More Related Content

Similar to Credit Policies

Similar to Credit Policies (20)

More from Nirmal Pandya (10)

Credit Policies

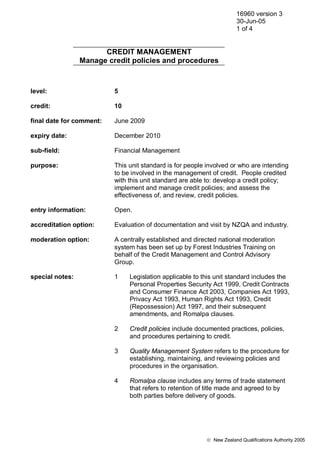

- 1. 16960 version 3

30-Jun-05

1 of 4

CREDIT MANAGEMENT

Manage credit policies and procedures

level: 5

credit: 10

final date for comment: June 2009

expiry date: December 2010

sub-field: Financial Management

purpose: This unit standard is for people involved or who are intending

to be involved in the management of credit. People credited

with this unit standard are able to: develop a credit policy;

implement and manage credit policies; and assess the

effectiveness of, and review, credit policies.

entry information: Open.

accreditation option: Evaluation of documentation and visit by NZQA and industry.

moderation option: A centrally established and directed national moderation

system has been set up by Forest Industries Training on

behalf of the Credit Management and Control Advisory

Group.

special notes: 1 Legislation applicable to this unit standard includes the

Personal Properties Security Act 1999, Credit Contracts

and Consumer Finance Act 2003, Companies Act 1993,

Privacy Act 1993, Human Rights Act 1993, Credit

(Repossession) Act 1997, and their subsequent

amendments, and Romalpa clauses.

2 Credit policies include documented practices, policies,

and procedures pertaining to credit.

3 Quality Management System refers to the procedure for

establishing, maintaining, and reviewing policies and

procedures in the organisation.

4 Romalpa clause includes any terms of trade statement

that refers to retention of title made and agreed to by

both parties before delivery of goods.

© New Zealand Qualifications Authority 2005

- 2. 16960 version 3

30-Jun-05

2 of 4

CREDIT MANAGEMENT

Manage credit policies and procedures

Elements and Performance Criteria

element 1

Develop credit policy.

performance criteria

1.1 The credit policy is developed in accordance with the quality management

system.

1.2 The balancing of risk against benefits is reflected in the development of credit

policy.

1.3 Minimum acceptable criteria for the granting of credit are developed and

documented in credit policy.

1.4 Relevant legislative requirements are met in the development of credit policy.

1.5 The reduction of risk to a minimum is reflected in the development of credit

policy.

Range: cash, progressive billing, securities and guarantees, factoring,

credit insurance, payment inducements, Romalpa clauses.

1.6 Recovery, repossession, and write-off procedures for overdue accounts are

clearly documented in the development of credit policy.

1.7 Levels of authority and roles in the granting or stopping of credit are clearly

described in the development of credit policy.

1.8 Credit policies are signed off as consistent with the strategic direction and

values of the organisation in accordance within the quality management system.

element 2

Implement and manage credit policies.

performance criteria

2.1 Credit policies are documented and communicated to all staff in accordance

with the quality management system.

© New Zealand Qualifications Authority 2005

- 3. 16960 version 3

30-Jun-05

3 of 4

CREDIT MANAGEMENT

Manage credit policies and procedures

2.2 Credit policies are applied fairly and consistently across all levels of the

organisation.

2.3 Application of the credit policy is monitored and non-compliance noted.

Range: includes but is not limited to – granting of credit, credit limits, stop

credit, collection of overdue accounts, repossession of goods,

write-offs.

2.4 Procedures for the storage, retrieval, and use of credit information are

consistent with credit policies and legislative requirements.

2.5 Implementation and management of the credit policies are in accordance with

the quality management system.

element 3

Assess the effectiveness of, and review, credit policies.

performance criteria

3.1 Credit policies of the organisation are reviewed on a continuing basis and

changes are recommended in accordance with the quality management system.

Range: includes but is not limited to – the economic climate, the

organisation’s strategic direction and objectives, market forces,

the total indebtedness in the accounts receivable ledger and the

cash flow requirements of the organisation.

3.2 Recommendations for changes to policy are considered, actioned, documented

and communicated in accordance with the quality management system.

3.3 Debtor viewpoints are canvassed on credit policies and their effect on the

organisation’s business, in accordance with the quality management system.

Range: customer focus groups, conferences, questionnaires, surveys,

individual interview, complaints register, incoming mail, telephone

calls.

Comments on this unit standard

Please contact Forest Industries Training forestindustries@fitec.org.nz if you wish to

suggest changes to the content of this unit standard.

© New Zealand Qualifications Authority 2005

- 4. 16960 version 3

30-Jun-05

4 of 4

CREDIT MANAGEMENT

Manage credit policies and procedures

Please Note

Providers must be accredited by the Qualifications Authority or a delegated inter-

institutional body before they can register credits from assessment against unit standards

or deliver courses of study leading to that assessment.

Industry Training Organisations must be accredited by the Qualifications Authority before

they can register credits from assessment against unit standards.

Accredited providers and Industry Training Organisations assessing against unit standards

must engage with the moderation system that applies to those standards.

Accreditation requirements and an outline of the moderation system that applies to this

standard are outlined in the Accreditation and Moderation Action Plan (AMAP). The

AMAP also includes useful information about special requirements for providers wishing to

develop education and training programmes, such as minimum qualifications for tutors and

assessors, and special resource requirements.

This unit standard is covered by AMAP 0172 which can be accessed at

http://www.nzqa.govt.nz/site/framework/search.html.

© New Zealand Qualifications Authority 2005