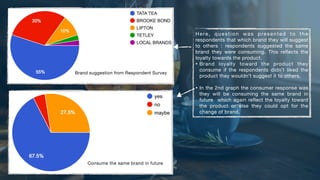

This presentation analyzes consumer brand loyalty toward tea brands in India. A survey was conducted of 40 people to understand their tea consumption behaviors and brand preferences. The results showed that 54% of respondents preferred Tata Tea over other brands like Taj Mahal and Red Label. Tata Tea has been successful due to its wide product range at different price points, strong supply chain, and continuous advertising campaigns promoting social messages. The data indicates consumers exhibit loyalty to their tea brands, with 66.7% drinking the same brand for over a year.