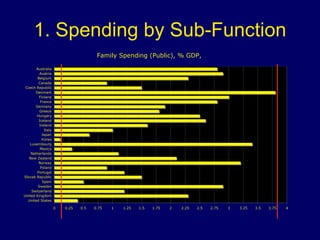

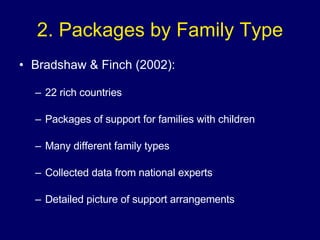

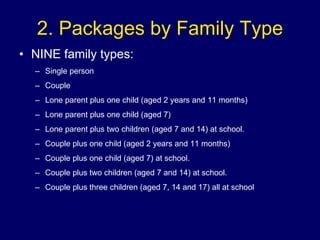

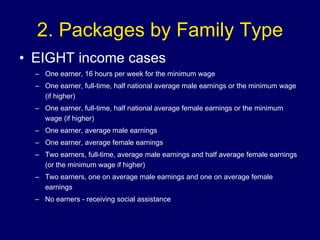

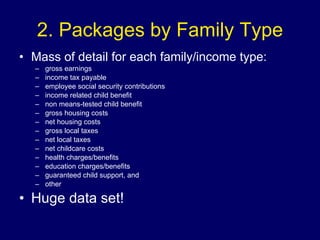

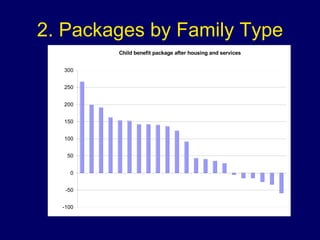

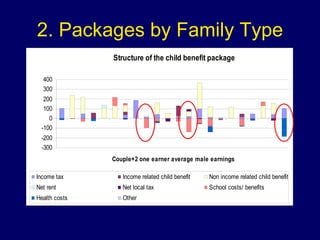

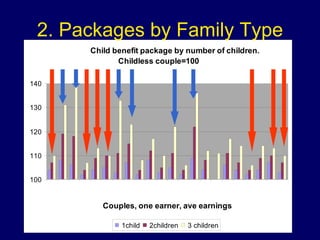

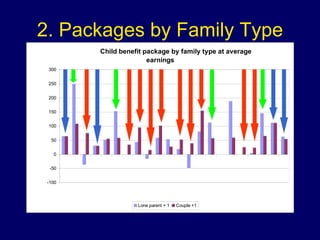

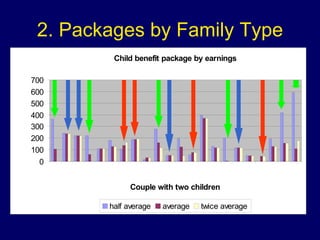

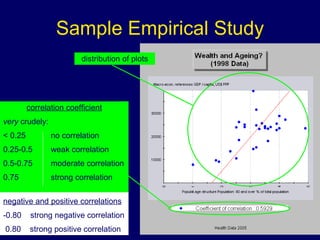

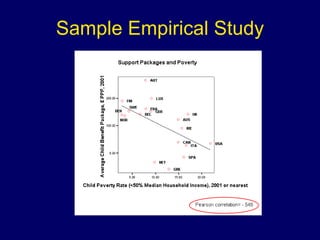

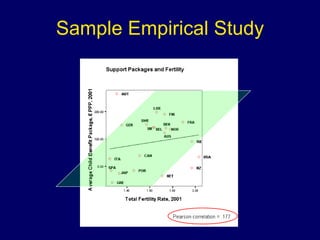

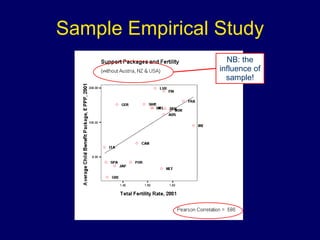

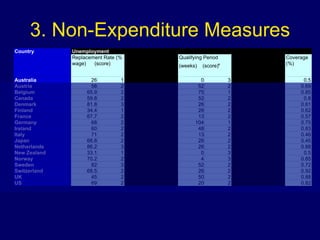

The document discusses different ways to measure and compare welfare states beyond just spending levels. It examines micro-level input measures including spending by sub-function, packages of support for different family types, and non-expenditure measures. One study analyzed packages of support for 9 family types and 8 income levels across 22 countries. Non-expenditure measures like decommodification indices based on social insurance rules can also provide insights but data is limited. Comparing micro-level inputs provides a richer picture of how systems function but data availability remains a challenge.