange rates, gives support and resistance levels for various currency pairs, and outlines upcoming economic indicators and international news that may impact currencies.