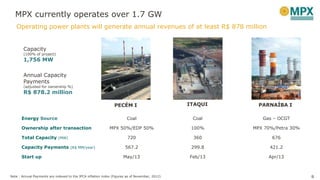

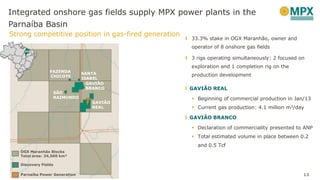

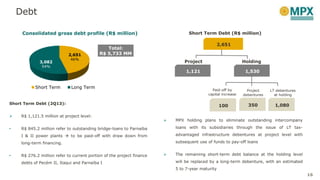

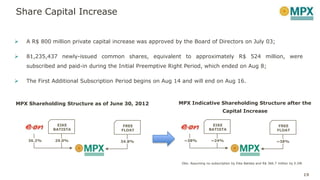

The document provides background information on MPX Energia S.A., a Brazilian energy company. It summarizes MPX's portfolio of power generation and natural gas assets, including operating power plants generating annual revenues of $878 million and additional assets under construction that will provide $620 million in revenues. It also outlines MPX's ownership in gas fields that supply its power plants in Parnaiba Basin, with recent exploration successes. Financially, MPX has $3.1 billion in total debt, with plans to replace short-term debt at the holding level with long-term debentures.