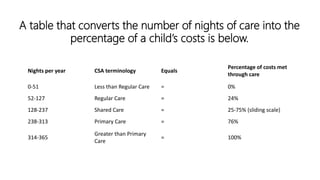

Child support assessments can be based on a legislative formula or an agreement between parents, considering variables like parent incomes, child costs, and care levels. The formula, established on July 1, 2008, factors in parents' taxable income and specific financial contributions, while the costs of children tables are adjusted annually based on research. The level of care each parent provides is quantified in nights and impacts the percentage of children's costs they cover.