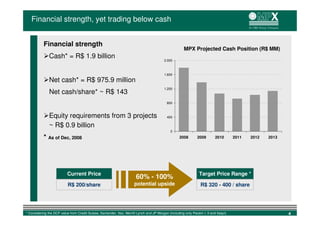

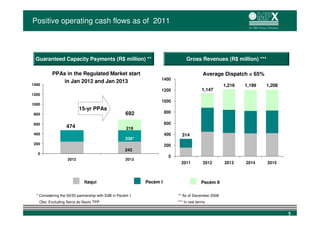

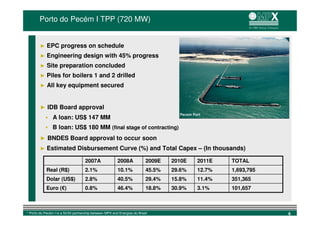

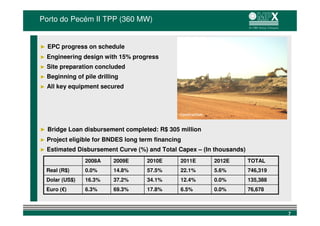

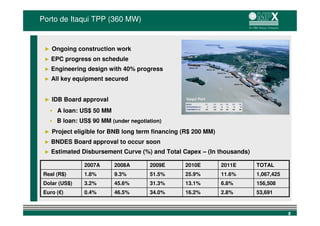

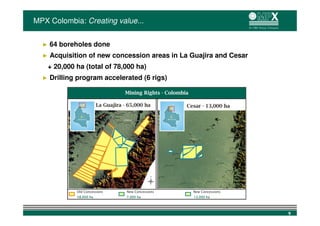

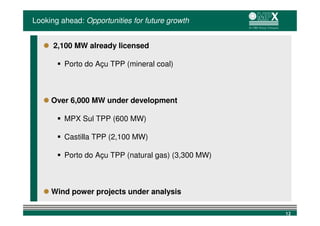

MPX Energia is a Brazilian power company with 3 projects totaling 1,440 MW under construction. It has 15-year power purchase agreements secured with the regulated market in Brazil. The projects are fully funded through loans from the IDB and BNDES and have lump-sum turn-key engineering, procurement, and construction contracts. MPX also has potential upside from oil and gas exploration in Colombia. Despite its strong financial position with over R$1 billion in cash, MPX is currently trading below its estimated cash value, representing potential 60-100% upside for investors.