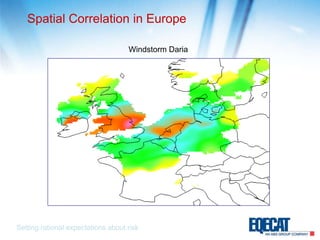

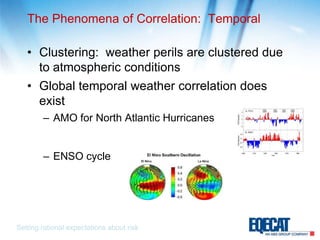

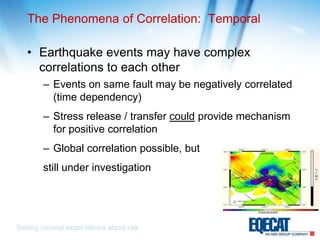

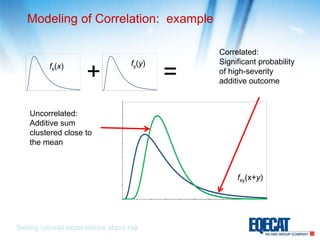

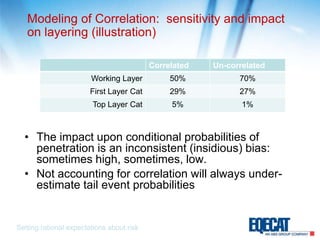

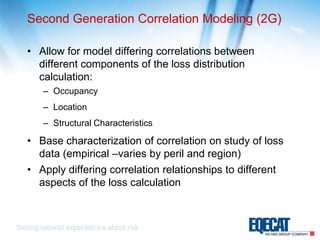

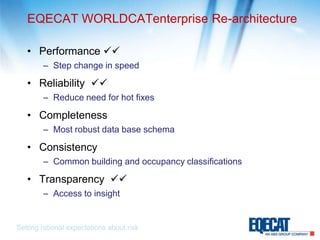

The document discusses the significance of correlation in catastrophe modeling, emphasizing its impact on risk assessment and decision-making related to extreme events. It critiques existing modeling methodologies and suggests a progression from first-generation to third-generation correlation modeling, aiming for greater accuracy and robustness in predicting outcomes. The document highlights the challenges and complexities involved in effectively representing correlations across different hazards and exposure classes.