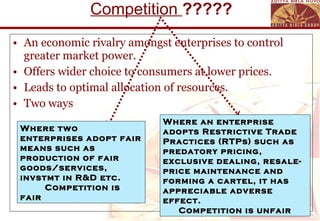

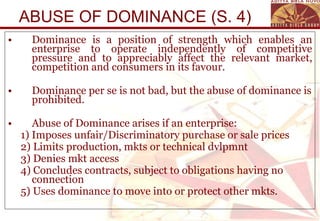

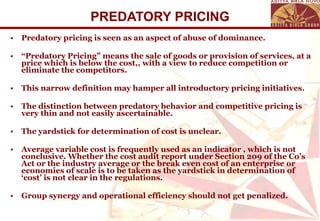

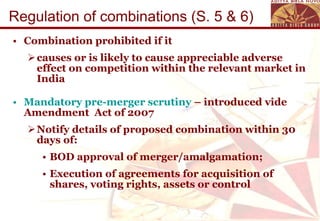

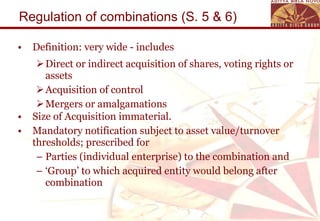

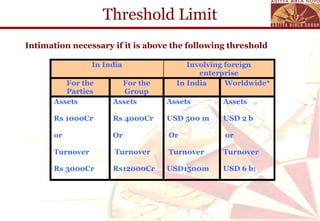

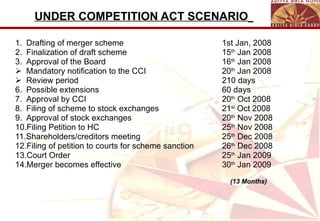

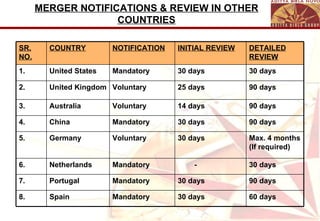

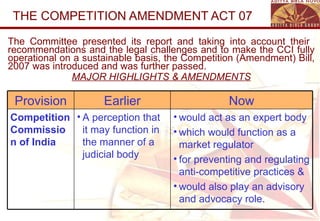

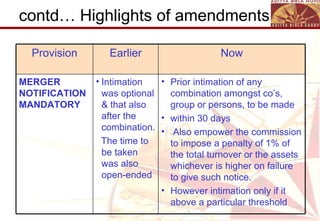

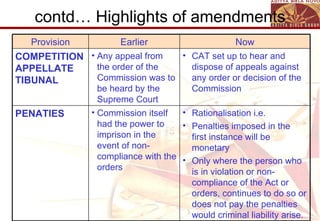

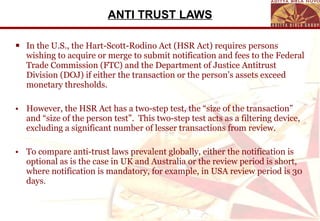

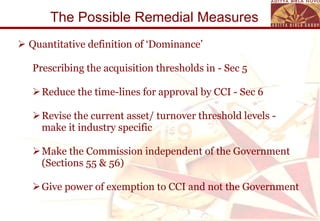

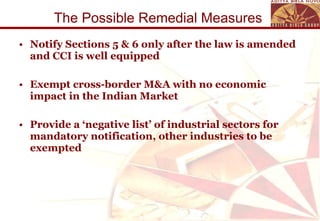

The document provides an overview of competition law in India, including the Competition Act of 2002 and amendments made in 2007. It discusses key provisions around anti-competitive agreements, abuse of dominance, and regulation of mergers and combinations. The amendments in 2007 made merger notifications mandatory, established the Competition Appellate Tribunal, and rationalized penalties. The document also analyzes issues around implementation of the law and proposes remedial measures like reducing timelines and revising thresholds to promote growth while preventing anti-competitive practices.