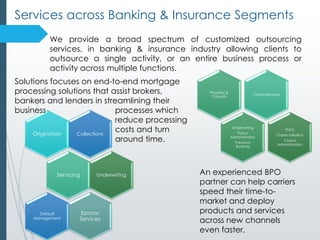

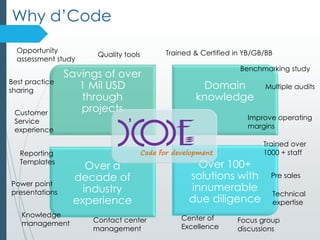

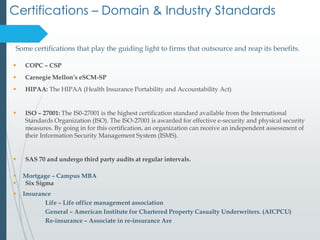

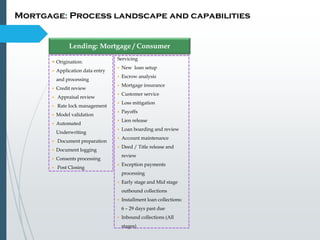

d’code offers ITES consulting services aimed at helping companies adapt to shifting customer expectations through technology and strategy design. With over a decade of experience, they focus on enhancing productivity, driving performance, and supporting businesses in establishing and optimizing BPO operations, particularly in the banking and insurance sectors. Their consulting model includes needs analysis, solution development, and ongoing management, while also providing a range of training and certification services to ensure effective implementation and compliance.