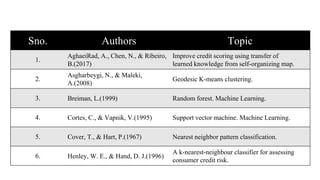

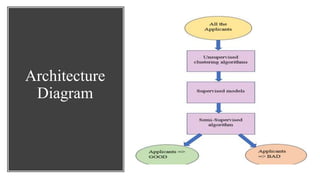

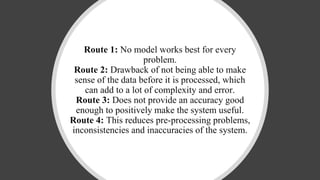

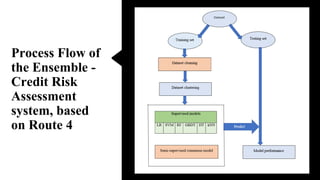

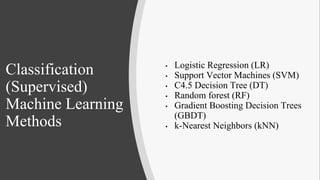

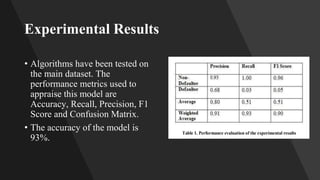

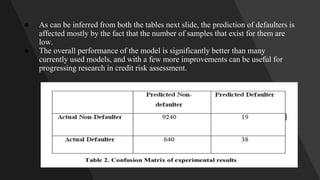

This document describes an ensemble-based credit risk assessment system that uses multiple machine learning models to improve accuracy. It proposes a three-level architecture using unsupervised clustering, supervised classification with algorithms like logistic regression and random forests, and semi-supervised consensus voting. Testing on real data showed 93% accuracy, better predicting defaulters compared to current systems. The system aims to reduce credit risks and losses for financial institutions.