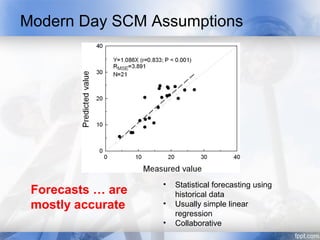

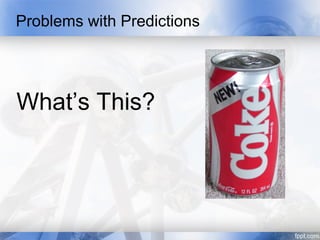

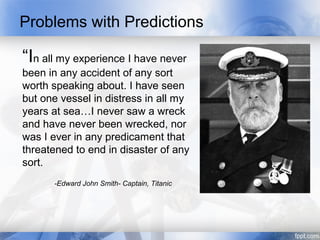

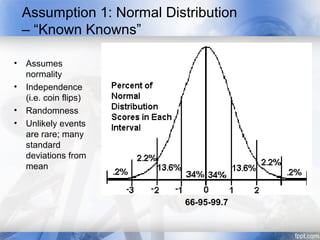

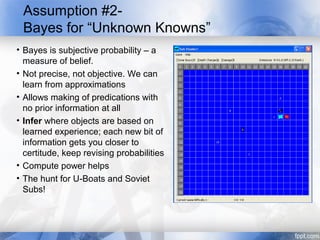

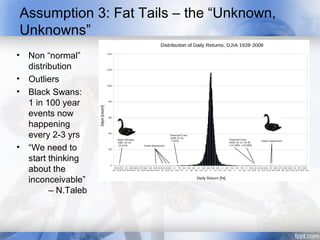

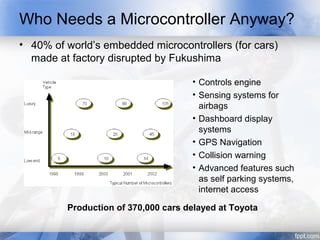

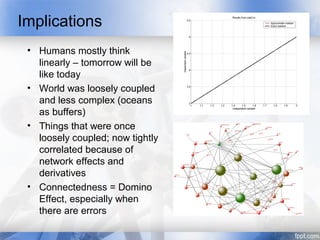

The lecture discusses modern supply chain risk management, highlighting misconceptions and the importance of adapting to 'unknown unknowns' and 'black swan' events. It emphasizes that traditional linear assumptions in forecasting can lead to disastrous consequences, particularly in a globally interconnected market. Solutions proposed include near-shoring, increased redundancy, and proactive disaster planning to mitigate potential risks.