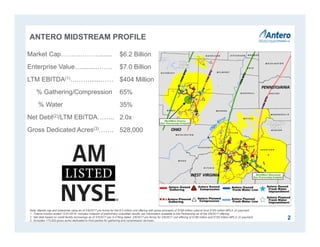

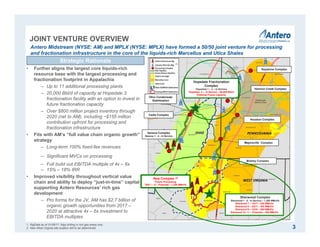

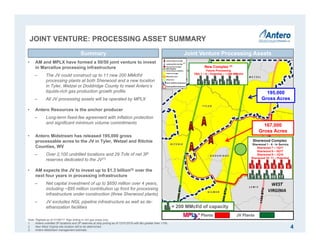

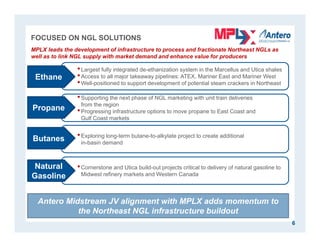

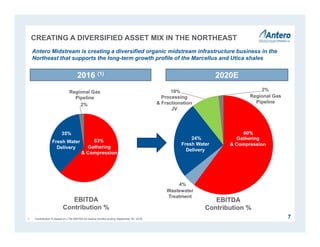

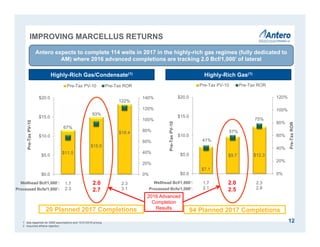

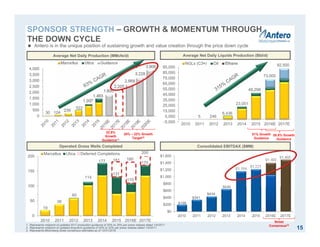

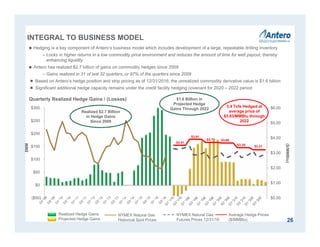

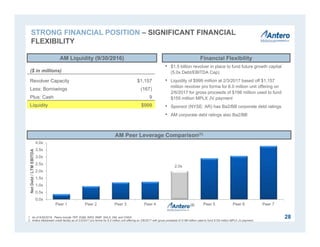

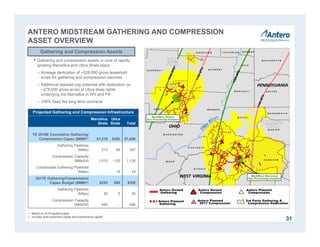

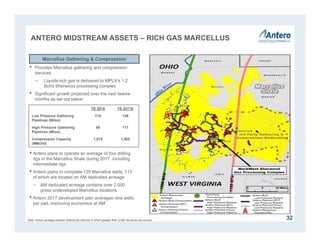

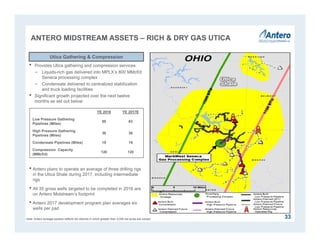

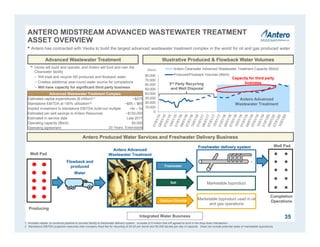

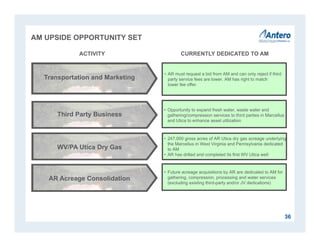

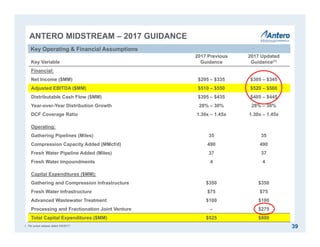

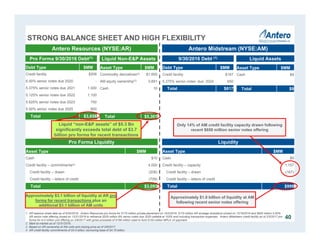

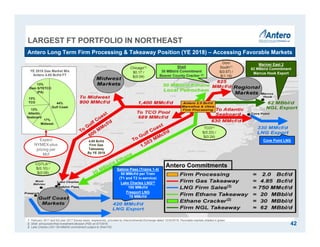

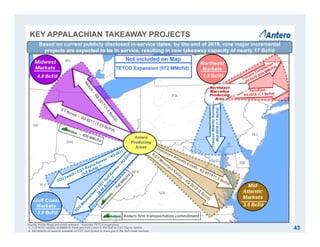

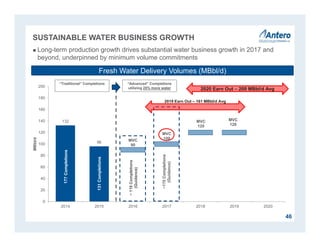

The document provides an overview of a partnership between Antero Midstream Partners LP and MPLX. It discusses forward-looking statements and risks involved. It then summarizes Antero Midstream's profile, including its market cap, enterprise value, EBITDA, net debt ratio, and dedicated acres. It also describes the joint venture between Antero Midstream and MPLX to develop processing and fractionation infrastructure in Appalachia, including existing and potential future assets.