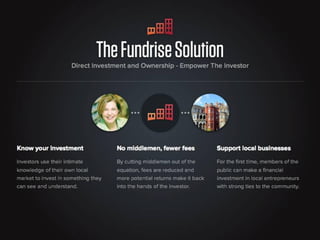

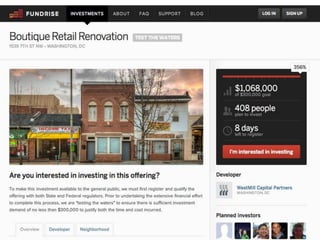

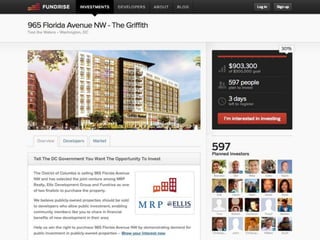

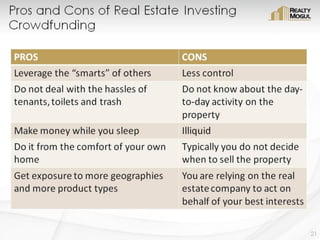

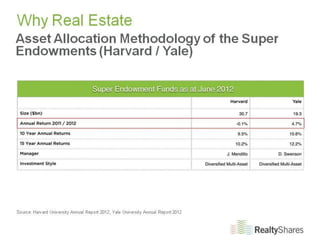

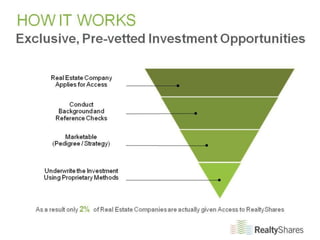

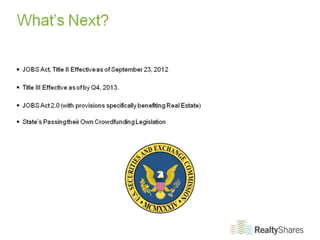

Nowstreet's webinar on July 25th focuses on how crowdfinancing is revolutionizing the real estate market, making investments accessible to the general public. Industry pioneers will discuss regulatory compliance and effective structures for real estate deals, along with the benefits of intrastate crowdfunding. The session aims to inform participants about the potential of this financial innovation to enhance local economic development.