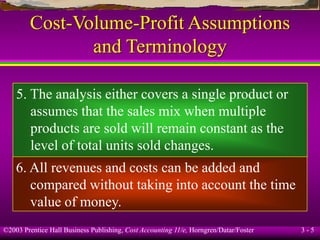

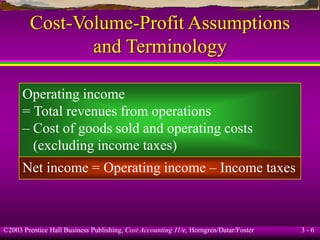

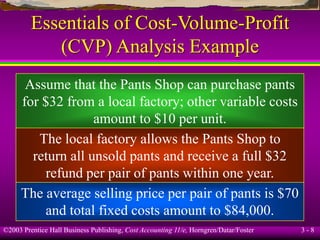

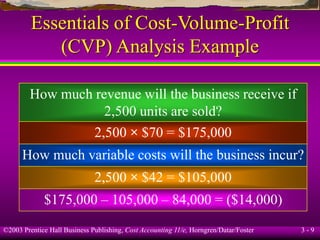

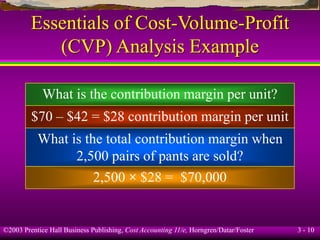

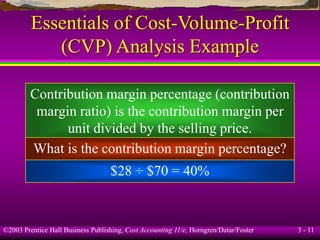

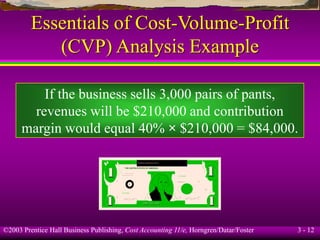

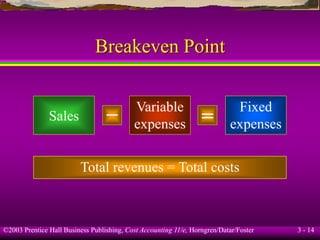

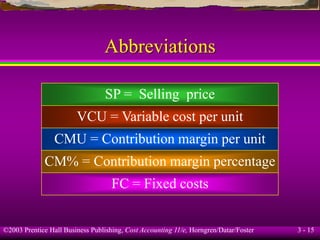

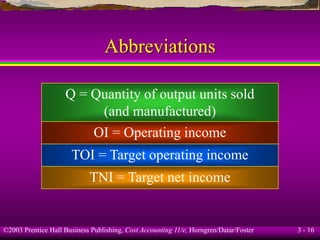

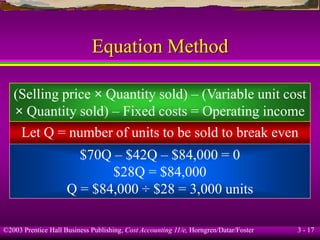

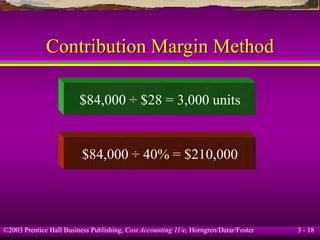

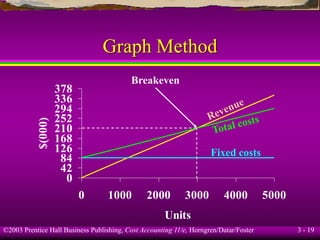

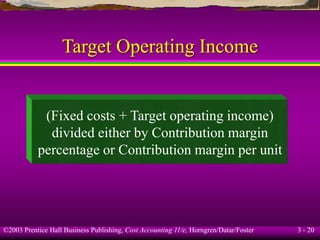

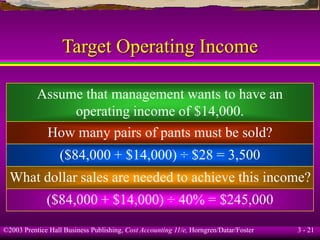

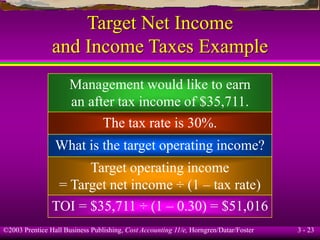

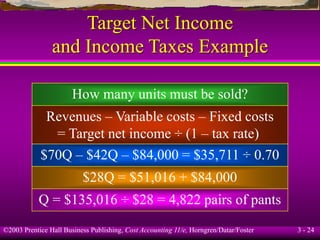

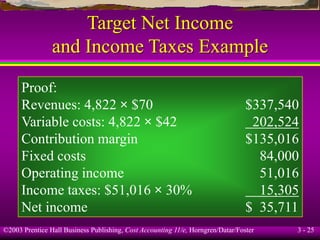

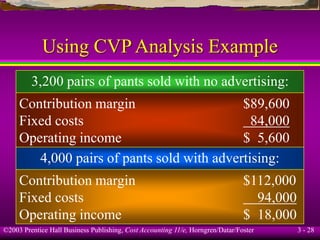

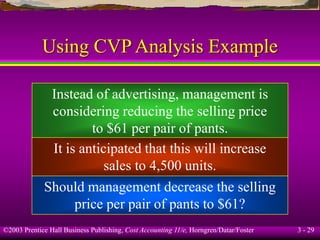

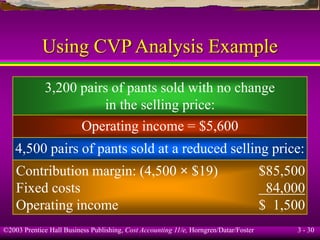

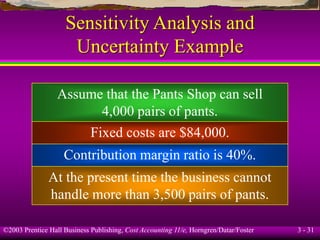

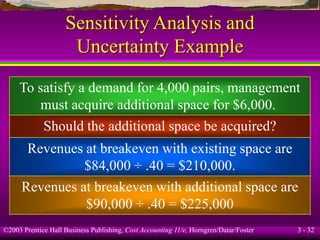

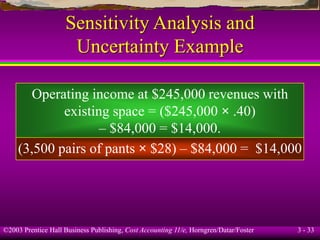

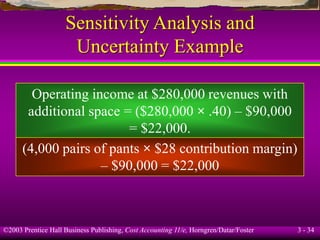

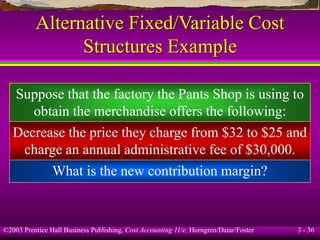

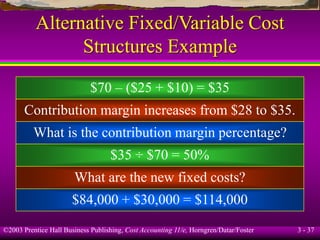

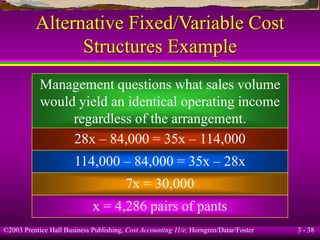

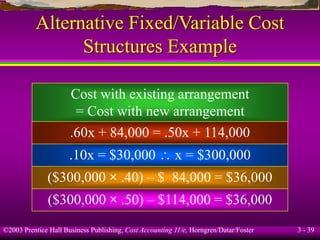

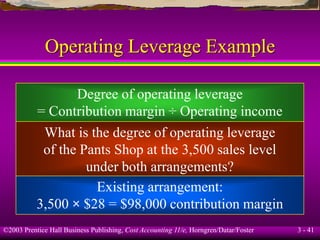

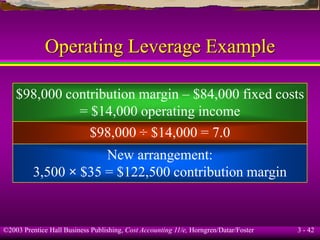

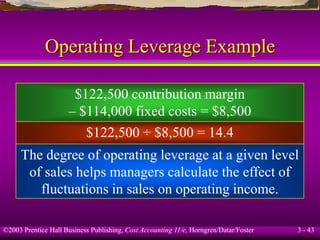

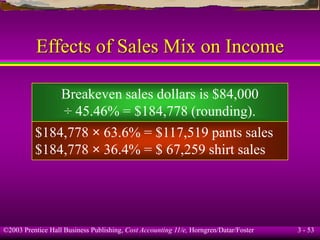

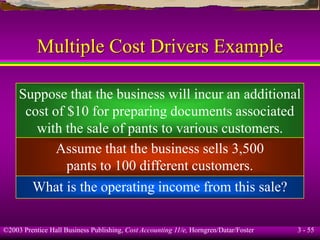

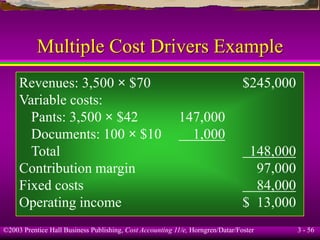

This document discusses cost-volume-profit (CVP) analysis. It begins by outlining the key assumptions of CVP analysis, including that costs can be separated into fixed and variable components and that revenues and costs change linearly with units produced. The document then provides an example to illustrate CVP concepts like contribution margin, break-even point, and using CVP to determine output levels needed for target operating incomes or profits. It also discusses how income taxes affect CVP analysis and how managers can use CVP and sensitivity analysis to evaluate decisions under uncertainty.