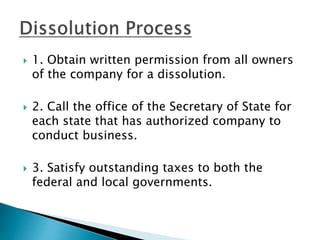

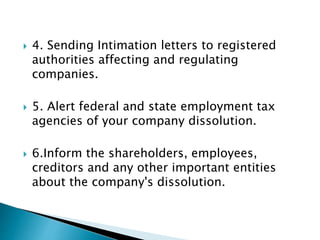

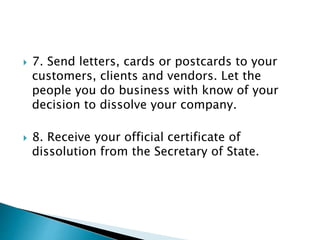

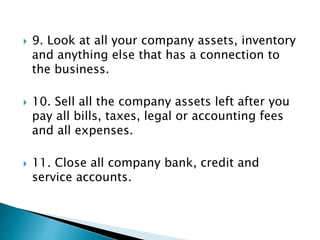

The document discusses different types of companies and the company dissolution process. It describes companies limited by shares, companies limited by guarantee, and unlimited companies. It then outlines the key steps required to legally dissolve a company, which include obtaining shareholder permission, satisfying tax obligations, notifying regulatory authorities, and closing all company accounts. Dissolving a company informally could leave shareholders vulnerable, so the legal dissolution process with professional assistance is recommended.