The document discusses various economic concepts including inflation rates from 1993 to 2012, labor productivity, consumption functions, and the impact of fiscal policies in closing recessionary and expansionary gaps. It evaluates the effects of unanticipated inflation on purchasing power, the relationship between aggregate supply and demand, and the implications of technological changes on employment. Additionally, it delves into the history of labor productivity in the U.S. and examines the theoretical frameworks that govern economic growth, including shifts in potential output and the role of fiscal policy.

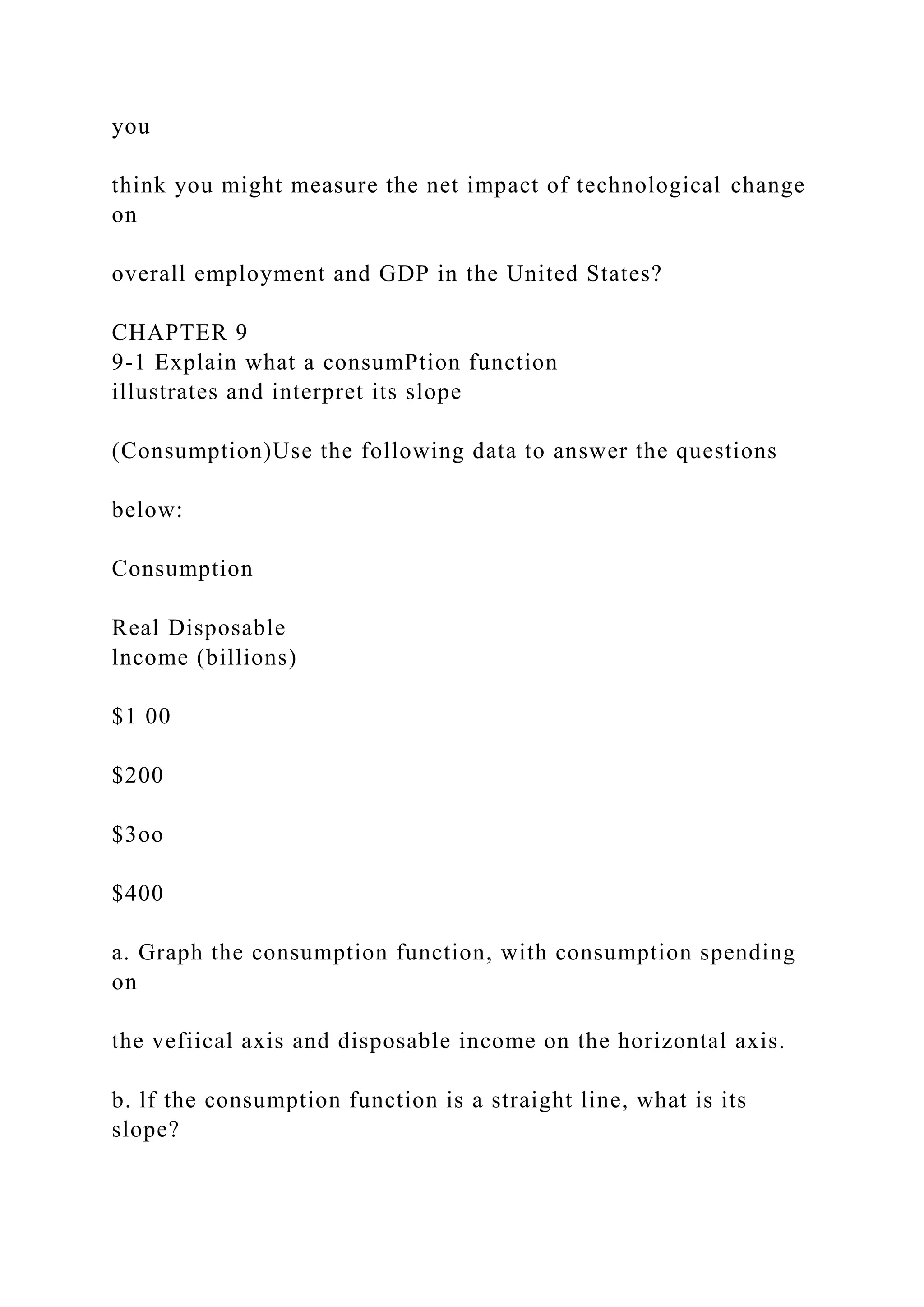

![and

the total change in real GDP demanded following a $10 billion

decrease in spending:

a. MPC -- 0.9

b, MPC: 0.75

c. MPC: 0.6

(Simple Spending Multiplie] Suppose that the MPC is 0.8 and

that

$14 trillion of real GDP is currently being demanded. The

govern-

ment wants to increase real GDP demanded to $15 trillion at the

given price level. By how much would it have to increase

govern-

ment purchases to achieve this goal?

(lnvestnent and the Multiplier)Ihis chapter assumes that

investment is autonomous. What would happen to the size of the

multiplier if investment increases as real GDP increases?

Explain,

9-6 Summarize the relationship between

the aggregate expendiarre line and

the aggregate demand cunre

12. (Shifts of Aggregate Demand)Assume the simple spending

multi"

plier equals 3. Determine the size and direction of any changes

of](https://image.slidesharecdn.com/computetheinflationrateforeachyear1993-2012anddeterm-221112182140-4dc7ccca/75/Compute-the-inflation-rate-for-each-year-1993-201-2-and-determ-docx-9-2048.jpg)